After months of persistent rumours, here's confirmation: European online fashion retailer Zalando plans to go public on the Frankfurt Stock Exchange before the end of the year.

This was confirmed this morning by Kinnevik, a Swedish investment group that holds a 36 percent share in the company.

Zalando plans to offer between 10 and 11 percent of its shares (post-IPO capitalisation), but we'll have to wait for a valuation until later.

Also very much worth noting: the offer is expected to consist exclusively of new shares from a capital increase by Zalando.

Get ready for one of the biggest tech floats in Europe in recent history. According to the Financial Times, Zalando's valuation could be as high as 5 billion euros ($6.6 billion).

It would mean a big payday for Kinnevik, as well. Here's Kinnevik CEO Lorenzo Grabau's comment:

"Kinnevik is delighted about Zalando's plans to list on the Frankfurt stock exchange. We first invested in Zalando in 2010 and since then have invested cash of SEK 5.5 billion to become the company's largest shareholder. We look forward to continuing to work with Zalando's founders and management team, and to support their future growth ambitions after the listing."

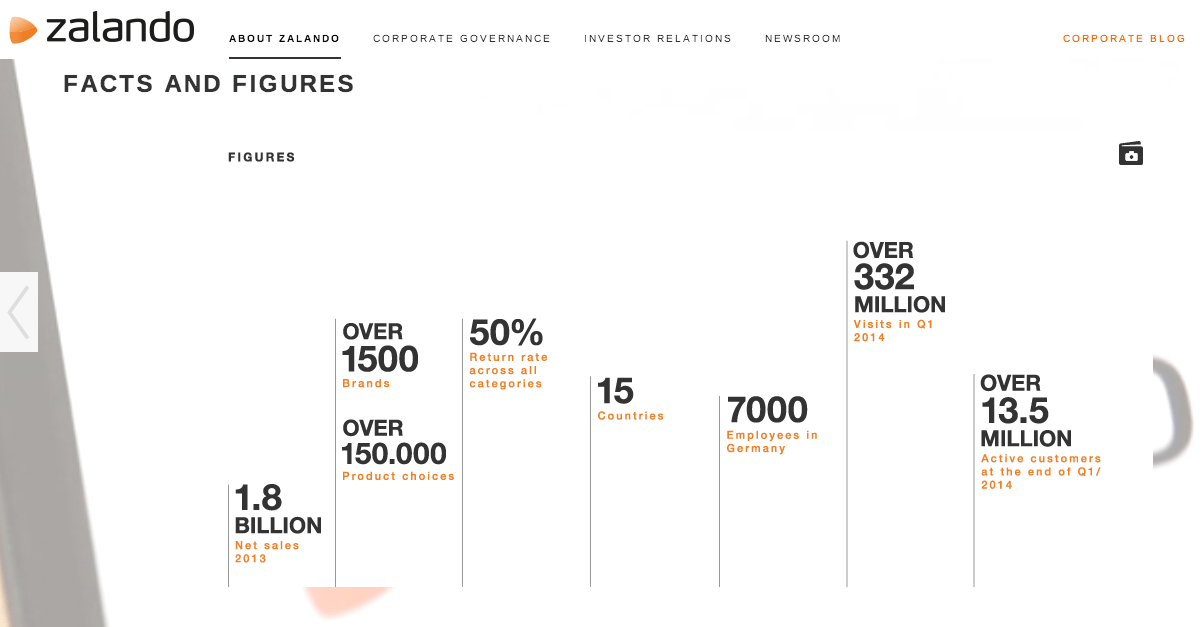

Zalando recently announced that its group revenues have increased by almost 30 percent in the first half of this year (H1 2014), hitting 1,047 million euros for the six-month period.

Zalando performed particularly well in the German-speaking parts of Europe, known as the DACH region, with revenues growing by more than 21 percent to 594 million euros (roughly 57 percent of total sales). The company is only mildly profitable as a whole, but profitability in the DACH region has ballooned to 4.6 percent in H1 2014. Also read: How big is Zalando?

And now we wait for the Rocket Internet IPO plans to surface.

Would you like to write the first comment?

Login to post comments