On Monday morning, at the 14th annual EBAN Congress held in Dublin, early-stage startup investors from across Europe presented the first ever joint 'Startup Investors Manifesto' (see the full doc below).

The Manifesto is essentially an investor-driven call to increase the European early stage investment market from 7,5 billion euros today to 15 billion euros in 2017, and generate 1.5 million new jobs across the EU while we're at it. It is not to be mistaken for the broader 'Startup Manifesto' that's been heavily promoted by the European Commission and a number of tech entrepreneurs in recent times.

From the Startup Investors Manifesto, which you can read in full below:

These actions and policies commit investors and engage policy makers at European, national and regional level to take responsibility on the changes that need to be implemented. They involve both the private and the public sector on a common strategy to increase funds available for startups and to create the Single Market for early stage investors.

The supporting investors of this manifesto, call for the attention of Heads of State from all EU28 & accession countries, for the commitment of the Members of the European Parliament, for the active involvement of the coming European Commission and for the economic responsibility of corporate investors which can, all together, supported by a motivated early stage investment community, draw up new perspectives for aspiring entrepreneurs and game changing startups.

Update: live goes the site, where you can also download (and sign) the manifesto.

Most of the growth in early-stage startup investment will in the future come from equity crowd-funding, the investors reckon according to the manifesto, with increased activity from business angels and seed / VC funds as additional drivers:

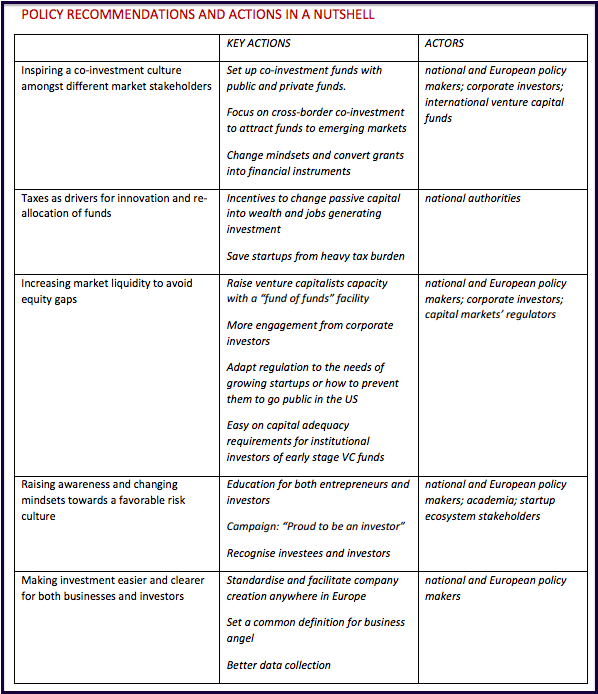

The investors identified the following 5 areas where changes will prove most crucial:

1. Inspiring a co-investment culture amongst different market stakeholders

2. Taxes as drivers for innovation and reallocation of funds

3. Increasing market liquidity to avoid equity gaps

4. Raising awareness and changing mindsets towards a favourable risk culture

5. Making investment easier and clearer for both businesses and investors

You can view and download the full manifesto here:

European Startup Investors Manifesto

Featured image credit: pashamba / Shutterstock