It was one of the largest European tech acquisitions of the year, and its repercussions are still being felt in Helsinki (and London, where it had a lot of investors): SoftBank's November 2013 acquisition of a 51% stake in mobile game studio Supercell for $1.5 billion.

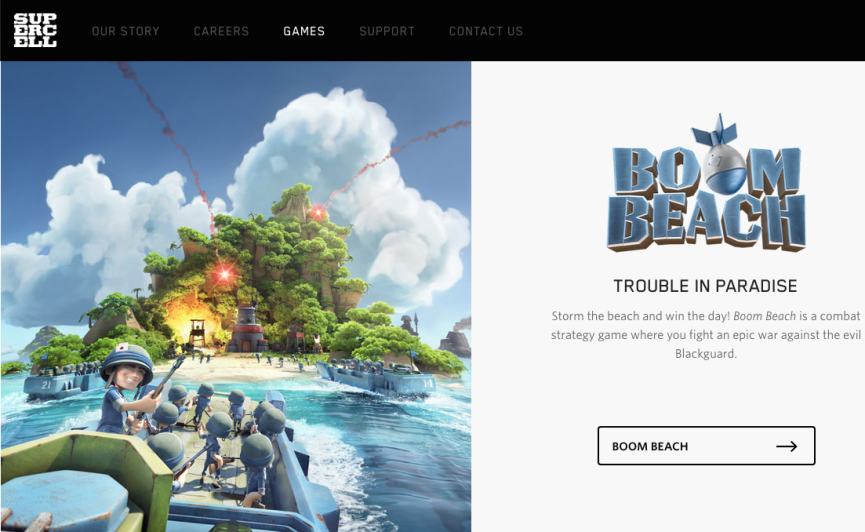

If the transaction at the time valued Supercell, which is behind hit games like Hay Day and Clash Of Clans, at more than $3 billion, then what to make of this: SoftBank has just agreed with existing backers to acquire a further interest in Supercell, upping it stake to 73.2% on a fully-diluted basis.

More specifically, SoftBank bought an additional 22.7% holding in Supercell by purchasing stock held by existing external investors. The deal was closed last week. Supercell will continue to operate independently, it says, and co-founder Ilkka Paananen will continue to serve as CEO.

**Update:** a comment from Accel Partners, which was the first institutional venture investor in Supercell, financing the company in May 2011 with $11 million when it was still pre-game and pre-revenue, and has now sold its remaining stake to SoftBank.

Accel Partners’ Kevin Comolli, who led the firm’s investment in Supercell and sat on its board, says:

“Congratulations to Supercell and SoftBank on deepening their thriving partnership! It’s been fantastic to see Supercell’s growth and success from pre-game through to pioneering the ‘mobile-first’ gaming category.

From the beginning, we were impressed by the team’s clarity of thought, sense of purpose and creative process, and I am very proud of their achievements. We had complete conviction that they would create the next-generation gaming company and believed that well-capitalising Supercell at an early stage would empower it to control its own destiny and take risks.”

Would you like to write the first comment?

Login to post comments