Ben Grol heads the growth team at Atomico. He has quite an interesting background – high school dropout, professional chef, Stanford computer science graduate, and so on. Ben was also a key team member for some of the most successful large scale products and services which practically all of us use today, including Gmail, Google Maps, Facebook and Facebook Messenger.

"My role at Facebook was growth," Ben explained, on a phone conversation as he was boarding a plane to Stockholm, "so the stuff I do now I mostly learned at Facebook. I met (Atomico founders) Mattias and Niklas even before that and we got on well."

"I reached out to them in 2016, and it turned out that Niklas was looking for someone to head growth. I also talked to a bunch of other VCs in Europe and I simply felt that there wasn't another fund in Europe – maybe anywhere – that's founder-friendly in the way Atomico was."

See part 1 of this article: The State of Atomico: up close and personal with one of Europe’s premier venture funds and its ‘growth acceleration team’

"Niklas was there in the hard days, eating crappy sandwiches, sleeping on a friend's sofa, essentially starting from nothing and building two hugely successful businesses. That's an experience that partners in other VC firms simply don't have. So he gets it, and the empathy and compassion he has for founders is really special. That's a large part of why Atomico's priorities are – helping the entrepreneurs comes first, and making money comes second."

I was curious to hear Ben's views on how Atomico's investors, the LPs, feel about this particular set of priorities.

"If you believe in the entrepreneurs and give them the tools to be successful, you actually maximise profit," Ben said. "Niklas has the long view, the right strategy and I think that the way he's doing it is the right way."

Considering how different the various Atomico portfolio companies are – in terms of development stage, technology, market segment, etc., I asked Ben how he works with them; how does he share the knowledge and experience he's gained?

"I work mostly with the companies that are purely digital. As an example, I've met the Lilium team (Note: Lilium is building an electric vertical take-off and landing (VTOL) jet) but there's not much I can add to what they are doing. Anything digital – marketplaces, fintech, SaaS, consumer apps – is where I can add value."

"I'll sit down with them, I have my 'Growth 101' deck – it's all the growth frameworks I've seen used effectively. We talk about what I've seen in my experience, what are best practices today and the teams can pick and choose, it's kind of a Chinese lunch menu. Some of the founders are quite hands-off, they want to meet or talk once a week or even once a month, others want us to come in and do multi-day sessions. It varies a lot."

One of my questions for Ben was the same one I had for Dan Hynes (see part 1 for context) – considering the breadth of the portfolio and his limited time, did he ever feel he was becoming a bottleneck?

"That's becoming more of an issue now with the companies from Fund IV. We're trying to find new ways to manage it, particularly developing 'self-service solutions'. A lot can be achieved by distributing good quality materials such as the decks we've been using and there's a lot to be said for pre-reading. If you have a meeting where everyone is expected to have read the materials before the meeting and if they haven't, they're asked to leave – you have a much more productive time during the meeting itself."

"Oftentimes I act as a broker of sorts. If a team needs SEO skills – I'm not an expert at that but I can put them in touch with someone who is. So by combining all these tactics I find I can effectively work with five to eight companies at a time. My colleagues in other firms tend to get really involved, working daily with the firms and can then manage only 1 or 2 at the most."

tech.eu: And what about utilising the skills and knowledge some of the founders have learned in order to help others?

"One of the things I want to do a lot more of in 2018 is getting the founders together. One of the benefits of Silicon Valley is the tight geographic space. You can get a hundred pricing experts in a bar on 20 minutes notice. Here in Europe – we're all over the place, in Copenhagen, Stockholm, Berlin... Atomico organises a Founders Summit where people get together in person and after that the Slack channels and other communication is much more valuable. We need to think about how to make that stronger and more powerful."

tech.eu: "Have you ever considered having an event or events with companies outside the Atomico ecosystem – companies with different investors, perhaps on a European level?"

"Yes – we do a growth meetup with other firms and teams funded by Balderton, Localglobe and others. First and foremost we are builders. We are sharers of the craft. That's our priority, and the fact that we are invested in by whoever matters less. This is something we'd like to do not just in London but elsewhere in Europe as well."

Another member of the growth acceleration team is Sophia Bendz. Sophia is a Spotify veteran, having been hired as the first non-tech employee at the music streaming behemoth and spending nearly eight years there as Global Marketing Director. After Spotify, she spent some time as an angel investor, invested in 11 companies and then decided to go into 'proper investing' after a conversation with Atomico co-founder Zennström.

Sophia Bendz: "I tend to work directly with the founders or the marketing chief. My work can include anything from helping to find the right person to run marketing to designing a brand strategy. Brands are becoming more and more important, especially in light of the fact that consumers are getting very sceptical and in some cases literally fed up with all the branding and marketing being pushed their way. The only answer we have, I guess, is authenticity – trying to be honest with customers and consumers."

I wondered whether Sophia and the other growth team members work with the portfolio companies one by one or in teams?

"We don't really storm in like a SWAT team," – Sophia laughed and continued – "It really varies from company to company and very much depends on what they really need. I try not to go in with a heavy-handed, hands-on approach. That typically doesn't work very well with the kind of entrepreneurs we back. Another important reason is that it might create a bottleneck on my part and overly limit the number of teams I can work with."

I asked Sophia for a specific example.

"GoEuro is a very good example. We set up a brand strategy workshop, and we came out of it with a very clear and specific set of documents outlining the DNA of the brand. Very often the outcome of such a workshop can be something the founders actually 'carried around' in their heads for a while, but we can help them express their ideas much better, put them into writing and use the resulting strategy almost as a navigation tool, a kind of compass the help the whole team steer the boat in the right direction, so to speak. We help them tell their story – coming back to the issue of brand authenticity, stories are a great metaphor to communicate an authentic message."

Kelly Poon and Carlos Pires live and work in very different places. Kelly loves Beijing ("except for the terrible smog") while Carlos enjoys life in the megalopolis that is São Paulo.

Their career trajectories however, first with Skype and now with Atomico, as well as their operating styles, are quite similar. They both joined Skype in 2004 and built up the business through 2008 almost single-handedly, each in their own markets: Kelly in China (and the rest of Asia) and Carlos in Brazil (and the rest of Latin America).

They then went on to join Atomico in 2008 where they are partners yet continue to work alone – without at least a small executive team one might expect from two global executives of one of the largest European VC firms. Atomico's remarkable achievements in these markets speak to the effectiveness of the firm's far-flung operations, however, lean to the extreme as they may be.

"Following Atomico's Series B investment into Supercell I spoke with Ilkka Paananen while attending Slush some years ago," Kelly Poon recalls her conversation with Supercell's CEO.

"I tried to get him to come to China that year and the next. He kept explaining how he's too busy, doesn't understand the dynamics of the market and so on. Then, two years later, he finally came over and Supercell's business in China exploded. Of course, then he said he should have listened the first time!"

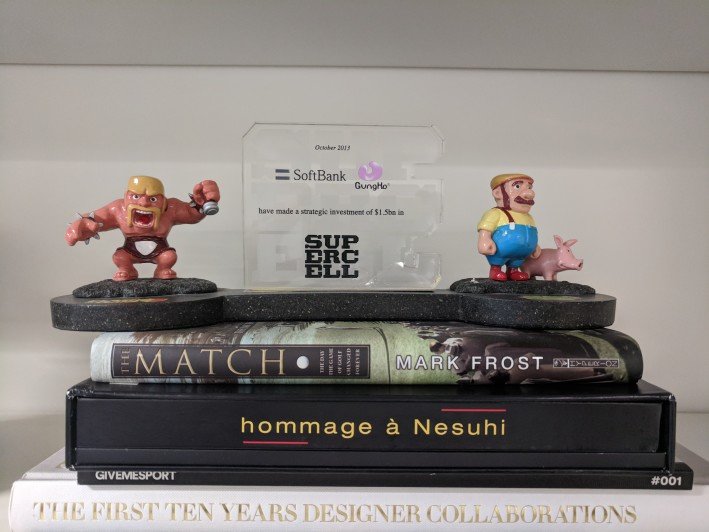

The rest – as we all know very well – is history. Atomico joined Supercell's $130 million B round in early 2013. The company was valued at $770 million at the time. Later that very same year, SoftBank purchased a 51% stake at a valuation of $3 billion. The Japanese company later bought an additional stake, buying out all of the (very happy) Supercell investors who collectively made a profit of almost $400 million in less than a year.

Supporting the Atomico portfolio companies is the primary focus of Poon's and Pires' work in their respective cities. Looking for potential local or regional investments comes a distant second, although several startups from both China and Brazil have joined the Atomico family.

Working with the investees' founding and executive teams, in fact, isn't just a marginal activity. It's a deliberate strategy, what Atomico calls the 'Growth Acceleration Program'. The firm is proud of this operational model. Every single partner I spoke with claimed that Atomico is unique in the industry in that regard.

I was curious about the competition in China and Brazil. Do other world-class VC firms, either US-based or European have teams on the ground in Hong Kong, Beijing, São Paolo or Rio de Janeiro working to help the companies they've invested in grow rapidly in those markets?

Both Poon and Pires were quite confident that Atomico is also unique in this regard. Big-name funds, of course, do have offices there, especially in China, but the two Atomico partners both pointed out – in separate conversations – that the competition's teams and offices were there to look for new investments and to 'oversee' current ones, making sure they are following the agreed-upon strategy and – of course – reporting in full and on time about how things are going.

Pires highlighted the global expansion of Atomico portfolio company Gympass, headquartered in São Paolo, as a great example of a Brazilian company expanding internationally into Europe and the US. Unfortunately, it remains an exception.

"Brazil is a big country and a big market. Two São Paolo neighbourhoods alone equal the whole Chilean market," Pires pointed out. "Entrepreneurs from other South American countries are forced to think of an international presence. Brazilian ones, faced with the size of their domestic market, often are not as motivated to go global as are the ones from Argentina or Chile."

That comment reminded me of startups coming from the tiny geographies of Central and Eastern Europe, who naturally plan for internationalization from day one, viewing their local markets purely for piloting and perfecting their MVPs – if even that.

Another Atomico investment that has come to Europe from far away – this one from China, working closely with Kelly Poon – is the bike-sharing company Ofo.

Pires and Poon have somewhat differing views on European high-growth companies expanding to Brazil and China.

Pires offers a few words of caution: "You need to prepare very well for Brazil. Most likely you don't want to make it your first expansion market. Teams that are expanding here need to do their homework properly – otherwise you could end up knocking on quite a few wrong doors."

While she certainly recommends good planning, Kelly Poon is quite critical of European founders' reluctance in approaching the Middle Kingdom. "It seems to me they are often just scared. They say 'We don't know the market, it's a big question mark for us, we're worried about copycats etc.'. These entrepreneurs should be more ambitious and more aggressive about China. It's a huge market and, with proper planning and preparation, you can manage all these issues that I keep hearing are obstacles."

"I often see global companies having concerns about how they can operate in China given the rules laid down by the government," Poon continued. "One of the keys to Skype's success here is very simple – Skype played by the rules. In my opinion that's a very basic thing – if you come to my house, you come under my roof, you need to show respect to your host. Of course there are issues of freedom of expression, privacy and others. But these issues require a careful, balanced approach. International managers, especially from the US, are often concerned with 'bad PR'. Well, sometimes you need to ask yourself if you're willing to risk giving up on a large market such as China because of PR concerns."

An area of their work which both Poon and Pires see as a new, but quickly expanding one is, in a sense, a direct opposite of supporting European and US companies in their expansion into the huge Asian and South American markets. Large pools of capital from those markets are becoming more and more interested in Europe.

"To a certain degree, this is the result of changing interest rates. Brazilian funds and wealthy family offices could park their money in Brazil and, until recently, enjoy high and attractive interest rates. These have since come down," explained Pires.

On the other hand, European companies are becoming more and more visible on the global stage. Investors are noticing the innovation and high quality of technology coming from Europe.

"We are now of course focused on deploying Atomico IV," continued Pires, referring to the $765 million fund Atomico closed and announced early in 2017. "But for Atomico V, we may very well see interested investors from all around the globe, and part of my job, as well as Kelly's, is to keep in touch with them so we are ready to discuss specifics when the time comes."

Also read:

A chat with Niklas Zennström about the Skype days, scaling and the future of Atomico (video)

Atomico beefs up its ‘value creation team’ with growth expert and Silicon Valley vet Ben Grol

Would you like to write the first comment?

Login to post comments