London-based proptech and insurtech startup Reposit has announced a new £500,000 funding round. Reposit offers an alternative way for tenants and landlords to handle deposits, easing cash flow problems for renters by enabling them to secure a property with just one weeks rent.

The investment is backed by Andrew Weisz of Weisz Investments and Michael and Simon Blakey of Avonmore Developments, and brings the total amount raised by the company to £950,000.

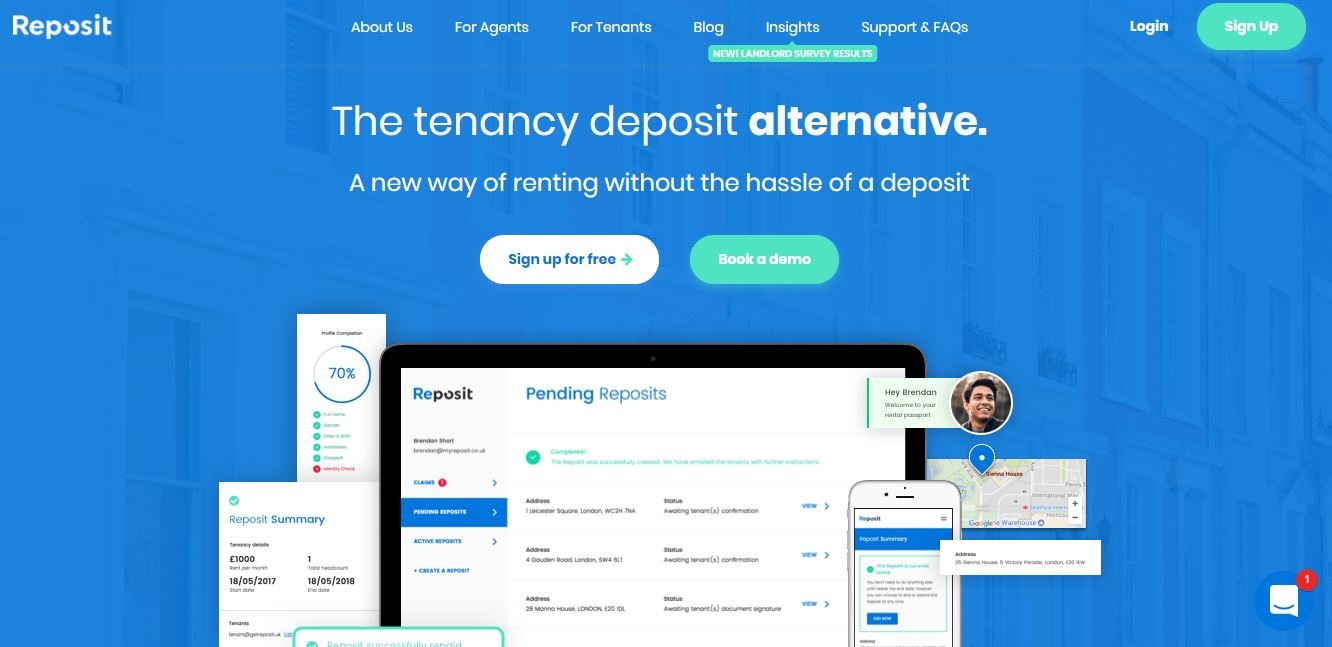

Under Reposit's scheme, tenants purchase a deposit with one weeks rent, plus an annual fee of £30 should they stay for more than one year in the property. The landlord becomes a named beneficiary on Reposit’s insurance policy and is protected for up to six-weeks rent for anything a deposit would have covered.

According to research by the company, 91% of tenants have paid a deposit, with 49% claiming they borrowed the money from family, loans, and even payday loans - often causing significant stress. Among landlords, 61% also reported that they worried about tenants being covered by insurance, and that deposits may not be enough to cover damages.

“Everyone at Reposit has been a tenant and has felt the pain of trying to claw together a tenancy deposit to move into a new property," said Jude Greer, Reposit’s CEO and co-founder. "Paying for one deposit, and waiting for an old one to be released, really highlights a cash flow issue for a lot of people, and there is £4.5 billion of dead cash sitting in tenancy deposit schemes. Cash that could actually have a massive impact if made available to tenants again."

“By easing the burden of a six week deposit, we’re speeding up an entire process and helping more people rent property quicker. A win-win for all involved.”

Reposit says it plans to use the new funding to scale its team and expand its business across the UK rental market.

Would you like to write the first comment?

Login to post comments