London-based insurtech startup FloodFlash, which offers a new way for customers to insure previously uninsurable flood risks, has raised £1.9 million in seed funding from LocalGlobe, Pentech Ventures and InsurTech Gateway.

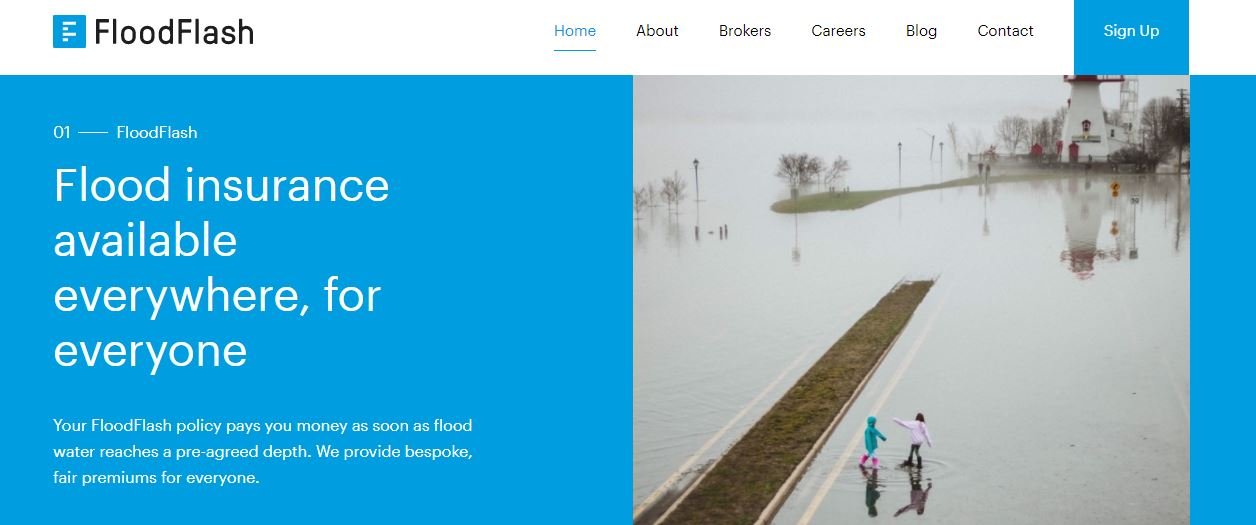

FloodFlash has developed a tech-based approach that makes flood insurance available to everyone, including those with the highest flood risk. The startup's policy pays out a fixed sum as soon as a pre-defined level of flooding occurs. The flooding itself triggers an internet-connected water-sensor and the payment is made immediately to the policy holder.

Recent data shows that every year there are $50 billion of losses caused by floods around the world, and only $9 billion of these are covered by insurance. FloodFlash’s approach allows personalised and competitive flood policies to be written for even the highest-risk locations around the world.

“Every year tens of thousands of business owners lose their livelihoods because they have been unable to take out an affordable policy that protects their business," said Adam Rimmer, co-founder of FloodFlash. "In the immediate aftermath of a catastrophic flood, people care less about dollar-for-dollar reimbursement for damages and more about whether their business will survive at all.”

“The efficiencies in the technology that we have developed make FloodFlash policies available to those who need it most," added co-founder Ian Bartholomew. "The FloodFlash sensor and high-resolution pricing algorithms are essential parts of that. We think that by pricing risk in this way, and by promising instant settlement, we can help to resolve what is arguably the largest market failure in insurance.”

Would you like to write the first comment?

Login to post comments