Editor's note: this is a guest post, syndicated with permission from Crunchbase News and written by Dr. Johannes Lenhard, the Centre Coordinator of the Max Planck Cambridge Centre for Ethics, the Economy and Social Change.

With fieldwork in Silicon Valley, New York, London and Berlin, his current book project focuses on the ethics of venture capital. His recent edited volume came out with Bloomsbury entitled Home – Ethnographic Encounters.

Last year, I spent five months in Silicon Valley and some time in New York interviewing anyone who was willing to talk to me in the VC industry.

From Sand Hill Road to Market Street to Greenpoint, the lack of diversity and inclusion was something I not only saw in the offices I visited but also something many people brought up when I told them I was interested in VC ethics.

I wrote about my findings in the U.S. last August, but perhaps underestimated how–comparatively–well the U.S. is doing already. Europe is even less developed when it comes to the representation of any diverse group in the venture capital industry.

Let’s start with the numbers – at least as far as they go. According to Diversity.VC, the situation in the U.K. is just as shattering as in the U.S.: only 13 percent of VC partners on the island are female (exactly the same share as two years ago). While the gender ratio is improving slowly for junior ranks–from 20 percent females in 2017 to 37 percent 2019–the upper echelons, the decision-making power hasn’t shifted at all.

In fact, estimating the number for all of Europe isn’t easy; there is no singular source of information. Sifted’s recent list of Europe’s Top Series A Investors can give us a sample snapshot: The top 10 firms Sifted identified including Accel, Balderton and Holtzbrinck include 12 female partners, or 15 percent, which is in line with the terrible U.K. numbers.

Bettine Schmitz, director at Axel Springer Plug and Play in Berlin, told me that if she decided to turn her angel collective Auxxo into a VC fund and add four female partners, they would almost double the amount in Germany.

Again, similar to the U.S., the consequences of the lack of investor diversity for founders is enormous.

Atomico’s recent State of European Tech finds that both women-only teams and mixed teams have lost (!) shares of VC money (from 2.6 percent in 2016 to 0.4 percent in 2019 for women-only, and from 8.4 percent to 8 percent for mixed teams). Another, much less talked about consequence of the lack of (gender) diversity is also highlighted in the Atomico report: Almost 50 percent of women in European tech–this is startups and investors–have experienced a form of discrimination in the last 12 months and more than 80 percent believe the discrimination was based on their gender.

Kathi Wilhelm, investor at Berlin-based Cherry Ventures, believes this discrimination issue to be even more poignant: “For female founders, when you are raising money there can still be lots of bias in the process. VCs still unconsciously value ‘male’ criteria–how aggressive they are in their growth plans and so on. We have taken active measures not to let this bias get into our due diligence process.”

What is happening right now for female investors?

Sophia Bendz and her partners at European heavyweight Atomico often try to go one step further than working against “unconscious bias” in their investment (and hiring) process. They have an angel program that is currently running in its second year and boasts more than two-thirds female investors (giving them a chance to build up a portfolio that will facilitate them joining a fund).

They also support their portfolio companies in thinking more inclusively. She explained: “We require all of our portfolio teams to have a diversity strategy and we challenge founding teams that are too homogeneous there is a great report and guidebook we developed with Check that we use if need be.”

Check Warner in fact recently raised a diversity-focused fund in the U.K., Ada Ventures, after starting and leading Diverstiy.VC to its first successes. With Diversity.VC, Warner and her partners are trying to be empathetic to the VC industry while supporting funds in changing: “Over the last three years, we have developed tools and programs and worked together with many funds to roll them out; with the tools we are trying to VCs structurally more inclusive while helping investors to focus on what they do best.”

Maren Bannon, co-founder of female-focused Jane VC in Amsterdam and Boston is still slightly puzzled by how slow everything is changing: “The European ecosystem is maturing–there are exits, there is talent, there is research, lots of engineers and many more venture firms across stages.”

These are great fundamental–so what is the issue? Bannon believes one problem comes with the LPs in Europe: “LP capital in Europe is much more skewed to public finance–the EIF and the BBB are major anchor investors. They are rather conservative in their views.”

Anya Navidski, founding partner at Voulez Capital, a specifically female-focused fund based in London, emphasized this point even more strongly:

"Traditional LPs that invest in VC funds are 3-5 years away from understanding the opportunity; they don’t understand the space. When you are told by the BBB, the government-owned entity specifically tasked with supporting the industry, that it will take 2-4 years before you can get money from them and that they need to be the anchor investor, that naturally skews the market to people who have left big VCs or big banks. Who else can afford that?"

As a result, the financial services reproduce themselves and with it their terrible gender (and diversity) ratios. And the data for the biggest European anchor investor indeed doesn’t look good; for instance, the publicly available list of European Investment Fund (EiF) angels reveals 91 names. Two of the people are female–while the name Michael appears three times (four if we count Mikael). Shouldn’t the most important European anchor investor lead by example?

So, where are we?

At least in the U.K. (and in the Nordics), the issue has been identified, quantified and is continuously measured and talked about now. Diversity.VC has done a tremendous job in this respect. There are panels about it (like this one here organized by Entrepreneurs First), and mainstream media (like the FT) report on it regularly.

The crucial first female-run (and often female-focused) funds–Jane VC, Ada Ventures, Voulez Capital–have been raised. That is all very promising and will hopefully push up the number of female decision-makers across the industry at least from the next generation onwards.

But it hasn’t spread as widely as it needs to, yet.

In particular, Germany–the second-largest VC market in Europe–and France are lagging behind. Obviously, there are positive signs. Berlin is moving ahead in this respect: It is again women like Bettine Schmitz and Dagmar Bottenbruch and the Evanglistas network of female angels who are leading the investors while the Grace accelerator is focusing fully on supporting female entrepreneurship.

WER–the Women Entrepreneurship Roadshow–tries to span a network for female founders across all of Europe. These kinds of initiatives should also be replicated on the investor side–from seed to growth–however, we really need somebody to make a stronger push yet, to actually put a number on the issue.

How about if the next ‘Deutscher Startup Monitor’ also has a section on diversity and inclusion, just like Atomico’s report, to begin? And why does Diversity.VC seemingly not have any followers on the continent? Similarly, ALT–Ambitious Ladies in Tech, founded by Blossom-Capital GP Ophelia Brown–has not yet really been copied–why?

In short, yes, there is awareness, there are first starts, there are initiatives–but we are still missing the networking and networked power of a European AllRaise. Most importantly, we need to admit across the board that a cultural shift will be needed in order to tackle the issue of diversity in VC. Just hiring the odd female partner won’t be enough.

Fortunately, there are now females, such as Marianne Österlund, starting to infiltrate the industry with exactly that attitude.

I asked Österlund, currently based in Stockholm as investment manager at the student-run Wave Ventures, about the main issue she was facing when first thinking about the VC world.

Her response: “When I was in high school, finance was nothing I considered. It felt like such a boys-thing to be interested in When I started looking into VC, Sophia Bendz was promoted at Atomico–and that was when I realized: She has done it, I can do it too.”

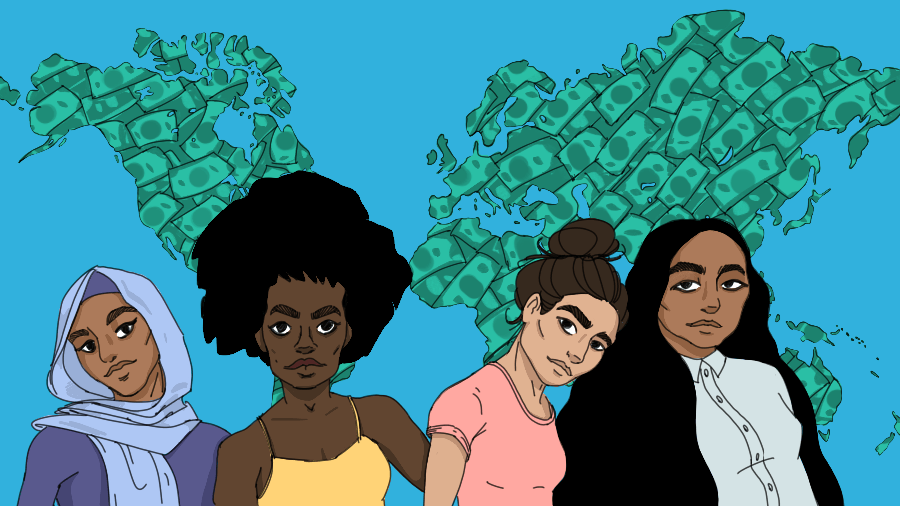

Illustration: Dom Guzman

Would you like to write the first comment?

Login to post comments