Late last week, Paris-based web, dedicated, and cloud hosting giant OVHCloud quietly had its IPO filing approved by the French stock market regulating body AMF (Autorité des marchés financiers). Through this move, the company intends to raise €400 million.

Founded in 1999, OVHCloud has raised a total of €650 million over two rounds, the first a €250 million equity round that saw TowerBrook Capital Partners and Kohlberg Kravis Roberts (a.k.a KKR) participating, the latter a debt funding round of €400 million led by JP Morgan Chase.

The filing submitted to AMF reveals that the company had a turnover of €632 million at the end of its last fiscal year (ending 31 August 2020), a number up 8.9% year-over-year. Accounting for EBITDA this breaks down to €263 million. The company logs approximately 1.6 million customers, of which, “the top 50 account for about 8% of the business, and the top 500 about 20%.”

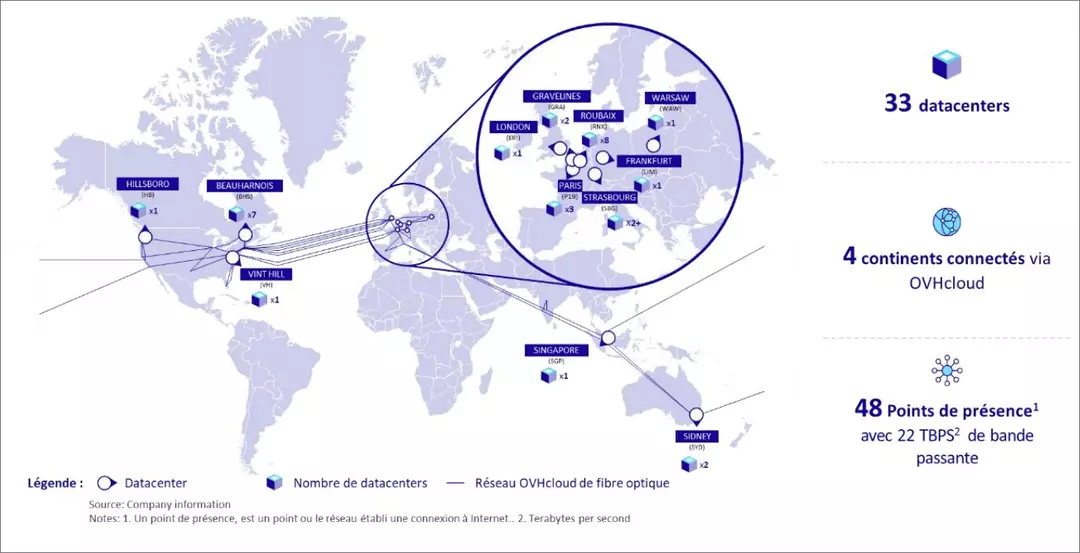

Looking at the geographic breakdown, 52% of revenues are generated from customers located in France, 28% in another European country, and 20% in the rest of the world.

If the name OVHCloud is ringing any bells, yes, it’s the same provider the suffered a fire in March of this year, taking millions of websites offline including government agencies’ portals, banks, shops, news websites, and a fair chunk of .FR domains. It should be noted that as part of the filing OVHCloud declared a €58 million insurance claim compensation from insurers Axa.

Would you like to write the first comment?

Login to post comments