As IPOs no longer remain the only source of capital for growth investments, the relevance of long-term partnerships could have never been more crucial. For the venture capitalist, this signals a much-needed structural evolution of the VC landscape.

To give a boost to the German VC scene, Munich-based early-stage and growth investor HV Capital has unveiled a continuation fund with over €430 million. The new fund, HV COCO Growth will enable HV Capital to support portfolio companies from existing funds and expand further.

In addition to HarbourVest, which is the anchor investor, LGT Capital Partners, Pathway Capital, Holtzbrinck Publishing Group and a number of family offices and financial institutions invested in the fund.

All existing investments from the three funds HV IV, HV V and HV Co- investment Fund from 2010 to 2015 will be taken over by the new fund. The investment team will participate with more than 10 per cent.

The company has invested in around 225 companies in Internet and technology space, including Zalando, Delivery Hero, FlixMobility, Depop and SumUp. It supports startups with capital between €500,000 and €50 million. Notable exits of last year include the billion-dollar acquisition of Depop by online marketplace Etsy.

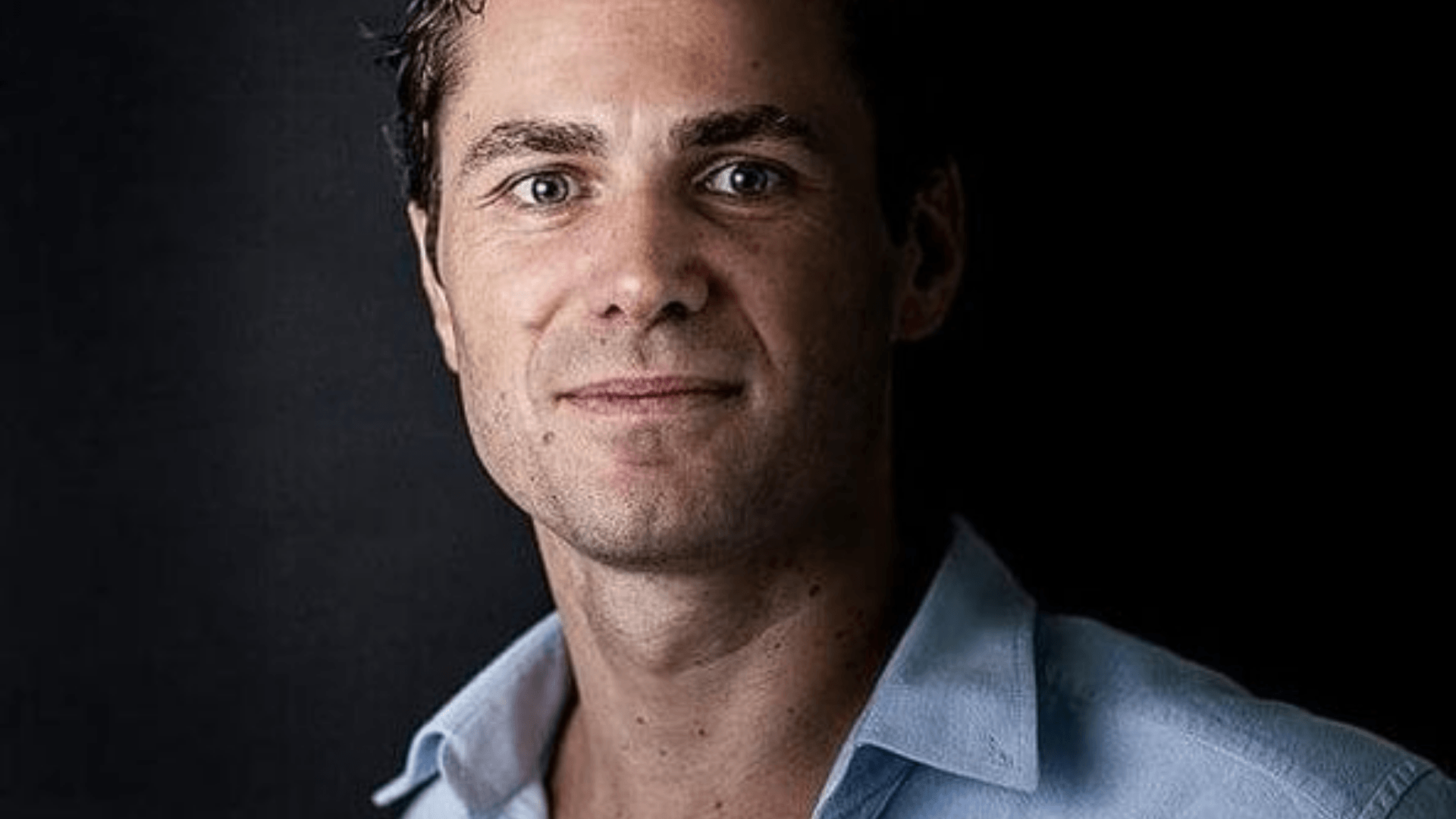

Martin Weber, general partner at HV Capital said: “By launching the continuation fund in the German technology scene, we are breaking new ground in the industry. With HV COCO Growth, many strong investments such as FlixMobility, Global Savings Group and SumUp have been transferred into a new structure.”

David Kuczek, General Partner at HV Capital said: “Our experienced growth team can point to an extensive track record of six investments through HV VIII in growth stage technology companies. In addition, we have launched four co-investment vehicles, thus creating direct investment opportunities for our investors. Therefore, this continuation fund is the logical evolution of our positioning in the market.”

Would you like to write the first comment?

Login to post comments