German urban air mobility company Volocopter has announced the “first signing” of a Series E round that’s provided the firm with $170 million. The funding will be used to further assist the company's certification process and is expected to help drive global commercial launch plans. To date, Volocopter has raised $579 million and has a pre-money valuation of $1.7 billion.

Having announced a €200 million Series D round almost a year to the date at this time last year, where it cited certification and commercialisation efforts, the company is now back with a slightly lesser amount and an update on these certifications and commercialisation plans.

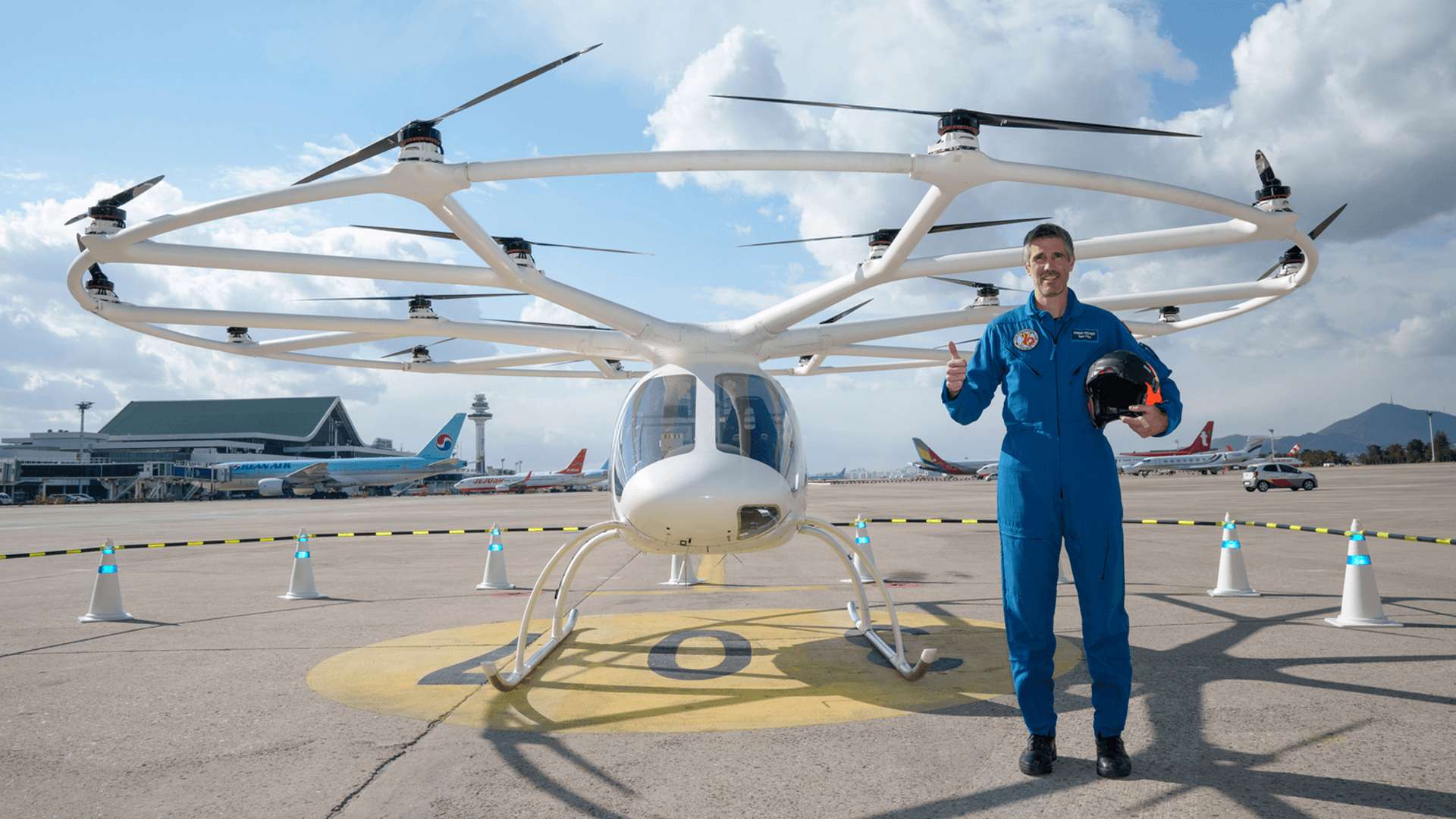

In a strong show of support, Volocopter and lead, and new investor Seoul-based WP Investments have signed a joint venture term sheet that ensures electric air taxi services in South Korean skies are on the horizon.

"We are confident that Volocopter will be among the first to bring UAM to cities globally, since seeing its aircraft fly in Seoul last year,” commented WP Investments’ Dr. Lei Wang. Co-chairman Tiffany Park added, “We are excited to kick off our joint venture and be the first to establish sustainable eVTOL logistics and air taxi services with Volocopter in Korea.”

This announcement arrives just a month shy of the company revealing that it’d signed, "agreement in principle to develop financing solutions that will assist with the sale of Volocopter’s family of electric vertical take-off and landing (eVTOL) aircraft for up to $1 billion."

Meaning, once the company obtains any and all necessary certifications, including those from the European Union Aviation Safety Agency (EASA) and the Federal Aviation Administration (FAA), it’s go time on delivering a fleet of sales and leasing option ready aircraft.

With multiple mentions of a “first signing”, one would have to wonder just how much more capital is heading Volocopter’s way in this Series E round. New investors include round lead WP Investments as well as multinational conglomerate Honeywell and “others” while existing investors including Atlantia, Whysol, and btov Partners also upped their stakes in the company.

"We have never been in a stronger position: we are financially diversified, certification of the aircraft is within reach, and we are demonstrating our advanced capabilities by public flights and strong joint-ventures across the world," said Volocopter advisory chairman Stefan Klocke.

Would you like to write the first comment?

Login to post comments