Investor term sheets can be baffling beasts for early-stage startups, packed as they are with terms and conditions that can sound opaque to the uninitiated. A new report out today from Mountside Ventures and Landscape VC is aiming to demystify these terms and increase transparency, by scrutinising deals sheets from over 200 European VC funds.

Beginning at the basics — what elements comprise a ‘market’ term sheet — the report serves up snapshots and data on things like the most common share and fee structures, founder vesting periods, and share options.

Jonathan Hollis, managing partner at Mountside Ventures, told Tech.eu that the report reveals some interesting points. One was the “always contentious topic” of founder vesting, where their results show that only 2% of investors ask for no founder vesting — the most common term being reverse vesting monthly over four years.

On fees, the report found that there is often confusion over deal fees versus management fees, and over understanding that VC funds take their management fees from those who fund them, the Limited Partners, while funds like Venture Capital Trusts charge these fees to the startups they invest in.

Hollis notes that founders often expect ordinary shares, but they found that 80% of VC investors require some form of preference shares. Preference shares usually don’t include voting rights, but come with, for example, rights to fixed dividends ahead of ordinary shareholders.

ESG (Environmental, Social, and Governance) clauses are gaining traction too, with 33% of funds asking for that in their term sheets.

The survey revealed that closing a funding deal takes between eight and 12 weeks on average. “There is always talk on VC Twitter of deals closing in 48 hours. In reality, our report shows that deals closing between 8 to 12 weeks are much more common, which should be refreshing to founders who think their process is taking longer than expected,” Hollis says.

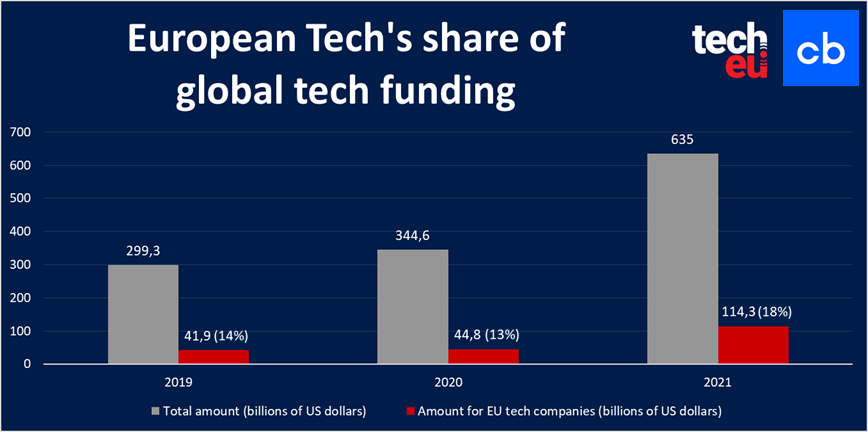

The European tech ecosystem has seen record amounts of VC funding last year, which might lead you to think founders' negotiating power has also increased as investors compete over deals.

However, Hollis points out that the key driver of this capital influx is ever-larger mega rounds, rather than to significant increases in the number of companies getting funded.

"The power has indeed shifted for the top 5% of entrepreneurs, but if you asked the average entrepreneur raising, the bargaining power hasn't changed significantly," Hollis says.

The fundamentals such as preferences, founder vesting and investor consents remain unchanged.

"For example, if terms were actually becoming founder-friendly, we wouldn't have expected 98% of investors surveyed requiring founders to reverse vest some or all of their shares following an investment as this is one of the most heavily negotiated areas (often second to valuation)," he says.

Lead photo by Scott Graham on Unsplash

Would you like to write the first comment?

Login to post comments