As VCs splash the cash in climate tech startups to accelerate the transition to net-zero, sustainable energy, transition technology and social impact businesses have gained significant momentum.

Adding on to the hot sector facilitating green solutions, London-based impact investment company Elbow Beach Capital has launched a venture vehicle with an initial £20 million of committed capital.

The fund will focus on decarbonisation, sustainable energy, and social impact opportunities. The range of opportunities where it will invest include disruptive technologies to decarbonise supply-chains and create profitable circular economies; sustainable energy technologies and infrastructure which reduce dependence on fossil fuels; and those which have a social impact; and improving quality of lives through improved access and reduced costs.

It is looking to make investments both within the U.K., where it is headquartered, and globally. The fund will allocate between £0.5 million to £1.5 million of long-term growth capital to support early-stage businesses (pre-seed to Series A), purpose-driven entrepreneurs with a commitment to improving lives, unique and scalable solutions to social and environmental problems and commercially viable companies with a clear runway to financial growth.

With £20 million immediately deployable, Elbow Beach Capital expects to announce several investments in March and April.

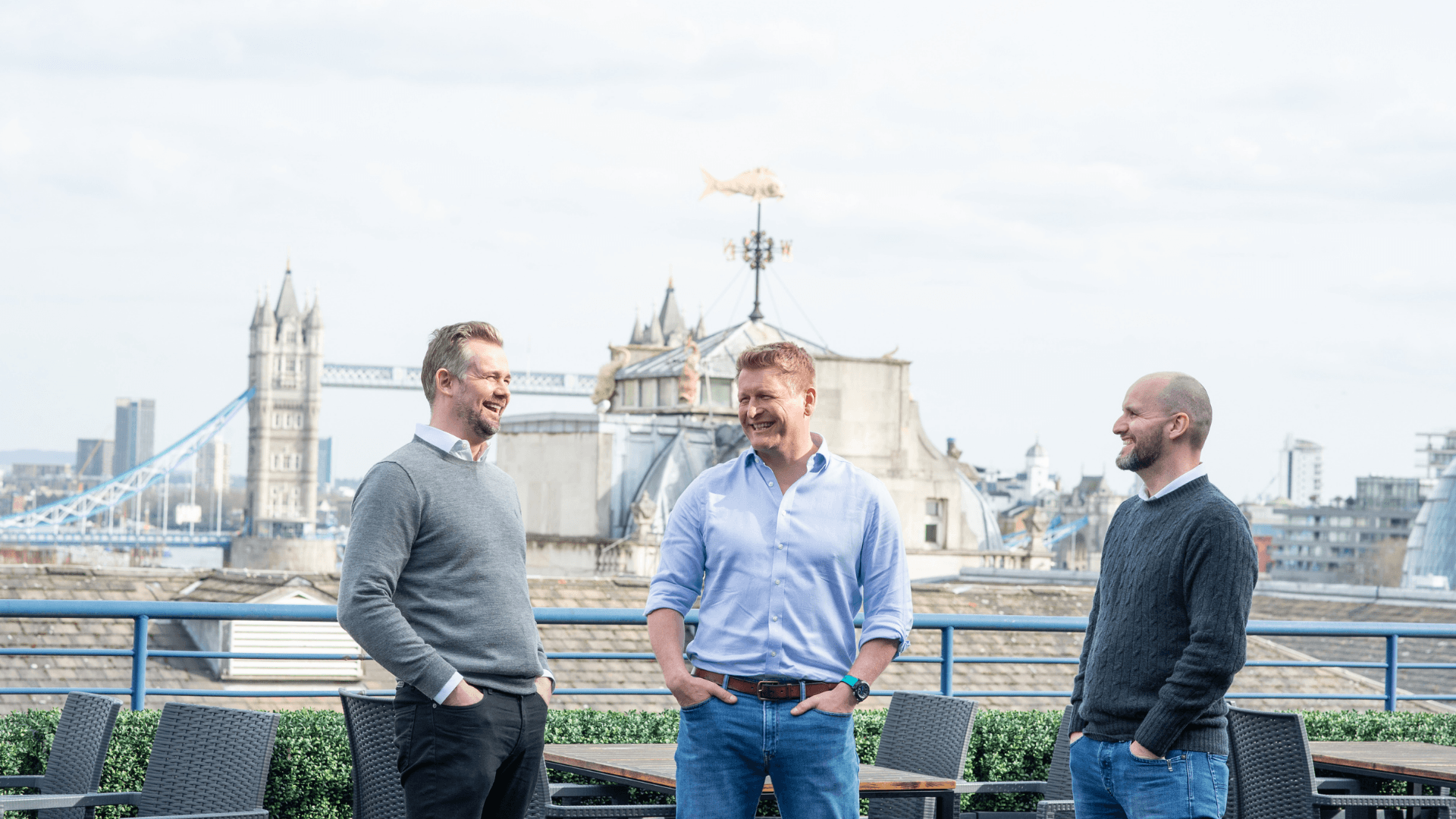

Nick Charman, co-founder and chairman, Elbow Beach Capital said: “Early-stage investment plays a vital role in the advancement of industry-wide solutions to mitigate climate change and improve lives. We are committed to ensuring that every investment it makes helps to protect the future of our planet, its inhabitants, and its unique ecosystems.”

Jonathan Pollock, co-founder and CEO, Elbow Beach Capital added: “The sustainability and environmental technology sectors are expanding but growth will need to accelerate dramatically if governments are to meet their ambitious climate targets. We see a massive opportunity for value creation in early-stage investment across a range of impact verticals.”

Thomas Hardy, co-founder and CTO, Elbow Beach Capital added: “We are looking forward to supporting founders in optimising their technologies and balancing growth and sustainability during a period of unprecedented innovation within impact sectors.”

Would you like to write the first comment?

Login to post comments