Operating out of key European innovation hubs Copenhagen, Berlin, and Stockholm, there’s a new VC on the block, Climentum Capital. A portmanteau of climate and momentum, the fund has already made its first close and is expecting to flesh out the remainder of its €150 million target by year's end.

The fund is targeting approximately 25 European startups in the Seed+ and Series A funding stage, offering investment commitments ranging anywhere between €1-5 million.

With a mass reduction in CO2 emissions at the core of its thesis, Climentum's research has identified the 6 most promising Co2 reducing verticals, and naturally, startups they’d be looking to back:

- NextGen Renewables

- Food & Agriculture

- Industry & Manufacturing

- Buildings & Architecture

- Transportation & Mobility

- Waste & Materials

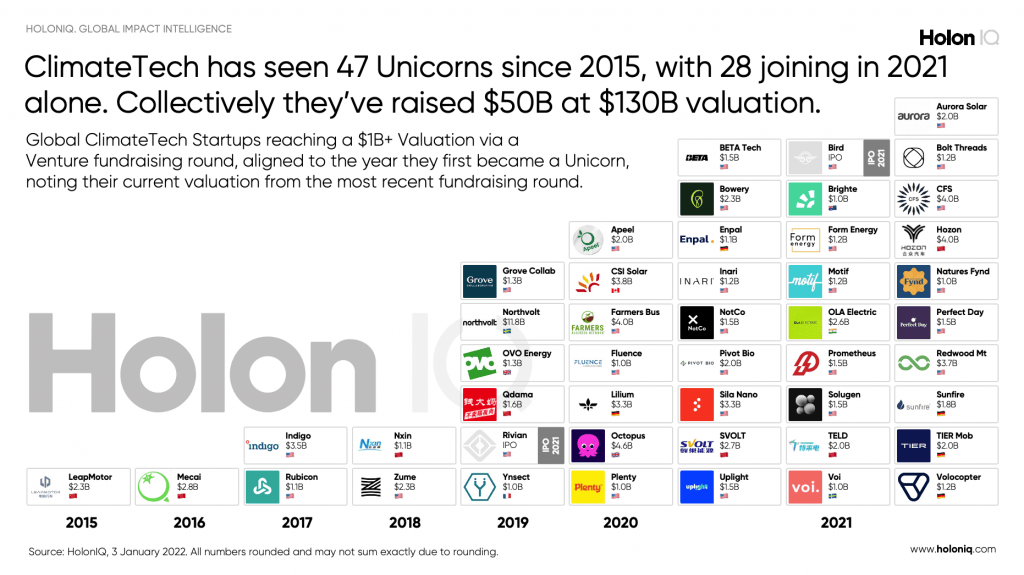

According to Holon IQ, As of 21 June 2022, the global count of climate tech unicorns stands at 47, who, collectively, have seen investors pour over $46 billion into the sector over the course of the past decade and are now valued at collectively valued at $131 billion.

However, scanning the list of the 47, only 10 are European, and collectively valued at €29 billion.

This disparity is precisely that gap that Climentum Capital is setting out on a mission to transform.

And they're going about it in a unique way.

The Sustainable Finance Disclosure Regulation (SFDR) has been introduced to improve transparency in the market for sustainable investment products, to prevent greenwashing, and to increase transparency around sustainability claims made by financial market participants.

More specifically, Climentum is an Article 9 fund. A fund with, "products targeting sustainable investments’. This means that the firm remains steadfast in only investing in companies that aim to realise annual emission reductions of 100 MtCO2e at scale. And not only that but portfolio founders truly walk the walk and not just talk the talk.

As part of the firm's due diligence process, they conduct a scientific climate impact assessment of any potential investment, and once on board, work closely with companies on ensuring that the climate impact goal actually comes to fruition.

And it's not just the startups and the firm that benefit from this procedure.

"There is a concrete value-add to both founders and investors. Investors gain access to a cutting-edge Article 9 fund that delivers climate impacts and the associated data to help them achieve and report on their own climate and ESG targets. This is something that has resonated well with especially institutional and more forward-looking investors," explained Impact Partner, Stefan Maard. "Looking toward the founders, they are keen to work with truly mission-aligned investors that are also willing and able to help them mature on their own sustainability journeys - including documenting climate change impacts and leveraging that to access non-dilutive capital such as carbon credits, grants, and ESG related project financing.”

Climentum Capital is comprised of five General Partners, each bringing a vast collection of skills to the table, aligning on a singular vision

- Dörte Hirschberg: formerly Junior Partner at McKinsey and member of the Rocket Internet leadership team, she offers strong operational expertise and a passion for food tech and female-led teams.

- Yoann Berno: ex-silicon valley software engineer turned serial entrepreneur turned investor, with a long-standing passion for climate-tech investing

- Stefan Maard: ex-Novozymes sustainability & venturing leader, building impact ventures and documenting sustainability impacts, before launching own corporate impact venturing studio

- Morten Halborg: ex-Executive at Skandia (CIO, COO and CEO roles), with extensive experience in institutional financing and asset management, including driving the ESG agenda forward

But that’s only four GPs, right? Well, every good superhero team needs a surprise guest, only to make her first appearance late in season 1 right?

- Stockholm GP to be announced: A deep-tech woman VC investor with decades of experience in corporate and financial VC

Collectively, the quintet possesses over 70 years of VC and startup world experience and has been involved in more than 50 deals.

If the expression fortune favours the brave still holds today, then GP Yoann Berno encapsulates Cimentum’s modus operandi in one statement, “We are absolute technophiles”, says Yoann Berno. “We will be looking for needle-moving technologies and solutions that often stretch a bit from your ordinary ‘safe-zone’ investment opportunities we might see the generalist funds go for. Deep tech is not something we shy away from – quite the contrary.”

Climentum Capital is backed by a number of well-known corporate investors, banks, and industrial conglomerates such as BASF Venture Capital, Arbejdernes Landsbank, Vaekstfonden (The Danish Growth Fund), prominent family offices, and successful tech entrepreneurs.

“Now is the time to invest in Climate Tech. We need to see results within the next decades and see momentum from all sides: governments and corporations are pushing for real change, the best talent is moving into the space and technology has developed massively," concluded Hirschberg.

Would you like to write the first comment?

Login to post comments