Gibraltar/Berlin-based Ethereum ecosystem infrastructure architect Gnosis' most well-known product, Gnosis Safe, now known simply as Safe, has raised $100 million in a venture funding round led by 1kx with Tiger Global’s participation.

Following a community vote to spin off Safe from Gnosis itself, the new funding will be used to support the non-profit organisation Safe Ecosystem Foundation and further development of Safe. Following an ICO that raised $12.5 million back in April of 2017, Gnosis as a whole has raised $112.5 million to date.

Safe has gained a reputation of its own, having processed north of 600,000 transactions and secured digital assets exceeding $40 billion. As a testament to its security, 13 percent of all Cryptopunks NFTs are secured using Safe.

Instead of employing the ‘traditional’ 24-word secret phrase private key-to-ownership solution, a solution that we’ve seen time and time again become compromised or simply lost, Safe uses smart contracts accounts that can be individually configured to suit the custody needs of different user groups:

- Authentications using multiple private keys (multi-sig) or community-control (DAOs)

- Recovery and inheritance mechanisms

- Improved transaction experience (transaction batching, gas abstraction)

- Transaction checks and hybrid-custody

- Spending limits and automation

“For mainstream adoption of web3 we need to overcome the risks and limitations of private key accounts. Safe provides a critical public good as a compostable and use-case agnostic smart contract account that can control digital assets, data, and identities. The transition towards smart contract account will be a joined effort by the entire web3 community,” explained co-founder Lukas Schor.

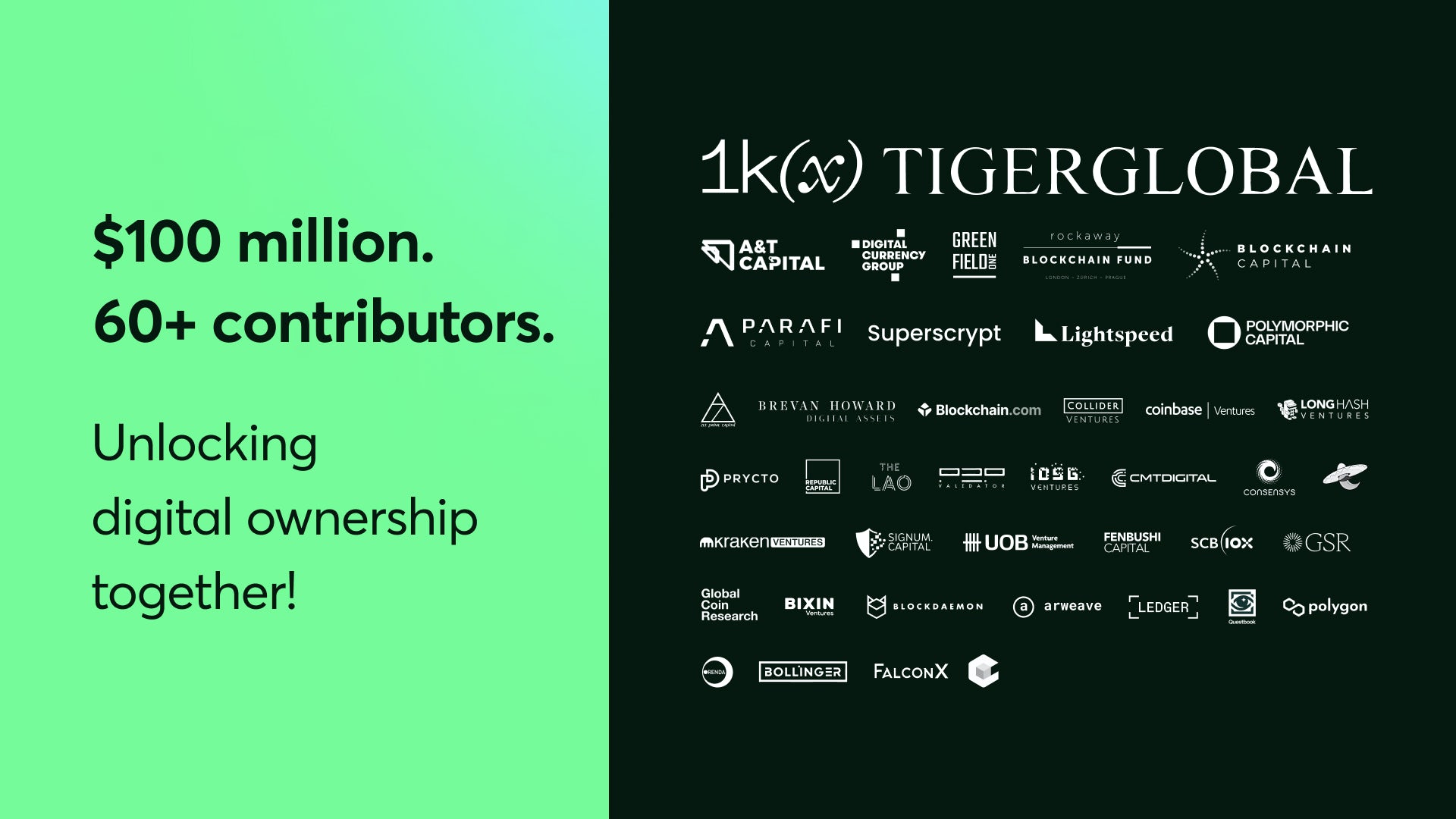

Safe’s $100 million venture round was led by 1kx, with some 60+ investors including Tiger Global, A&T Capital, Blockchain Capital, Digital Currency Group, Greenfield One, Rockaway Blockchain Fund, ParaFi, Lightspeed, Polymorphic Capital participating

“Safe has established itself as the universal asset management primitive. From DAOs to treasure management tools to institutional custody, Sage has achieved an excellent product-market fit through all segments of crypto and established itself as the absolute winner,” commented 1kx’s Lasse Clausen.

Would you like to write the first comment?

Login to post comments