According to Atomico’s 2021 ‘State of European Technology’ report, just over 1% of overall VC funding in Europe went to founding teams solely made up of ethnic minorities.

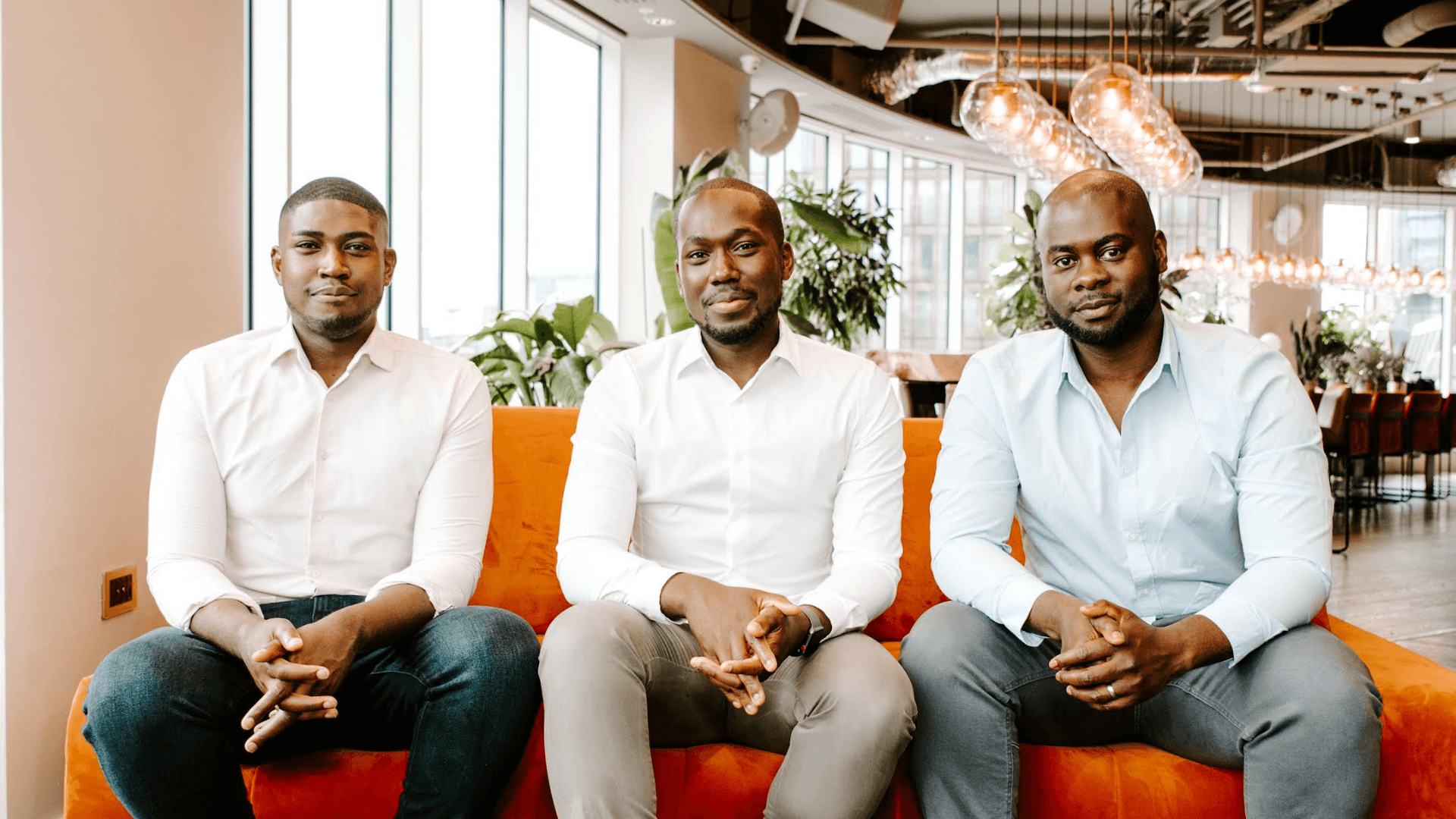

Stepping up to change the situation, Cornerstone VC, born out of black-led angel group Cornerstone Partners, has rolled out a £20 million fund to invest in exceptional entrepreneurs in the U.K. from diverse backgrounds. The fund will support tech-enabled companies at pre-seed and seed stage, with a ticket size of £250,000 and £1 million with capital reserved for follow-on funding.

The fund will invest in up to 40 companies with a significant proportion based outside of London. Cornerstone’s angel network will also receive a share of the fund’s profits via carry participation.

Cornerstone VC’s mission is to establish a leading VC firm with a diversity-led investment strategy that unlocks outperformance and delivers returns for investors.

So, what companies will be on the VC’s radar? It will target management teams with inherent (such as age, gender or ethnicity) and acquired diversity (social capital) and address the equity funding gap for entrepreneurs that are too often overlooked and underestimated by the wider funding community.

The first round close of the fund was led by BGF and The Hg Foundation with participation from Atomico. Other investors include Nic Humphries and several senior partners from Hg, a leading software and services investor and other individual investors, including former BVCA chair Neil Macdougall, Scott Mackin, Jamie Broderick, Stefan Ericsson and Sidumiso Sibanda.

Rodney Appiah, managing partner at Cornerstone Partners, said: “We are on a mission to put teams at the heart of our investment approach, believing diversity is key to driving outperformance. We are looking for businesses that are intentional about team composition, can excel in high-growth environments, and are truly obsessive about execution. People first, software second.”

Stephen Welton, executive chair at BGF said: “The seed-stage tech fund complements BGF’s established minority investment for small and mid-sized growth businesses. BGF is actively committed to supporting a targeted range of activities where the objective is to make a real and meaningful difference to broader representation in the investment and entrepreneurial communities. We are very encouraged that the work we have done supporting female entrepreneurs has resulted in us being the most active investor in women-led scaleups in the country.”

Nic Humphries, senior partner and executive chairman at Hg concluded: “Our experience has demonstrated that diversity in leadership often leads to better investment and business decisions. Diversity in the technology sector continues to be a priority for us, the businesses we invest in and is also at the heart of The Hg Foundation.”

Would you like to write the first comment?

Login to post comments