Super has raised £22.5 million in a funding round led by none other than existing investor Accel. According to Super's about us page, this is a pre-seed round. Which, would then make Accel, Union Square Venture, and LocalGlobe's $30 million venture round a pre-pre-seed round. Or is that pre-seed-seed round? Either way, Super is getting some more money.

Founded early this year by the former CEO and co-founder of a certain other fintech you’ve most heard of, publicly listed Funding Circle, Samir Desai CBE, Super Payments Holdings Ltd, or, Super’s raison d'être is simple: help businesses and consumers keep more of their hard-earned cash in their own pockets.

Ok, ok, ok, I’ll give you that, this is a promise as old as time, but not too many folks have the same track record as Desai, nor the backers he’s assembled standing behind the premise. Let’s get to the nitty-gritty, shall we?

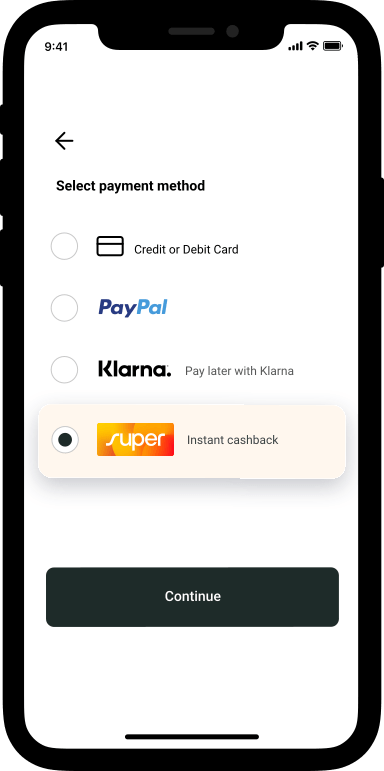

Taking aim squarely at the fees often levied by payments and digital advertising companies, Super is taking a page from a classic model, cashback and rewards, and presumably putting its own twist on things. I do have to say though, even the branding colour scheme is textbook Discover card.

Citing that businesses typically pay anywhere between 1 and 5% fees every time there’s an e-commerce transaction involved, and another 15-30% fees associated with sales driven through ad companies, Super says, why?

Instead, Super is offering businesses free payments “forever” and in turn promotes these savings to be passed on to consumers via a cashback rewards scheme. The company allows businesses to set a commission they are willing to give to Super in exchange to drive sales. Now, how that isn’t going to turn into a bidding war, I’m hard pressed for an answer, but hey, a spin is a spin.

Instead, Super is offering businesses free payments “forever” and in turn promotes these savings to be passed on to consumers via a cashback rewards scheme. The company allows businesses to set a commission they are willing to give to Super in exchange to drive sales. Now, how that isn’t going to turn into a bidding war, I’m hard pressed for an answer, but hey, a spin is a spin.

In a statement, Desai commented, “Businesses and shoppers have been stung by huge fees on the internet for too long, in many cases without even knowing. We believe that the simple Super app can save shoppers and businesses billions a year. At a time of high inflation and increases in the cost of living, redistributing the huge profits of payment and digital advertising companies back to users will significantly improve people's lives.”

Super’s £22.5 million pre-seed round was led by existing (venture round) investor Accel with existing investors Union Square Ventures, and LocalGlobe / Phoenix Cout Group following on, The round also included a healthy list of angel investors including Sir Ron Kalifa OBE, (former CEO of WorldPay), Edward Wray (co-founder of Betfair), Peter Jackson (CEO of Flutter), Gokul Rajaram, (Board member of Coinbase), Andrew Robb (former COO of Farfetch), Maria Raga, (former CEO of Depop), and the co-founders, Chairman and CEO of Funding Circle.

"In today’s economic environment, businesses and consumers alike are feeling the squeeze on their finances,” adds Accel’s Harry Nelis. “Samir and the team at Super are solving a problem that has flown under the radar for too long, and enabling everyone to keep more of their money. A second-time founder in the fintech space, Samir has the ambition, industry knowledge, focus and team required to build a company at scale. I’m delighted to be joining forces with Super on the next phase of its journey and continuing a long partnership with Samir.”

Would you like to write the first comment?

Login to post comments