Dutch mid-market infrastructure fund manager DIF Capital Partners has acquired a majority stake in Stockholm’s developer of subsidy-free solar projects in the Nordics, Alight. As part of the agreement, DIF will invest €150 million into the company and conduct a secondary buy-out of a number of existing shareholders.

With the capital raised, Alight plans to accelerate the buildout of its near-term pipeline of solar projects in both the Nordics and across Europe.

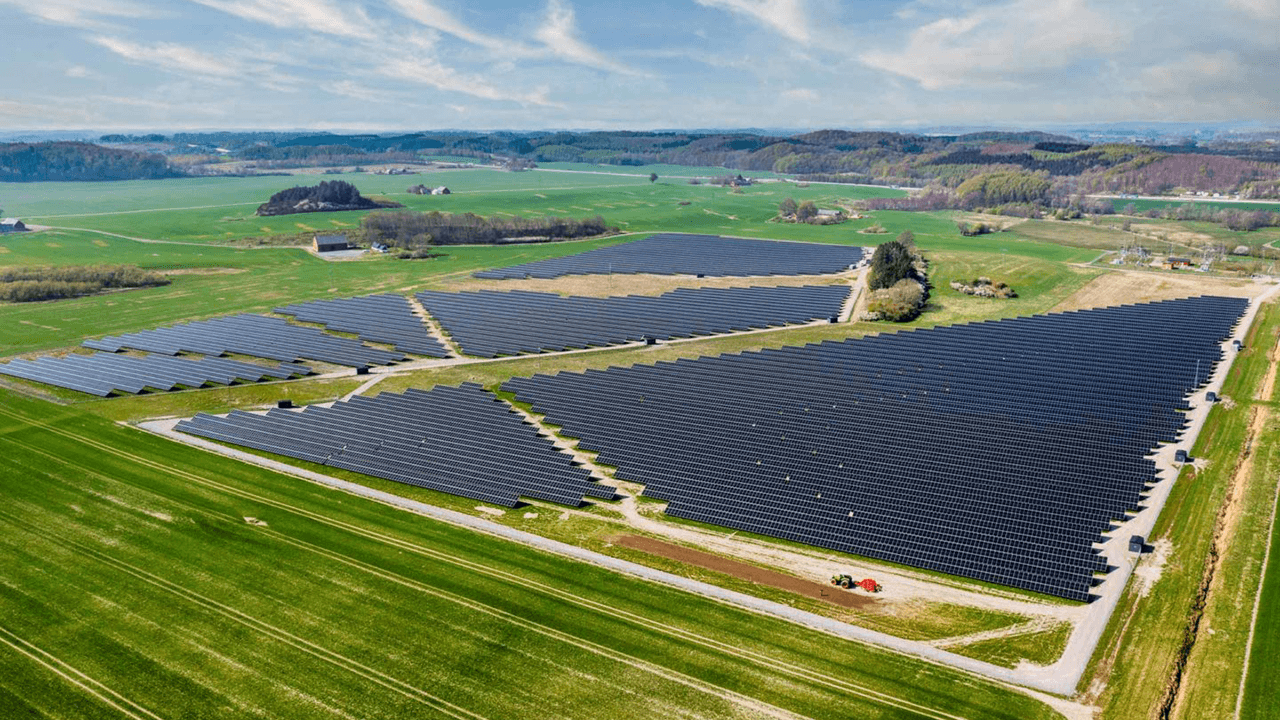

Alight develops and operates solar projects, onsite and offsite, across Europe. Having set an initial target to build 1 GW of solar assets by 2025, Alight now plans to have 5 GW of PPA-backed solar projects delivered across the Nordics and Europe by 2030.

The company counts Swedbank, Nolato, Kingspan, and Toyota amongst its client base – and is developing more than 1 GW of PPA-based projects across Sweden, with a further 170 MW under development across the rest of Europe.

On the investment, Alight CEO Dr. Harald Overholm commented, “We are excited to work closely with DIF on progressing the corporate transition to renewables; they share our vision for the industry and the urgency of our work to accelerate the energy transition.

Corporate power usage accounts for up to 70% of global electricity consumption, so making a prompt and effective shift to renewable energy is crucial. Solar remains the cheapest and quickest energy source to scale, so building more to deliver energy security and reduce emissions is crucial.”

Would you like to write the first comment?

Login to post comments