Antler is today publishing its 2022 Unicorn Founder roadmap for the Benelux region.

The review takes into account 33 unicorn valuation startups produced from Benelux and 22 companies that are expected to achieve unicorn status.

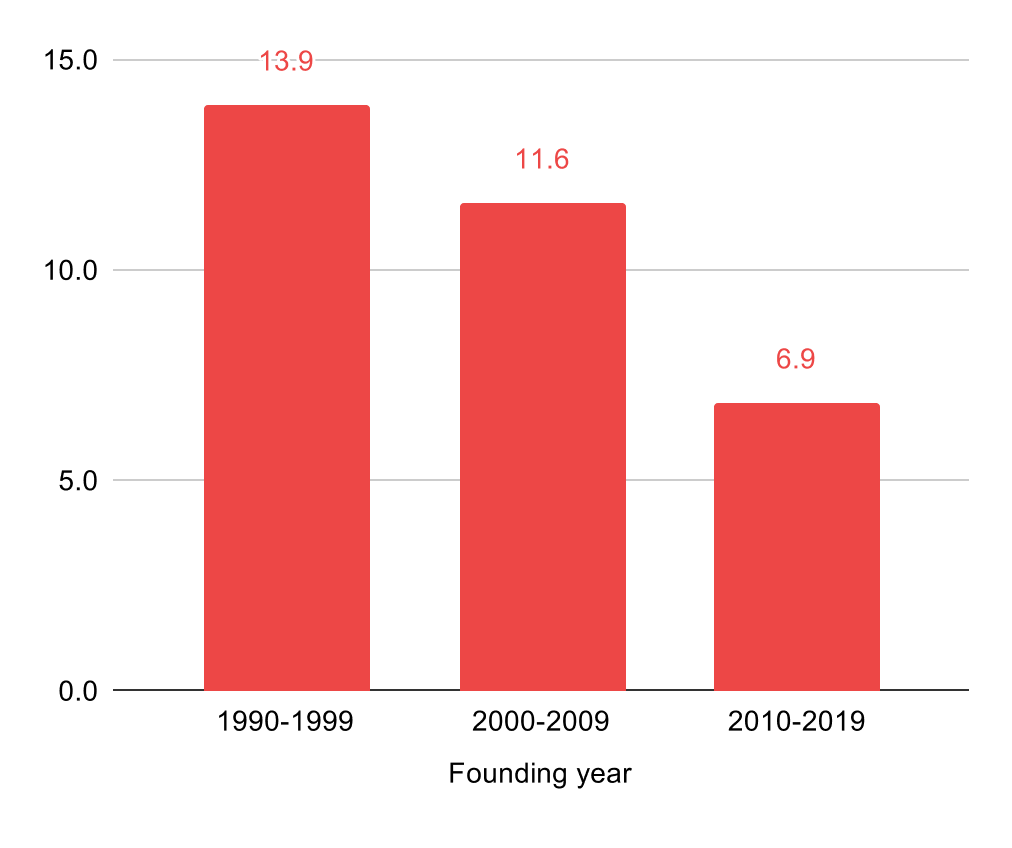

It reveals the $1 billion+ valuation is on average being achieved in half the time it took 30 years ago.

Better still, Antler says the valuation potential is sector agnostic, with no single segment offering clear advantage.

Visual data from Antler

The Benelux economic clusters of Brussels, Amsterdam and others have increasingly found their stride.

Following Brexit in 2020, London's decline as a European powerhouse has aided their prominence, though some might recall earlier Benelux success stories.

There's TomTom, whose in-car GPS platform went truly mainstream in 2004 but which took 14 years to achieve exits for its investors, which came with its acquisition by Bridgestone Europe in early 2019.

Further high profile exits have included holiday travel and accommodation portal Booking.com (10 years to exit) and food delivery service Takeaway.com (19 years to exit).

More recently, there's been the back-of-house kitchen to delivery manager Deliverect and smartphone grocery fulfilment service Picnic (both 4 years to exit), among countless others.

Despite industry efforts, the gender gap remains — just 4% of the 71 Benelux unicorn founders covered by Antler's report were women.

Drill down further and it's clear unicorn valuations often happen for Benelux founders who possess a Masters-level university degree (50.9% of unicorns), though there's success stories also for founders without any degree (10.5% of unicorn founders.)

In terms of the investment split, the US was responsible for 38% of Benelux unicorn funding followed by the Netherlands with a 13% share. Some 10.6% of venture inflows stemmed from the UK, followed by Belgian investors (6.9%), France (6.5%) and Germany (5.6%).

Would you like to write the first comment?

Login to post comments