Pitchbook's annual dataset shows that venture capital for European ecosystems was slightly lower last year, declining to EUR 91.6 billion from a record high of EUR 108.9 billion in calendar year 2021.

Late stage rounds continued to account for the lion's share of VC rounds, a trend that started in 2017. A total of 65.6% of total deal value came from late-stage venture capital funding and "venture growth" rounds (the latter is a new pitchbook classification introduced to capture mid- and later-stage activity). This is a slight increase from 64.8% in 2021.

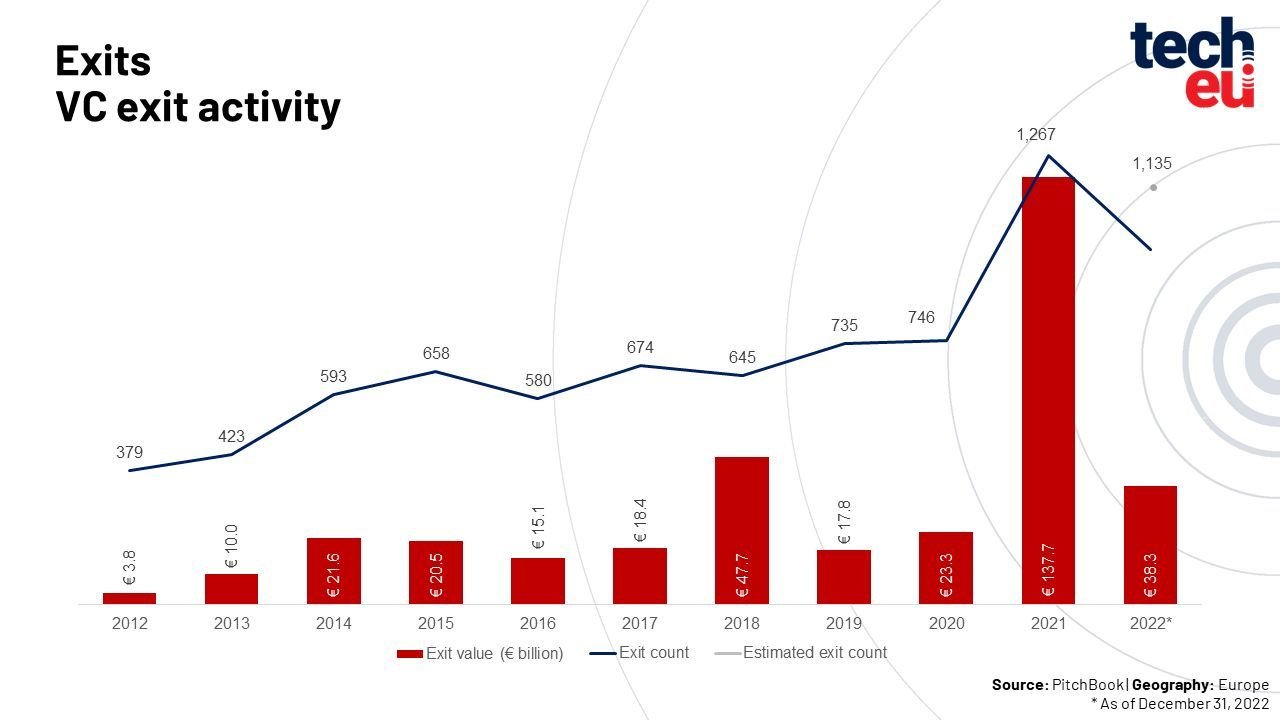

Exit values reached the third highest level ever (EUR 38.3 billion), despite deteriorating economic conditions and lower valuations, and the more challenging conditions are expected to continue this year. Shine aside, exit values have fallen dramatically compared to last year (EUR 137.7 billion), and according to Pitchbook, 63 public IPOs raised only EUR 13.4 billion. This trend is likely to continue this year, making the prospect of a corporate takeover a more enticing alternative.

Would you like to write the first comment?

Login to post comments