Over the last few years, proptech has gone from strength to strength. We're seeing consistent growth in companies that have previously disrupted the traditional real estate industry.

Overall, companies are increasing their funding, scaling their marketing and evolving their product offerings. All while delivering inventive ways of buying, selling, and renting home accommodation.

Let's take a look at the trends of the last three years:

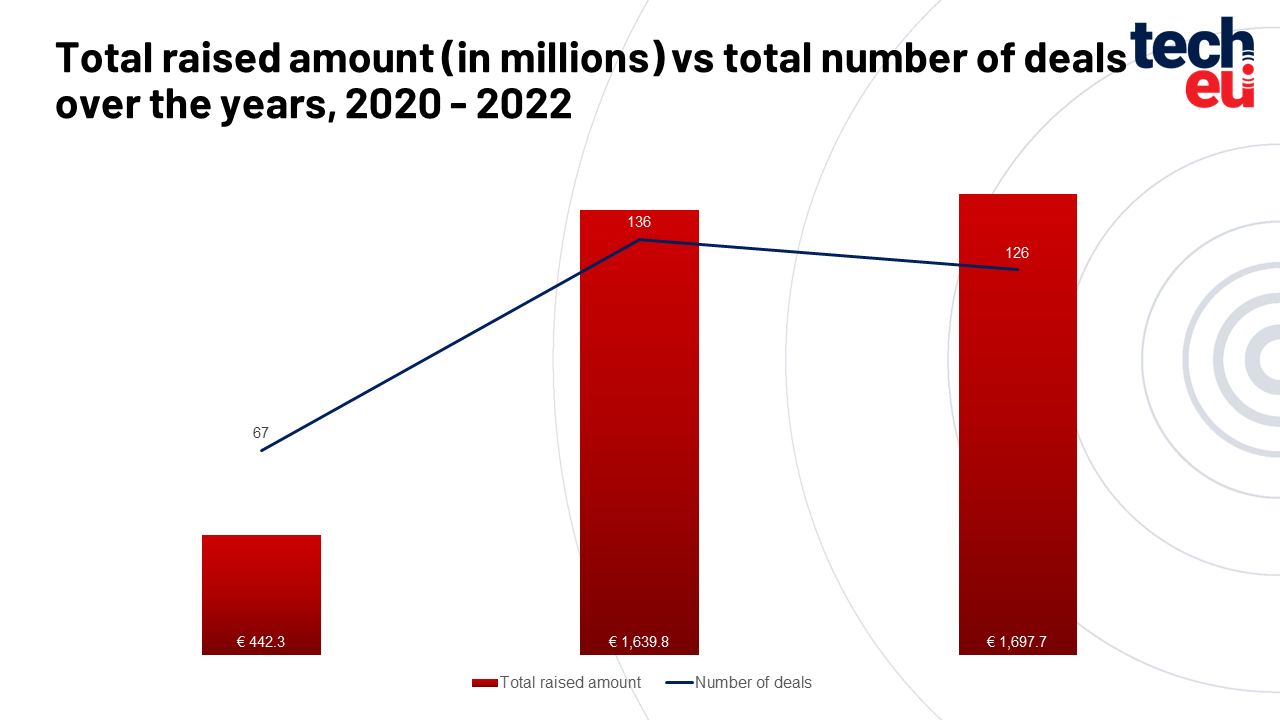

Proptech funding saw a massive increase from 2020 to 2021, with just over double the deals:

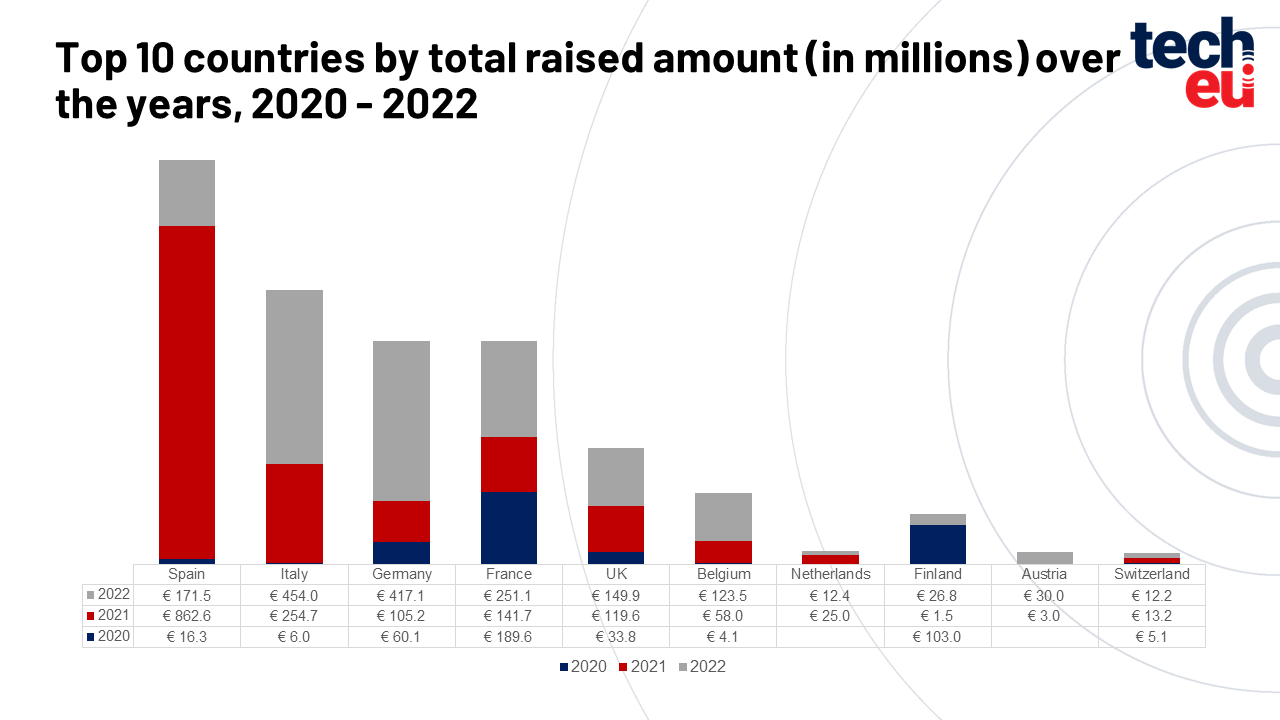

In 2022, Spain and Italy led the pack, although Spain has yet to see a significant funding increase like Italy, Germany, and France. This is not entirely surprising as 2022 was a bumper year for Spanish proptech startups.

But in 2022, companies raised more money than in previous years with fewer deals.

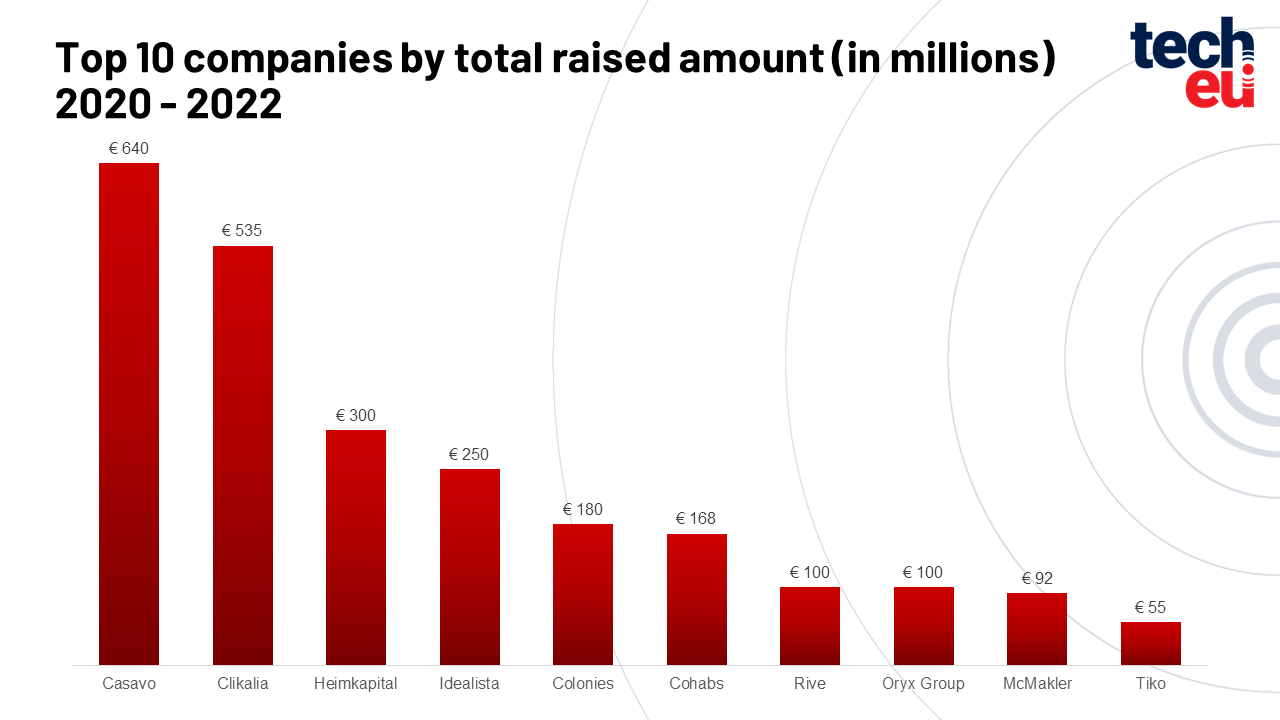

So what happens behind the scenes when we dig into the proptech startups currently raising the most funding?

Four compelling trends have persisted over the last three years of fundraising. They extend across multiple funding rounds, product maturity, and new service offerings:

iBuying

Imagine buying and selling a house online without a real estate agent in sight. iBuying uses AI , data analytics and digital platforms and accounts for four of the top 10 funding rounds since 2020.

A homeowner can sell their house online without needing to meet a real estate agent, list the home, stage it, show it, or do any marketing. Instead, potential sellers upload the details of their homes to an online platform.

These details are assessed using AI and data analytics to predict the home's future value, and the owner is presented with an offer based on the calculations. This happens fast.

Casavo was founded in 2017 in Italy and is the biggest fundraiser of the last three years and the European leader in iBuying. Casavo can formulate a purchase proposal based on a video call or simply by analyzing the house's planimetry and pictures directly uploaded on the app.

The company guarantees a sale within 7 to 30 days, providing an immediate home valuation and submitting a direct offer to buy in 48 hours via its app.

Sellers can receive a direct purchase offer by Casavo, or find a buyer through its network of partner agents. Buyers can access an exclusive inventory of 'ready to move-in' properties and integrated services such as mortgages.

Casavo's platform also connects real estate operators, including brokers, banks and renovation companies. The company currently operates in Italy, Spain and Portugal, rapidly expanding into other European markets.

Casavo has raised €708.9M in funding over 10 rounds, with its most recent funding in December 2022.

Spanish company Clikalia is also leading with iBuying. The company guarantees sellers "immediate" liquidity through an offer on their property as quickly as within 24 hours and, if accepted, a sale within seven days.

Most of the properties are then renovated by the company and put back on the market. The company has raised 983.1M in funding over six rounds. It's latest funding was raised in February 2022.

Finnish proptech company Rive has developed a comparative end-to-end platform that gives home sellers instant cash offers and offers fully renovated, move-in-ready homes to buyers and the opportunity to trade in their old homes for a data-based market price.

The company is valued at €136.7 million, with its most recent funding round of €22

Also leading the way in iBuying is Spanish proptech company Tiko, which raised $116.4 million, with its most recent funding round in 2021.

New ways to finance

As well as property companies buying your house back from you, there's also another idea.

Heimkapital is a German real estate platform founded in 2019. It enables customers to sell part of their property in exchange for an immediate payout. Targeting the ageing market, sellers sell up to half of their property to home equity and pay a monthly fee back to the company, such as rent. This leaves seniors with disposable income. Heimkapital has raised a total of €300M, including funding in September 2022.

An amalgamation of service offerings

Some companies in the top 10 are making a name for themselves through a mix of offering service offerings that use tech to facilitate buyers and sellers, but also B2B in-house product offerings that digitise real estate processes or other services within the industry.

For example, idealista is a real estate platform that shares industry news, data, and insurance. In 2020 EQT acquired the majority of idealista from Apax Partners for a whopping €1.3 billion. (Apax bought idealista in 2015 at a reported €150 million valuation).

idealista has acquired four companies and raised €426M in funding over five rounds, with the most recent funding in February 2021.

In France, Oryx Group operates a digital platform and a web of over 400 independent real estate agents throughout France. Beyond typical real estate offerings, it also focuses on training real estate agents.

The company acquired immoreseau in 2017 and Rezoximo in 2018 and is valued at $112.97 million.

And in Germany, McMakler, founded in 2015, is a hybrid real estate agency that not only buys and sells properties but has developed software that assists in listings, marketing, and appointment bookings. The company also has offshoots which focus on investment management and energy certification.

The company is active in Germany, Austria and France and employs over 600 people, including 400 real estate agents.

McMakler has raised a total of €188.5M in funding over 10 rounds, including two funding rounds in 2022.

Co-living

Co-living is a form of rental accommodation going gangbusters right now. People rent smaller private spaces and enjoy large communal spaces, such as shared kitchens, workspaces and living areas, without sacrificing their privacy. It helps reduce the housing shortages in many urban areas.

France startup Colonies is one of two co-living startups in the top 10 of proptech funding over the last three years. This new type of housing

Founded in 2017, the company has raised €180 million in funding,

Brussels company Cohabs is also rapidly increasing housing stock in cities with short housing supplies. The company has a current portfolio of 1.550 bedrooms across Brussels, Paris, New York, Madrid, and Luxembourg, with the goal to reach 5.000 bedrooms across 11 cities by the end of 2026

Cohabs has raised $203.1 million over six funding rounds, most recently raising €110 million in Series C funding in 2022.

Co-living 2.0 is here

Importantly, as co-living grows in popularity, we already see the next iteration of the accommodation to meet specific tenant cohorts. Two companies to watch are Her Roomies and Commune.

Spanish company Her Roomies launched in 2020 in response to the reality that women face more challenges than men when seeking rentals, partly due to the gender pay gap and because they have certain safety requirements and wants like neighbourhoods and proximity to facilities.

It has developed a comprehensive platform that simplifies the rental process and has listed over 52,000 rooms, apartments, co-livings, and student residences. It also offers services such as help with removalists and relocation logistics such as banking The company raised €208.5K in 2022.

Single-parent families represent a growing proportion of the population, representing 1 in 3 families in the Paris region.

In response, Commune is the first co-living designed for single-parent families with communal areas and private units and tailor-made services in the works, such as legal aid, school support, and childminding.

Last year, the startup raised nearly €1.5M from business angels. The co-founder wanted an investor base that was as representative and equal as possible.

As a result, this round has 13 nationalities, 45 percent women, 50 percent first-time investors and a gap of almost 45 years between the oldest and the youngest member of the round.

Would you like to write the first comment?

Login to post comments