The valuation of Stockholm last-mile delivery company Instabee has taken a sharp knock, at least in the opinion of its Swedish investor Creades.

Creades is understood by Swedish news source Digital to have slashed value by 25%, cutting Instabee to 13.5 billion Swedish krona (€1.2 billion) from 18.1 billion krona previously.

According to Creade's CEO, John Hedberg, the lower valuation is essential to reflect data from listed last-mile delivery companies. As Instabee is privately owned, listed competitors could be a useful barometer for sales and growth potential.

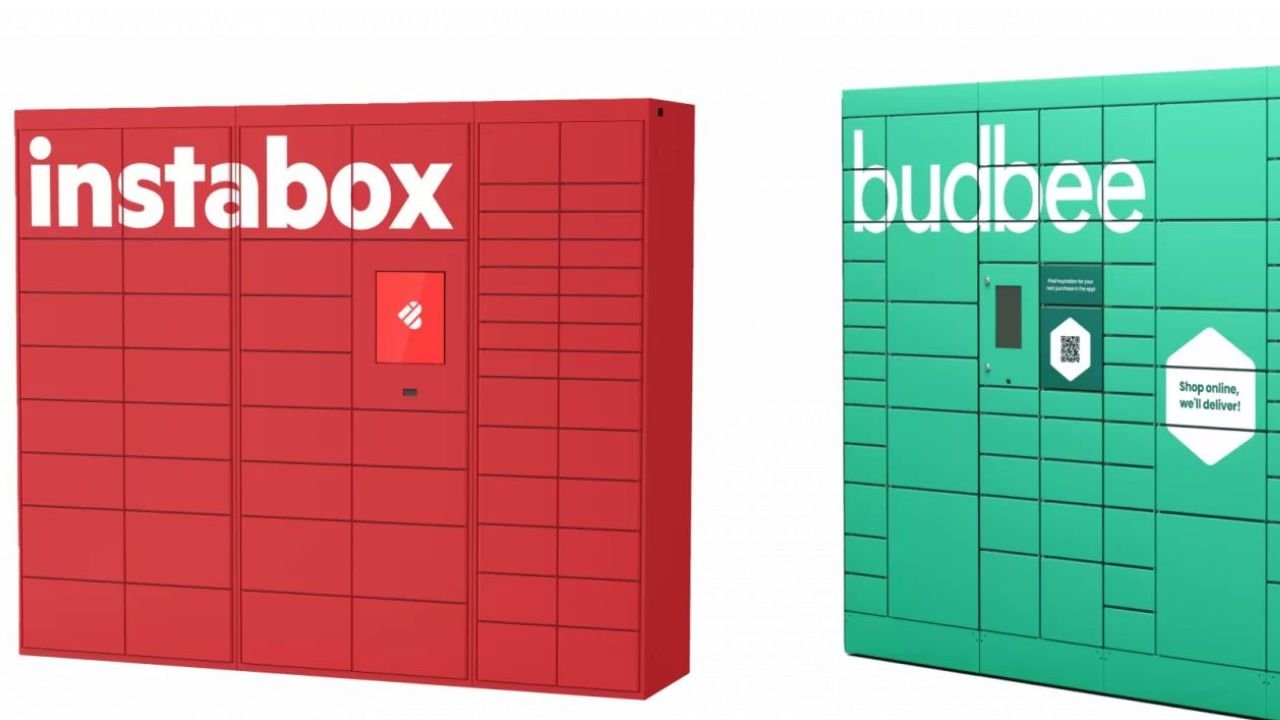

Hedberg currently holds 5.5% of Instabee's shareholding, Digital says. The news comes mere months after the company was formed, following last year's merger of Swedish last-mile players Instabox and Budbee. The merger itself took place at a €1.67 billion valuation suggesting Instabee probably inherited the same value, so it might just be a quick adjustment of expectations for the newly merged business.

Besides Creades, Instabee's shareholders include clothing giant H&M, Kinnevik and the founders of Instabox and Budbee, along with EQT, Verdane, AMF, Stena Sessan, CNI Nordic, and Tham Invest.

Would you like to write the first comment?

Login to post comments