A new European VC collective comprising 120 venture firms, including Northzone and Balderton, will attempt to disseminate industry knowledge on leveraging ROI and ESG value from impact-led investments.

The UK's ImpactVC programme has exited stealth after a stretch in incubation, led by the UK-based impact investor Big Society Capital.

To get the ball rolling, it has revealed its inaugural service — the VC Impact Playbook — will act as a guidebook for European investors unfamiliar with impact-led returns.

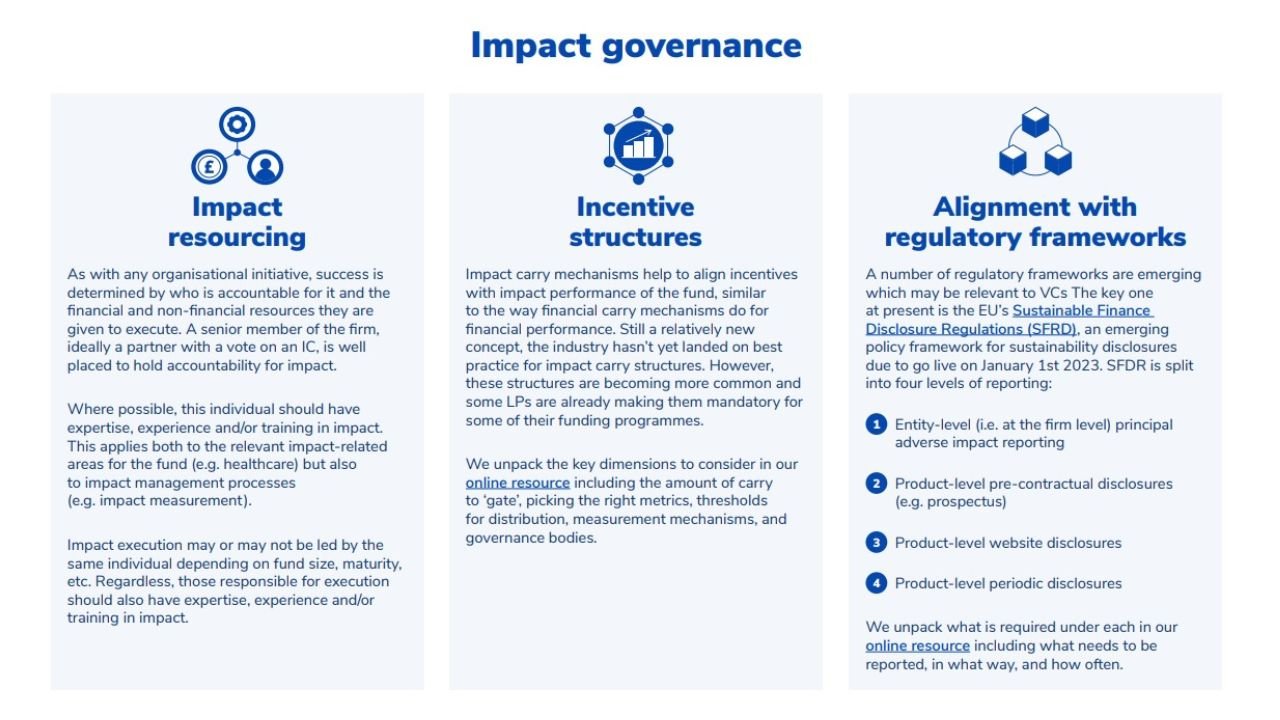

Per the formal press announcement, this playbook gives investors a solid foundation in measuring, evaluating and reporting their portfolio's social impact.

The authors have aimed to build a unified framework for early-stage VCs, based on actual best practice from experience in the European VC community.

Impact Playbook launches at a pertinent time for the European ecosystem, as the value of purpose-driven scale ups is manifesting at pace. Estimates predict Europe will possess 42 impact-led unicorns this year, almost trebling its total in 2019 (15).

ImpactVC gets underway following a formal launch event in London. Before launch, it counted sign ups by almost 200 individual VC practitioners. Sponsors of the initiative include Amazon Web Services, BMW Foundation Herbert Quandt, and Katapult Foundation.

Leading VCs like Northzone attended the launch along with specialty impact vehicles, including Eka Ventures and AENU, as well as the founder of UK startup Wagestream.

London's Wagestream's financial wellbeing business is backed by Northzone. Its impact theme comes from the application's role reducing stress factors for frontline workers, by offering access to vetted financial products.

Northzone sustainability head Anna Skarborg argued it was crucial for VCs to learn how to optimise impact strategies while also making headway on traditional VC objectives.

Skarborg said: "We are seeing companies with huge potential to scale and develop appear in the impact venture space.

"At the same time, we need to better understand how to combine this potential with our generalist platform and traditional focus. ImpactVC can be vital in helping us sharing learnings, best practices and collaborate better across generalist and impact VCs.”

AENU's investment principal and impact vice president, Melina Sánchez Montañés, added: "To fulfil the promise of the good intentions in the VC space, there needs to be alignment on what impact represents and how it is best achieved.

"ImpactVC is a fantastic opportunity to channel that and ensure that VCs are best prepared to be successful.”

Would you like to write the first comment?

Login to post comments