Parisian KYC orchestration startup Dotfile has picked up €2.5 million in its latest fundraise to give enterprises a single source of automation for running digital background checks.

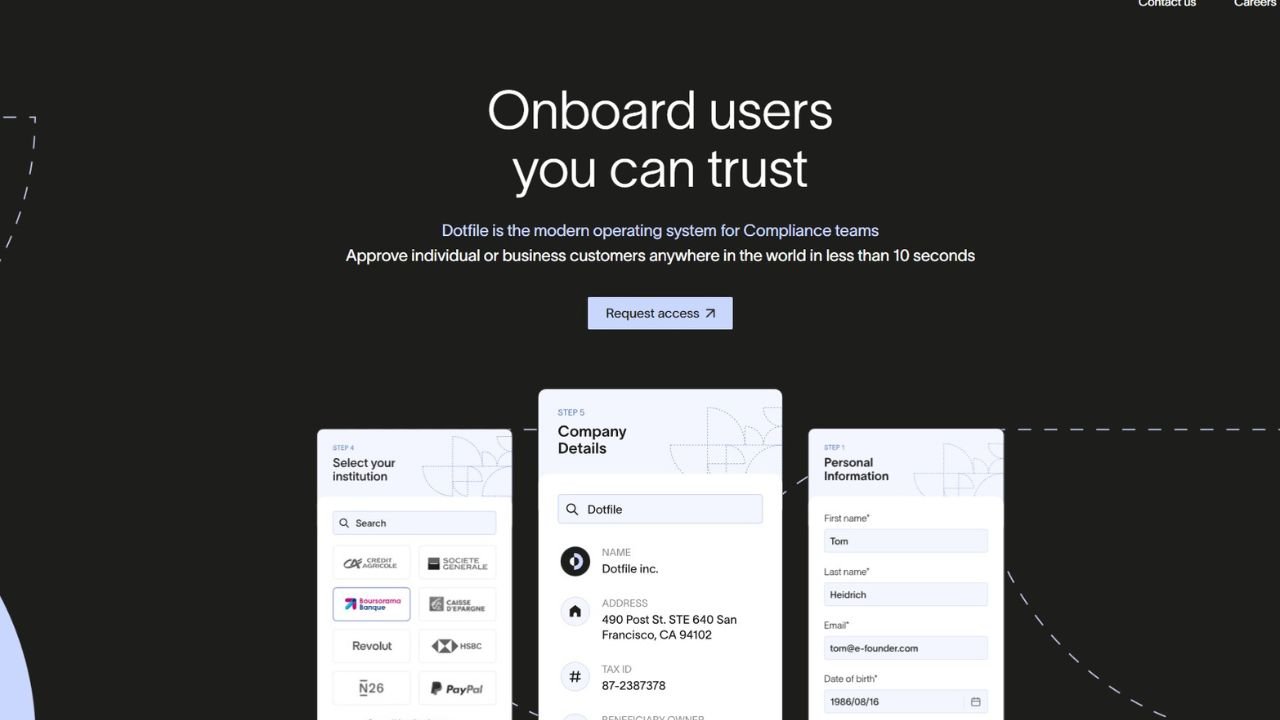

Billed as an "operating system for running modern compliance", Dotfile's API-driven KYC platform allows enterprises to integrate customer verification tools for use in internal workflows. Fundamentally, KYC checks let companies root out fraud by checking formal ID against government data.

Dotfile is also touting its platform's ability to perform know-your-business (KYB) checks, potentially serving yet more enterprise segments.

The reg tech's seed round is led by V13 INVEST, a corporate venturing subsidiary of French lottery operator La Française des Jeux (FDJ) that's managed by Serena Capital. Also backing the seed round is Kima Ventures, Pareto Holdings, Super Capital, Upscalers, Polymatter Ventures, and unnamed fintech founders.

FDJ's indirect involvement is notable considering state gambling laws frequently cover lotteries, meaning operators typically must satisfy KYC under licensing terms.

Dotfile will use the funding to double headcount before year-end, while also exploring further means of customer verification and delivering data-led analytics to enrich compliance reporting.

The startup's existing partners are mainly French enterprises, but it aims to build a runway for a US market debut and also hopes to launch in more European territories. Dotfile says tackling financial crime costs businesses above $214 billion annually, with many looking to automation to keep pace with evolving compliance laws.

Vasco Alexandre, CEO of Dotfile, a product of eFounders' startup studio, said: "The KYC market is highly fragmented. Businesses spend millions integrating multiple providers or developing in-house solutions. We are developing an all-in-one platform that is highly flexible and can be easily tailored to local legal requirements and to each client’s unique needs.

"We are also very focused on making the process as seamless as possible. Users have no patience for frustrating verification experiences anymore. Companies live or die by the quality of their onboarding.”

Would you like to write the first comment?

Login to post comments