Danish startup Uniify recently collected €3 million to simplify financial customer onboarding, providing digital tools to easily register users for things like credit checks and anti-money laundering.

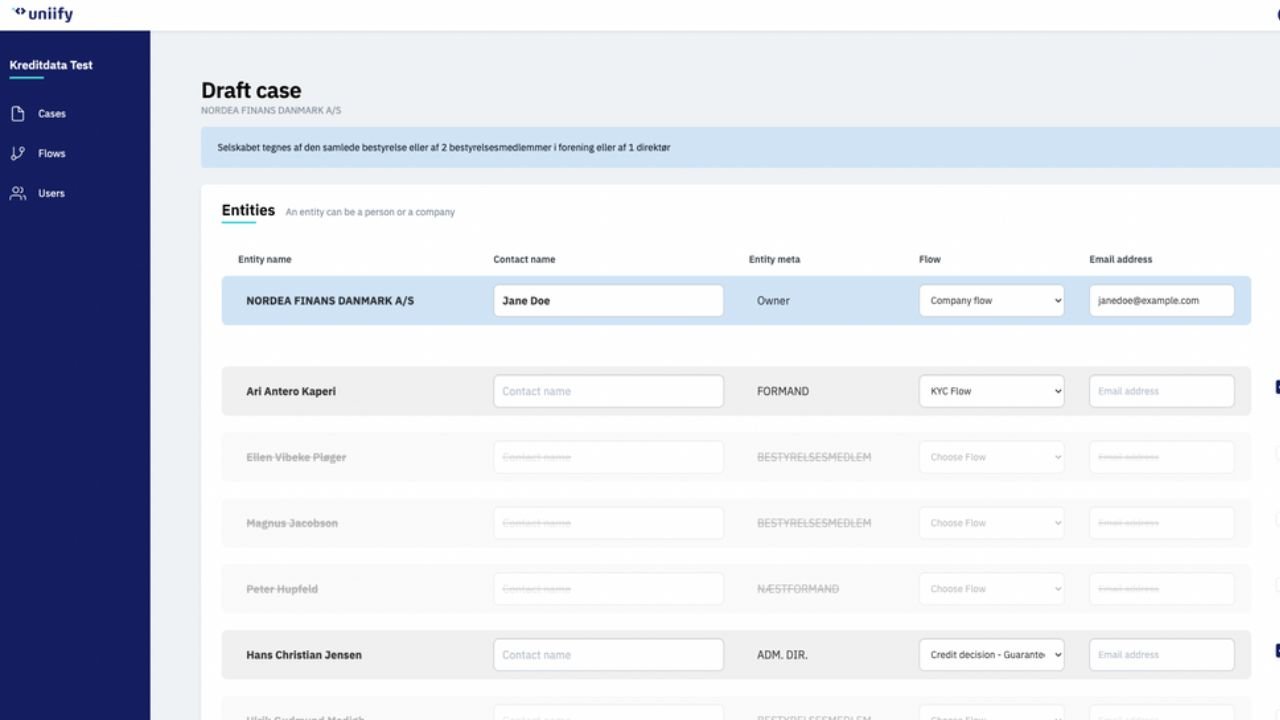

Uniify's software securely collects financial client data including details pertaining to income, credit status and identity papers.

The interface is designed to be highly accessible and should enable customer data to be easily leveraged for know-your customer checks and open banking.

Up till now, Uniify was operating as a bootstrapped company. The €3 million round was backed by Forward VC, People Ventures, and the founders of crypto investing app Public.com — Jannick Malling, Leif Abraham — and fellow angel investor Heini Zachariassen, among others.

As Uniify noted in its press release, financial services must follow regulations when collecting customer data. That's become even more of a challenge given the rise of digital tools, and financial firms need to be sure digital onboarding software complies with the most recent regulations.

The €3 million funding was raised to help drive staff recruitment, bolstering Uniify's capacity to expand geographically. First up is the UK, due to the "size" of its fintech market and role as "Europe's" financial hub.

Would you like to write the first comment?

Login to post comments