UK-based employee savings and pensions platform Cushon is set to be acquired by banking firm NatWest in a £144 million deal (source).

The deal will result in NatWest owning 85% of Cushon's share capital, including equity bought from UK fintech investor Augmentum for a £22.8 million consideration.

Augmentum, which first backed Cushon two years ago in its series A round, said the sale to Natwest would be its fifth exit and its third in the wealth and asset management sector. Its investment totalled £10.8 million in the span of two venture rounds.

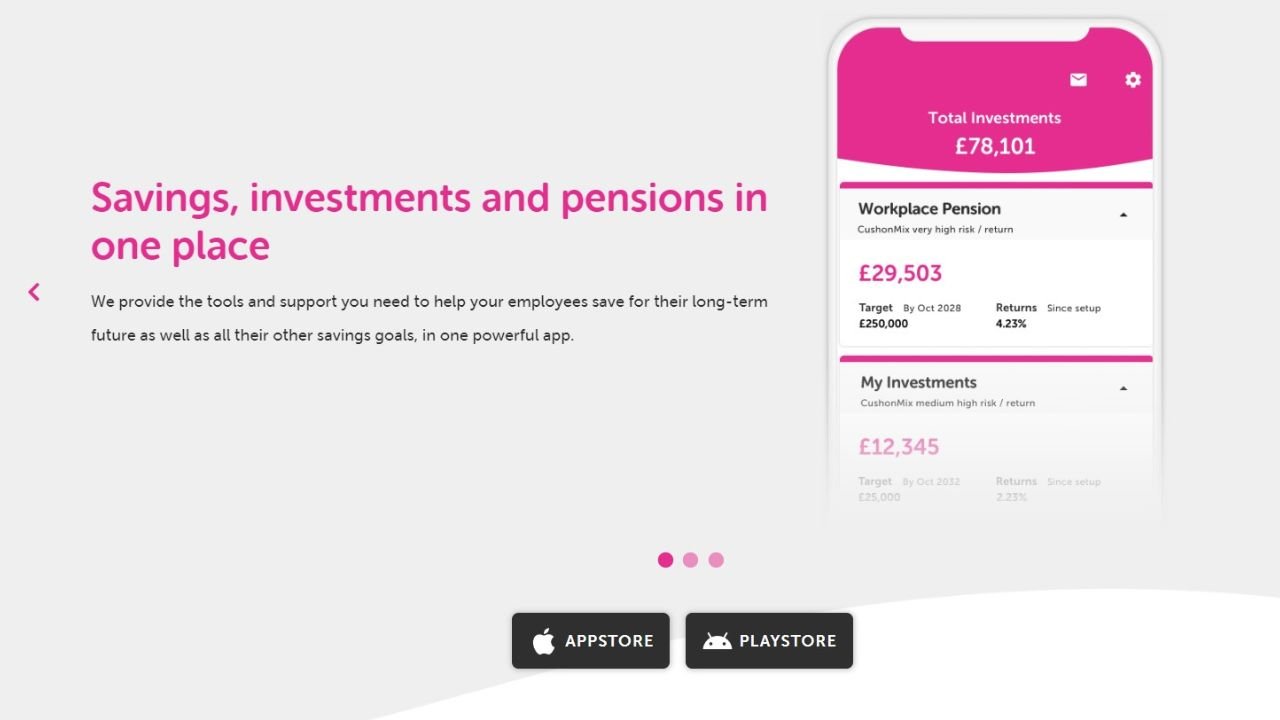

Cushon's app-driven employee savings platform allows workers to save money and prepare pensions for retirement. The platform offers pensions where savings are invested in ESG-friendly companies, tapping into public concern over sustainability.

The acquisition deal follows comments by NatWest CEO Alison Rose in 2022 that hinted the firm was eyeing assets in the wealth management segment.

Augmentum said it expected the transaction to close in the next 12 months. Its £22.8 million consideration is priced 46.2% higher than the unaudited holding value, of £15.6 million, reported for its Cushon stake as of September 30.

Tim Levene, Augmentum Fintech CEO, commented: "The acquisition of Cushon by NatWest Group marks Augmentum’s fifth realisation since IPO and demonstrates the strategic nature of many of the assets in our portfolio.

"Financial incumbents are increasingly looking to accelerate their digital transformation through acquiring innovative, digital-first propositions. The pensions industry has certainly suffered from a lack of transformative innovation to date and with their Net Zero pension offering and tech-led approach, Cushon is a true digital disruptor.

Would you like to write the first comment?

Login to post comments