UK-based DirectID has procured €9 million in funds from IKEA operator Ingka Group's investment wing.

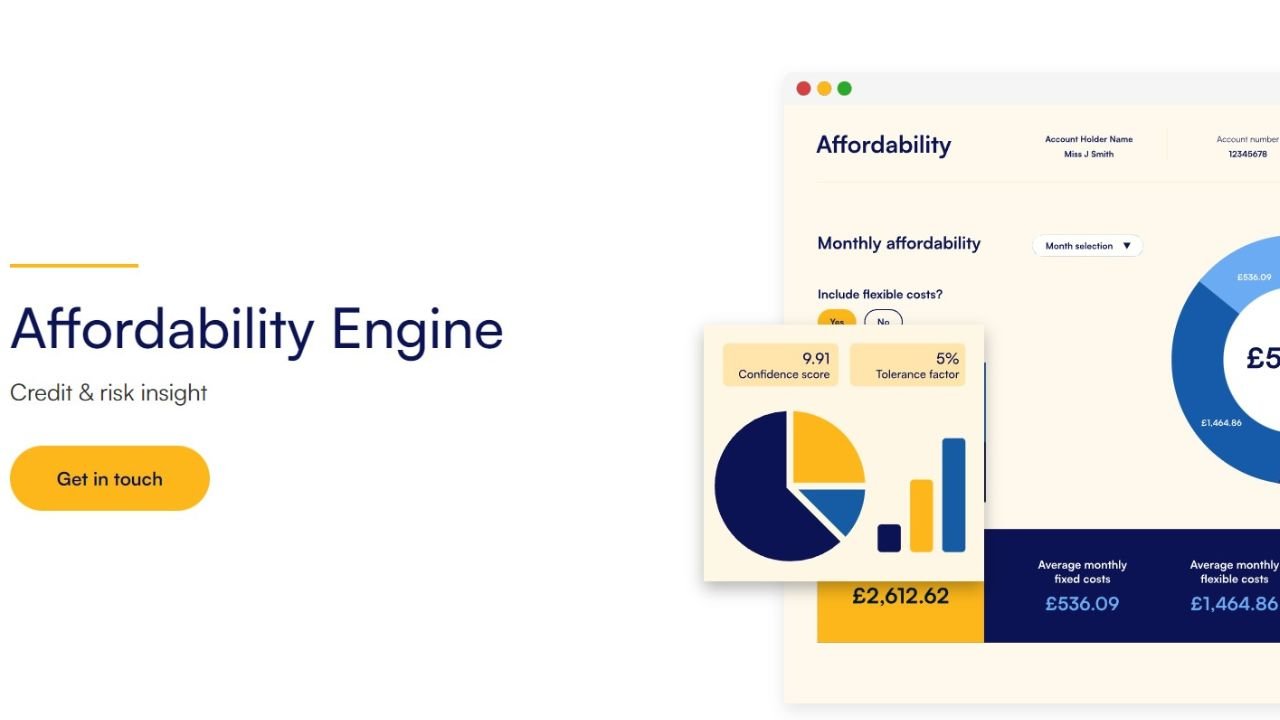

DirectID's fintech risk platform enables informed credit and risk judgements by businesses. The platform relies on access to open banking data provided by 13,000+ partners, spread across 65 countries.

A "global credit risk score" acts as a reference point supporting credit checks across international borders. DirectID's platform also flags up risk indicators around income, affordability and financial distress.

Company CEO and founder James Varga had got behind lobbying efforts to secure UK government support for the PSD2 payments standard, which requires two-factor authentication for many digital payments services.

"We're proud to join Ingka Investments' portfolio of market-leading firms," Varga said. "We are excited to be shaping a new global standard in credit scoring that enhances people’s lives by enabling access to products they need in an affordable way."

"Our coverage, advanced insights and predictive models provide a unique opportunity to achieve this by creating the world's first real-time, inclusive, credit score based on open finance data."

DirectID claims to be the most "comprehensive" credit risk platform on the market, providing strong grounds for strategic investment at a time when CVCs are investing more frequently. The funding is set to support the launch of new predictive models for credit and risk monitoring, based on open banking data.

From Ingka's side of the deal, backing DirectID aligns with strategic innovation targeting its core retail business.

Peter van der Poel, managing director, Ingka Investments, commented: "We are pleased to have made this investment in DirectID and are confident of their continued growth in the open banking market.

"They have developed an innovative solution with the potential to complement and disrupt the traditional credit and risk market and help drive financial inclusion for more people.

"Open Banking-enabled credit and risk insights is an area we believe can add value to Ingka’s financial services proposition in the future."

Would you like to write the first comment?

Login to post comments