Right now, two key priorities preoccupy the minds of automakers developing vehicles to take us from now into the future. Safety always comes first. But the second is the transition to all-electric vehicles and carbon reduction in line with EU regulations. And the secret weapon for greater vehicle sustainability just might involve blockchain technology.

It's not the industry’s first rodeos when it comes to blockchain.

Over the last decade, almost every major automaker has struggled with problems like mileage fraud prevention, usage-based insurance and identity verification.

They are also anticipating what future autonomous mobility will mean, so they’ve looked to resolve vehicle identity verification to facilitate car-to-car transactions. This has led to a decade of experimentation with blockchain proof-of-concepts or pilots.

But while there’s been promise, none of these has ever made it to market.

Why has this failed to live up to its promise? What are the lessons learned from past failures?

Bringing it back to sustainability, the EU is now funding mass commercial blockchain pilots. Do we finally have a way to connect all of the industry players to develop commercial applications that can solve real industry pain points when vehicles operate autonomously? Let’s find out.

The earlier promise of blockchain and mobility

In the mid-2010s, blockchain pilots looked to solve mobility challenges. For simplicity, I will use the term blockchain technology in this article simply because it is most familiar to those broadly interested in the tech without a deep understanding of distributed ledger technology (DLT) such as IOTA’s Tangle or Hyperledger Fabric – the rest of you, if you know you know. But let’s get back to the mobility projects. Some notable examples:

Jaguar teamed up with blockchain technology company IOTA to deploy smart wallet technology in their cars. Owners earn credits by enabling their cars to automatically report useful road condition data, such as traffic congestion or potholes to navigation providers or local authorities.

IOTA also proved it was possible to make a charging station operate autonomously from charging to payment in partnership with EV charging researchers ELAADNL.

BMW partnered with VEChain as part of the BMW Startup Garage to address the problem of odometer fraud in second-hand vehicles.

Daimler Mobility trialled a cryptocoin to reward drivers for ecofriendly driving.

From hope to a pilot graveyard

The previously mentioned pilots all proved the validity of blockchain technology to solve the specific problem they were developed for – something that is not always the case with pilots.

But despite this promise, what we've been left with, by and large, is a graveyard of very good ideas that never went beyond the pilot phase. That's bad for innovation and a waste of money and effort.

I wanted to understand why blockchain pilots fail to evolve to commerciality, so I spoke to a number of startups in the space.

What happens after you pilot with an automaker?

In 2018, after winning the Porsche Innovation Contest, Berlin AI startup Xain helped the automaker become the first to successfully test blockchain in a car. The startup worked with the company for three months to develop and test applications.

CEO and co-founder Leif-Nissen Lundbæk explained that the project combined Xain’s machine-learning models with blockchain technology. The use cases are sound:

- Lock/unlock your car, faster and more securely, thanks to a blockchain-powered direct offline connection (no server connection involved).

- Grant someone else temporary access to your Porsche remotely.

- Receive real-time notifications about who/when/where accessed your Porsche.

- Get your mail packages securely delivered directly inside the trunk of your parked car.Peq

However, the pilot never translated to a product. Xain has since rebranded to Xayn, a privacy-friendly search engine that provides users with personalized search results and a curated news stream without advertising or data storage using AI.

Lundbæk highlighted the problem of differing innovation cycles. Tech, and especially blockchain technology, have very different investment and development cycles from automotive corporations. Even when incomplete, blockchain startups can gain funding and push iterations to customers to test out.

Compare this to the long innovation cycles of traditional industries like automotive, which are slow in accepting new technologies without a compelling business model.

Lundbæk explained, “It takes around seven to nine years to really get (a new business offering) inside a car in production, and that's the fast track.” This is way too slow for a startup looking to develop products and expand its revenue.

Why are blockchain pilots failing to go to market?

The problem is to what extent the technology can improve the company’s value chain in terms of the bigger OEM ecosystem. Fail to demonstrate this and you have a problem. And selling ideas to automakers isn’t easy.

Berlin startup Peaq, are developing a network focused on the Economy of Things for connected devices, using their tech to build dApps (decentralised apps that run on a blockchain) for machines like cars.

Co-founder Leonard Dorlöchter shared the company's challenges in convincing auto OEMs of the business value of a great idea: "can it save costs, make money, improve the user experience? That's where companies struggle to get over the threshold."

But not all hope is lost, and it is possible to take a mobility blockchain project to market successfully.

What it takes to go to market

Last year, I met with Xeal, who successfully use distributed ledger technology to facilitate closed-loop EV charging payments in underground car parks without needing internet, SIM cards, or ethernet cables.

The company has a product, customers, and profits. They recently raised $40M in series B funding. Xeal's CTO, Nikhil Bharadwaj, attributes his company's commercial success to the fact that their solution ended up being embedded in distributed ledger technology but wasn't the original goal.

I reached out again. Nikhil suggests companies think Web 2.5 over Web3 and "don't be obsessed with the technology, but rather the problem, and that it's about "getting customers to pay for things that will automatically push you towards driving solutions that are solving real problems."

Likewise, Omer Shafiq, the founder and CEO at AuroraLabz suggests that the most successful blockchain companies are those who “are most adaptable to change. It is not necessary that all good ideas are successful as we have seen some really bad ones succeeding too and dying later.”

But now, auto manufacturing has a challenge and blockcain technology can be part of the solution.

EU Battery passports and circularity are the next mobility industry challenge – and it’s an opportunity for blockchain startups

Next year kicks off the expansion of global regulations for batteries and the origin of critical but not infinite materials like cobalt and lithium.

New EU Battery Regulations are rolling out that require battery makers (and users like carmakers) to consider the battery lifecycle from R&D to mining source materials, closing material recycling loops, and battery end-of-life management over time.

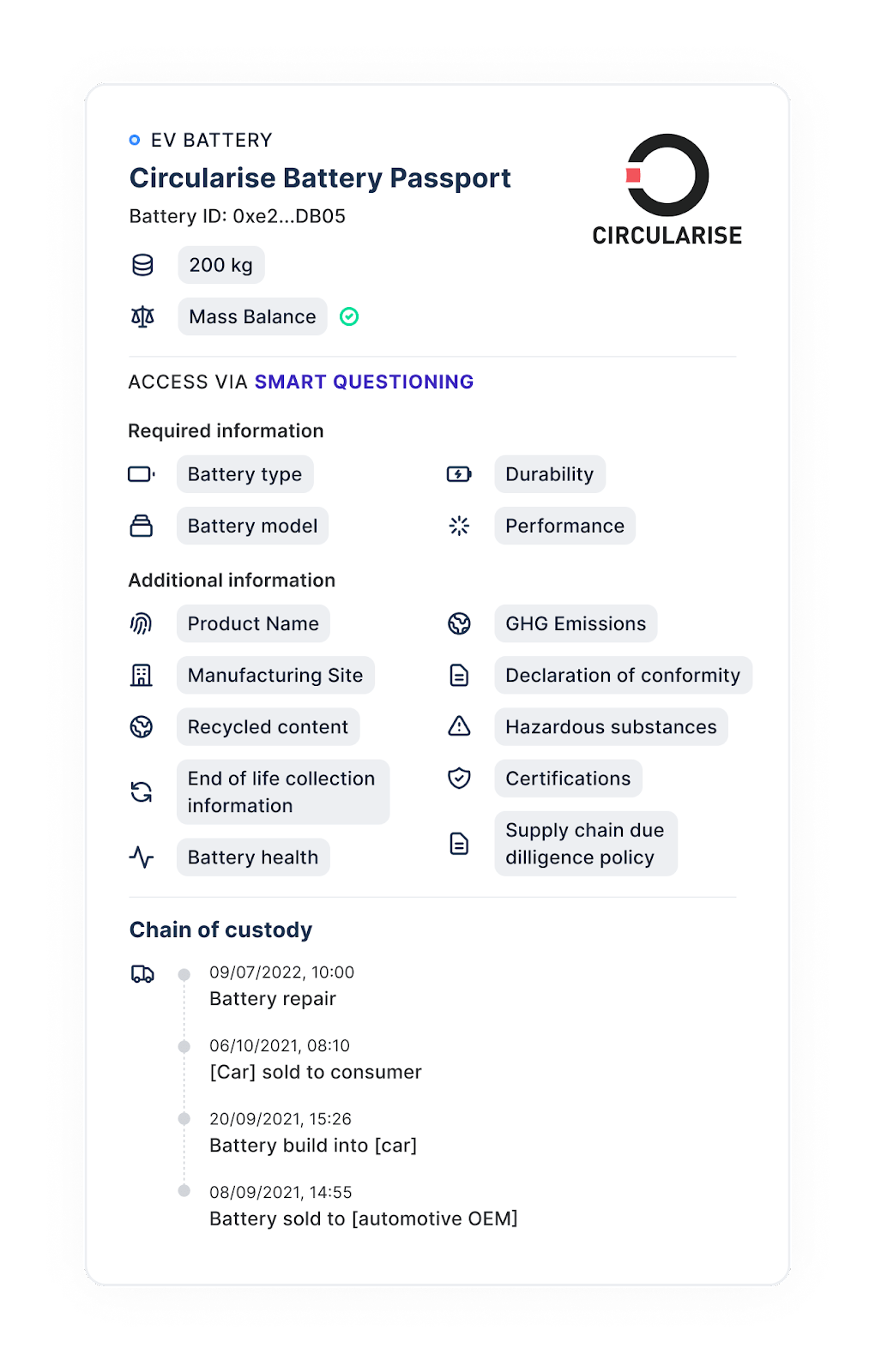

Part of the plan is a compulsory "battery passport" containing data and descriptions about the manufacturing history and provenance as well as advancing battery life extension and enabling recycling.

Each passport operates as a digital twin (a digital representation of a physical product) of a physical battery and must clearly show the battery's embedded CO2 emissions, compliance with ethical production standards, and a growing amount of recycled content.

This creates an opportunity for blockchain technology to shine. Digital product passports need to ensure all stakeholders and data are authenticated and fully protected. A blockchain platform makes it possible to verify the provenance, chemistry and identity of batteries and measure their environmental impact without data tampering risks.

And there are already proven use cases. Leather manufacturers Bridge of Weir has trialled the use of blockchain technology with traceability provider Circulor, to use blockchain to help trace materials, share sensitive data without risking privacy, and automate mass reporting using blockchain software. The leather is used in car interiors for brands like Jaguar Land Rover, and Polestar.

Comparatively, in the US, SyncFab has used blockchain technology for the provenance, tracking, and authenticity of automotive parts for several years.

These use cases create a successful precedent for the incoming supply chain sustainability regulations enabling a circular economy at scale.

Government funding can take projects over the line

Currently, the EU is funding two complementary mobility blockchain projects.

GAIA-X is a group of interconnected projects creating a foundation for the future of data infrastructure in Europe. Specific to mobility,

the moveID project is determining the standards that will allow vehicles to securely and independently exchange information with other vehicles and their environment – in other words, vehicle-to-everything standards for communication and transactions.

Imagine a car communicating with other cars, charging stations, barriers, traffic lights, and parking lots. The research project will use internationally recognized hardware and open source software to facilitate these interactions and the ability to trade data and money between machines. Collaborators include Bosch, Ocean Protocol, Airbus, Peaq, and Continental.

Then there's the Catena-X consortium, which focuses primarily on digital twins and automotive supply chains.

Many suppliers in the automotive industry are uncertain about the added value of sharing their data and rate the risk of data loss or the negative consequences of so-called lock-in effects as very high.

Consequently, there is a lack of business models, incentive mechanisms and the right technology. Catena-X connects automotive manufacturers, suppliers and service providers of the entire supply chain by developing infrastructure that facilitates the secure exchange of data across the entire supply chain.

What makes these projects different? Well, first, there’s EU funding. There’s collaboration – collectively connecting over 500 organisations, research institutions, companies and startups.

They have timelines and a commitment to creating deliverables. And, they solve actual problems that are facing the mobility industry, from circularity and battery passports to how vehicles communicate with each other and the digital world they move within.

Blockchain can facilitate the challenges of vehicle automation and communication

Why do these projects matter? First, they represent a wider conversation happening in society and governments about tech.

Peter Busch is the Product Owner of Distributed Ledger Technologies Mobility at Bosch. He attributes the funding of projects such as Gaia-X and Catena-X to a broader government push towards decentralisation. This is in response to a lack of public trust in centralised hyperscaling (think AWS, Amazon, and the like) underpinned by data breaches, data misuse, and security woes.

Blockchain technology will grow even more important as we traverse into a time when machines can operate autonomously without any human intervention, from vehicles to battery swap stations, robot-operated repair shops, and autonomous parking.

For these actions to occur, each machine (such as a car) requires the ability to find, authenticate, communicate and transact with those machines.

For example, a repair robot without identity verification could, for example, be hacked to damage a car’s battery, or in the case of vehicle-to-vehicle EV charging, the origin and amount of energy shared could be miscalculated or misattributed to another vehicle altogether. This has renewed interest in developing blockchain infrastructure and solutions.

And let’s get back to that EU funding. Previously blockchain technology as a solution, has been plagued by what Dorlöchter from Peaq and Busch call the chicken and egg problem.

Busch asserts:

"If nobody's investing, the technology can't get any more mature, because the mass adoption is normally helping you mature in this production technology."

Dorlöchter agreed, and said:

"No one wants to make the first move, instead thinking, Why should you put the capital and resources first? What is your incentive to be first?"

We're in a period where financially, companies are tightening their budgets. Betting on new technologies without external funding just won't happen.

And now, EU funding is making it possible to drag the traditionally reticent automotive industry to collaborate with over 500 organisations, from research institutions to car makers, materials suppliers, and startups to reach consensus about the digital future of mobility.

Busch says that we're a few years away from viable business offerings. Instead, we're in a period preceding mass adoption.

But there needs to be stable infrastructure before industry use cases can come to fruition: "

According to Busch, "We need really mature networks, which are interoperable, and able to allow applications on top of them."

Then these can get into production networks for usable, scalable products leading to new business models and financial opportunities for the automotive sector. This is where we are – finally – heading, and battery passports can lead the way.

Would you like to write the first comment?

Login to post comments