Having gone quietly and not-so-quietly about its business of servicing customers for close to a decade now, Europe’s second-largest neobank, bunq is now eyeing the US market and has filed an application for a US banking license with the FDIC (Federal Deposit Insurance Corporation) in the state of New York.

The move follows bunq’s announcement last month of securing more than €2 billion in user deposits and February’s announcement of being the first neobank in Europe to post a quarterly profit.

And all of this has come from a company that’s relatively bootstrapped. As a reminder, bunq’s first and only external funding, €168 million was provided by Pollen Street Capital, saw the company achieve a valuation (at the time) of €1.6 billion.

With the external capital, bunq indicated that M&A activities were on the horizon, and the announcement coincided with the company’s first - now former Pollen Street Capital property Capitalflow Group, an Irish digital specialist business lender.

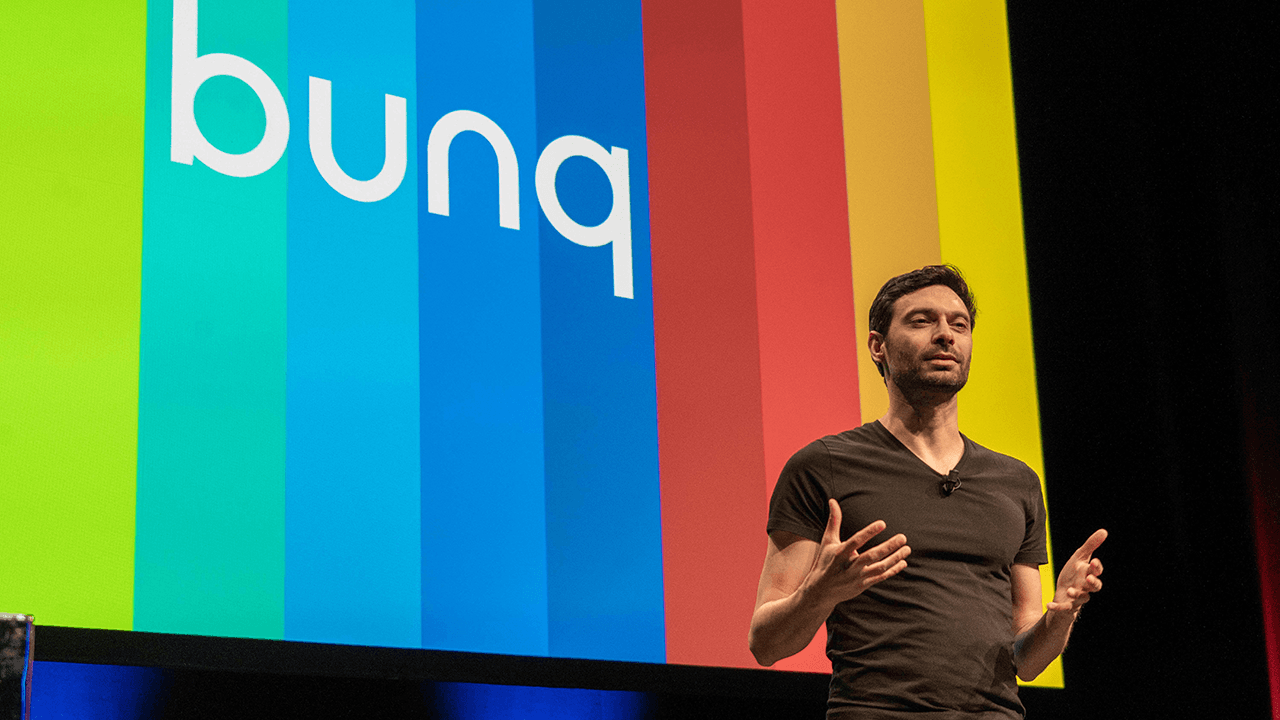

“In a world of banking giants, bunq was created to support people in their pursuit for individual freedom. Throughout bunq’s history, we’ve always focused on making life easy for digital nomads in Europe,” said bunq founder and CEO Ali Niknam. “We can’t wait to bring our user-centered philosophy stateside, giving a community of location-independent people an effortless way to bank on the go.”

Would you like to write the first comment?

Login to post comments