It should come as no surprise that the consequences of global macroeconomic changes can be seen in all sectors and regions. These changes did not bypass the dealmaking environment in Europe, creating challenging and different conditions both for the companies and investors.

Pitchbook has published its “2023 European Venture Report Q1” and the data doesn't lie - the situation in the VC ecosystem is, well, not so good, to put it mildly. The report provides a quarterly overview of deals, nontraditional investors, exits, and fundraising for the region. So, let's dig into some of the figures.

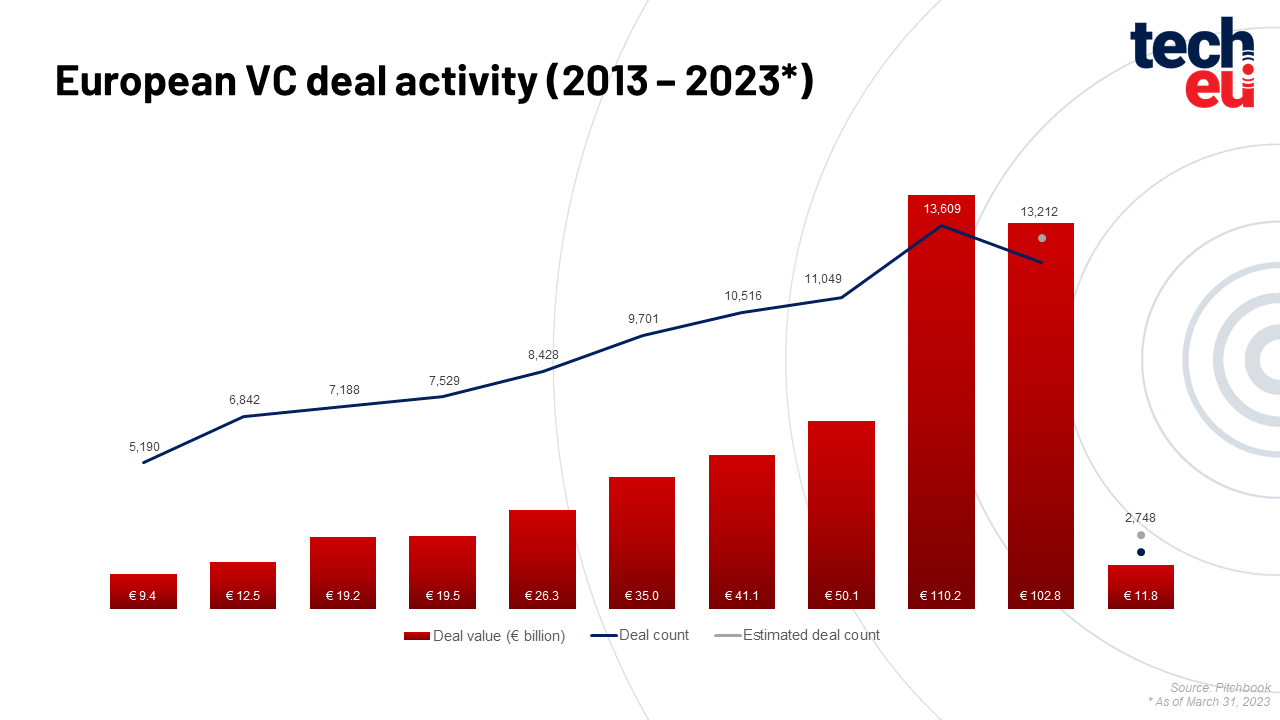

VC deal activity

According to the report, VC deal value fell 32.1% (to €11.8 billion), while deal count fell 19.2% in Q1 2023 compared to the same period last year.

This slowdown in the volume of deal activities was expected from the middle of 2022. Inflation and the tightening of monetary policies have influenced the slowdown of capital deployment, while high growth rates caused by the pandemic and bloated workforces have exacerbated the need to reduce costs and improve margins for companies across the financial landscape.

Although the data shows that most startup companies in the VC ecosystem record losses, investors and operators continue to prioritize capital efficiency and profitability.

Q1 2023 is characterised by numerous announcements and layoffs in many European tech companies. Previously VC-backed companies including Spotify, Deliveroo, and Arrival have had to cut their workforce in order to improve their bottom-line performance. The same trend can be seen in payroll software provider Payfit which had to reduce its workforce by 20% in Q1 2023, just 14 months after raising €254.0 million at a post-money valuation of €1.8 billion. And, unfortunately, it can be expected that mature companies in the ecosystem will continue with more layoffs further during the year.

Industry and the region

Although VC deal activities are falling, and there are some changes within the popular VC industries such as financial services and IT, there are some “promising” areas at the moment. The energy sector and its growth, particularly in public markets, have been present and covered in recent months.

This comes as a result of the near-term interest and long-term climate targets in Europe, which create opportunities for significant and big investments, all with the aim of creating more efficient and greener industries in the long term. Despite only 4.6% of capital invested in the energy sector in Q1 2023, some major deals happened in this period, perhaps most notably Germany's Enpal which received €215 million in Q1 2023.

As we see it, the clean energy subsector will most likely continue to grow as renewable energy sources are developed globally.

Regionally, inflation across major economies remained elevated in Q1 2023, and macroeconomic consequences are impacting confidence and purchasing power; the UK (as the only country with an inflation rate above 10%) together with Ireland, generated €4.0 billion, equivalent to one-third of the total Q1 2023.

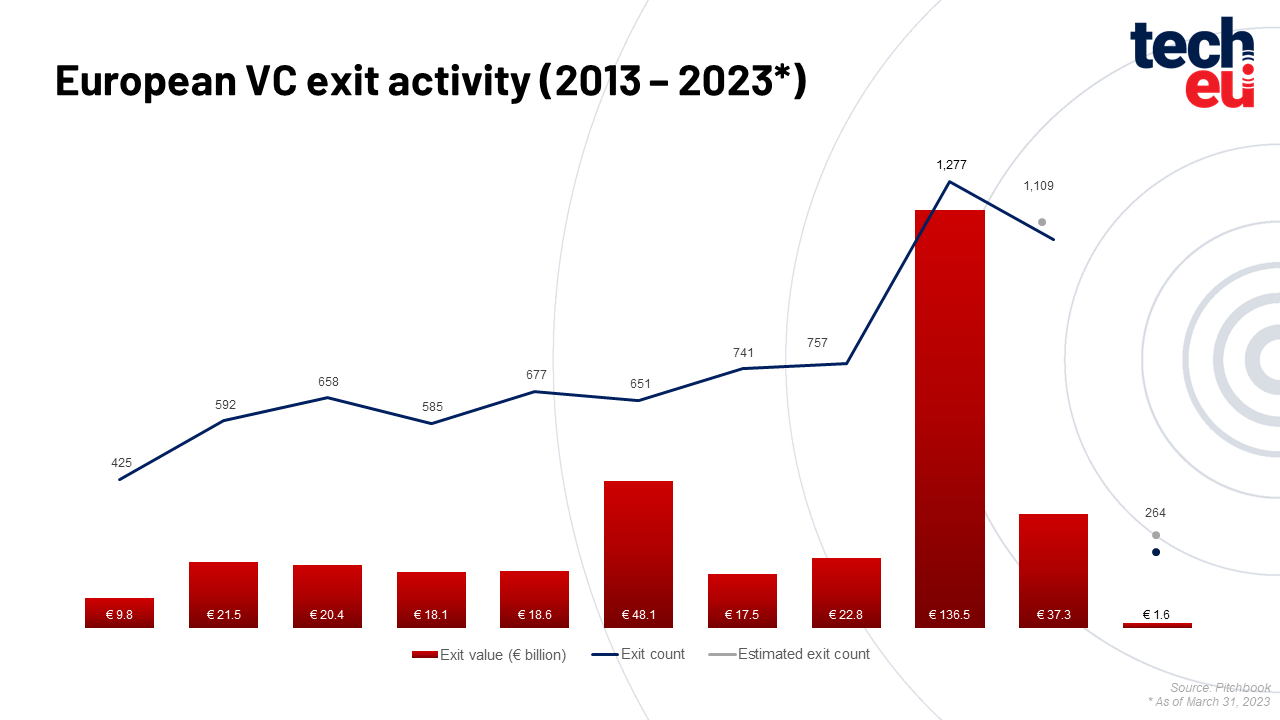

Exits

European VC exit activity has dropped in Q1 2023, with only €1.6 billion in exit value, which reflects a decline of 69.6% QoQ. The number of exits is the same as in Q4 2022, but the exit value is the lowest since Q1 2020. It looks like unfavourable macroeconomic conditions and weaker valuations influence exit appetite, so instead of seeking near-term liquidity, GPs and founders will be looking to manage runways as funding has become harder in 2023. With all this on the plate, it can be expected that exit activity will remain quiet for the next few quarters amid the volatility seen in public markets in the past 12 months.

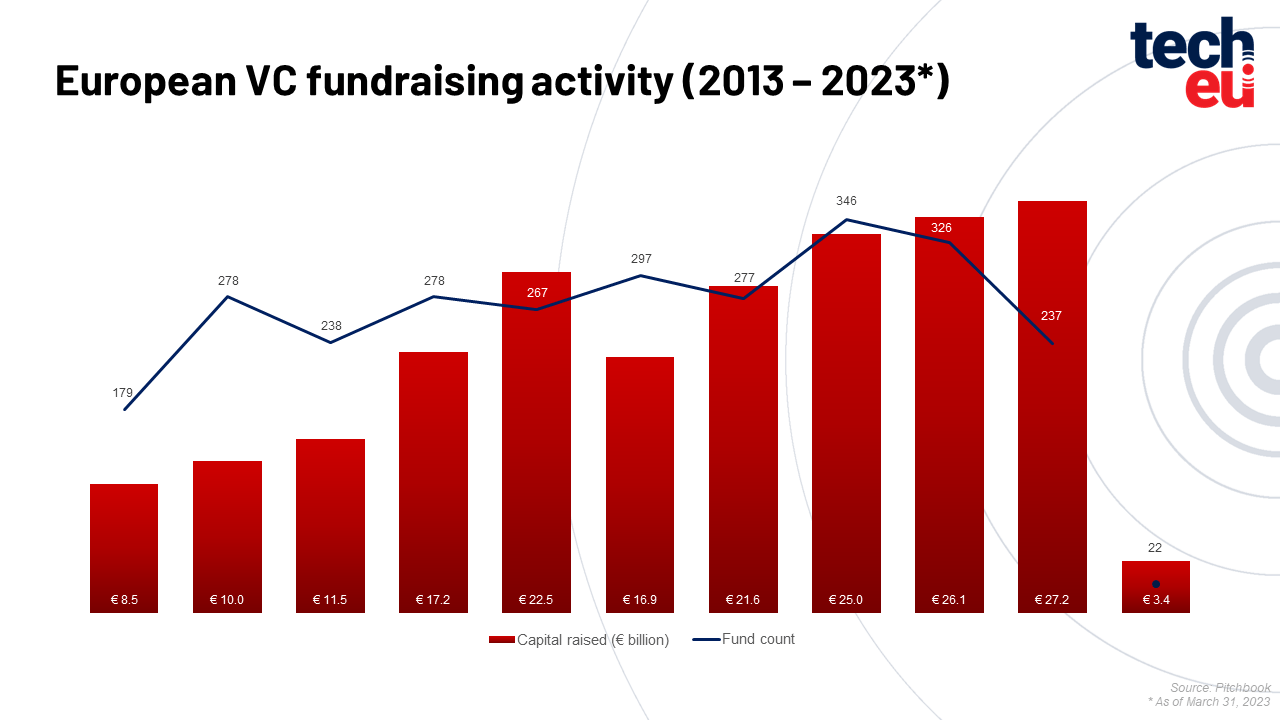

VC fundraising activity

While European VC funds raised in excess of €20 billion in each of the last four years, in Q1 2023 they collected only €3.4 billion, which represents the lowest annual figure since 2015.

If we take a look back, it should be noted that fundraising has been stable for the past four years, and Q1 2023 reflects the first substantial decline from the previously established pace. Despite a less conducive environment for fundraising in 2022, LPs committed a record amount of capital to VC funds. So, funds closed in H1 2023 may have been launched in 2022, and now the effects of weakened desire from GPs and LPs to launch and commit to new VC funds can be seen.

To read more about the VC ecosystem in Q1 2023, you can download the report here.

Would you like to write the first comment?

Login to post comments