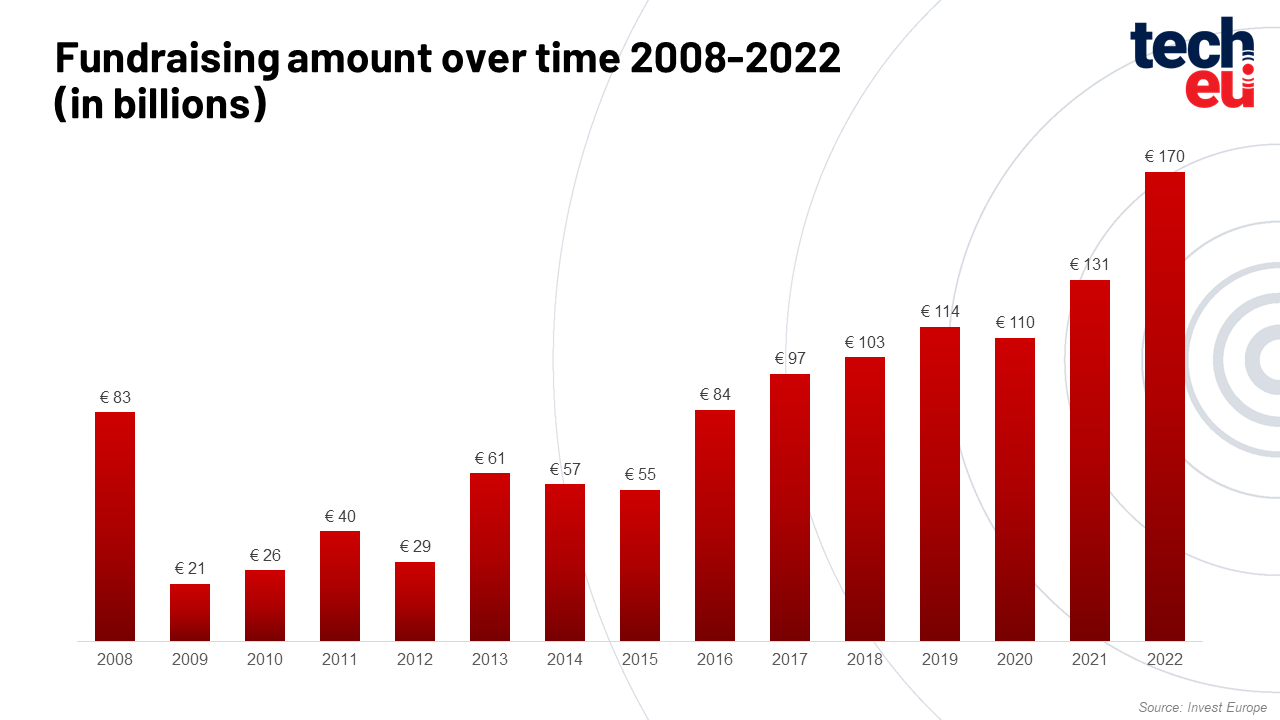

Invest in Europe's “Investing in Europe: Private Equity Activity 2022” research has shown that 801 European private equity, venture capital, and growth funds raised 30% more in 2022 compared to 2021 (€170 billion in 2022 compared to €131 billion achieved in 2021).

Analysed separately, Venture capital funds raised a record €23 billion, while buyout funds reached a new high of €111 billion, and growth funds had their second-best year with €21 billion raised.

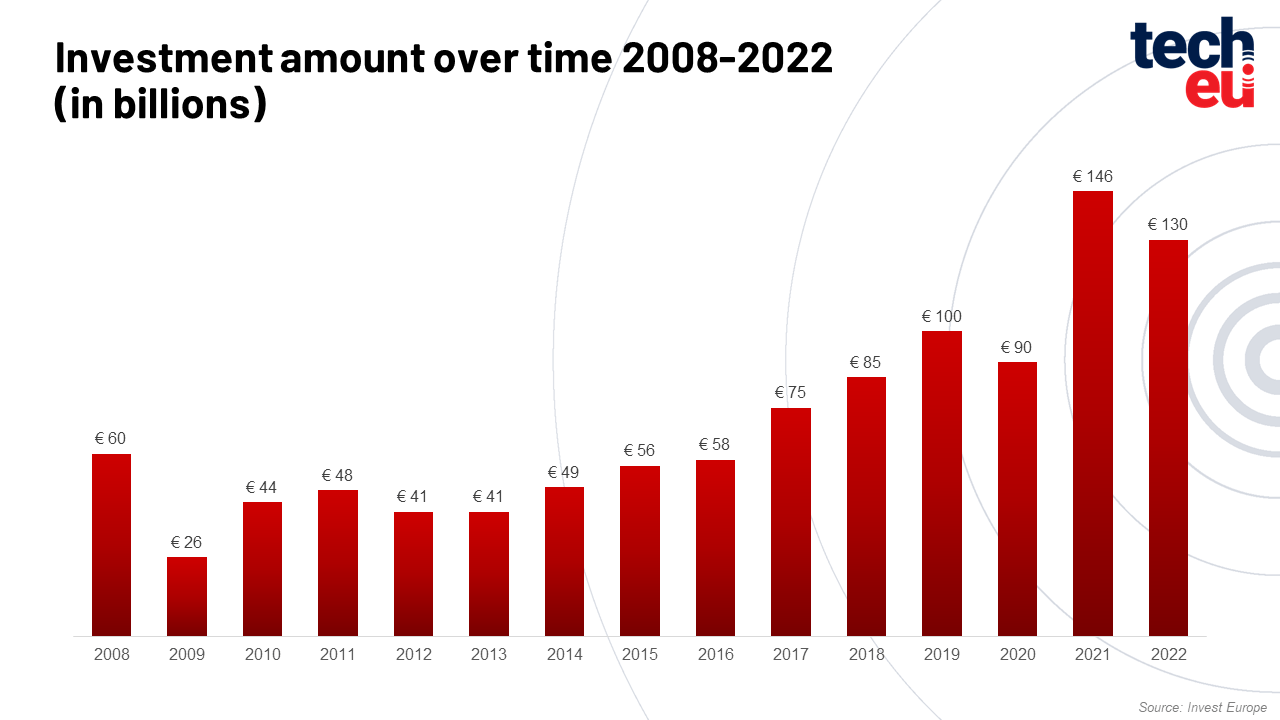

Speaking of investments, with €130 billion in 2022 a decrease was recorded compared to 2021. However, these results also represent a 30% growth compared to the average of the previous five years. Such data emphasise the step-change in private capital investment taking place across Europe.

Alongside insurers, long-term institutional investors contributed to almost two-thirds of all capital raised in 2022, as follows:

- pension funds committed 27% of the total fundraising

- sovereign wealth funds significantly stepped up investment, achieving 15% of the total fundraising and

- funds of funds accounting for 11% of the total fundraising.

The report states that over 50% of fundraising came from domestic and cross-border investors within Europe. As it is highlighted, Europe becomes more interesting to international investors looking to back leading companies and ground-breaking innovation.

To confirm this, the report states that capital from North America reached 24% of total fundraising (over €41 billion), while commitments from Australia and Asia also reached 22% of the total funds raised.

With the €130 billion invested by Europen private equity and venture capital, 2022 is the second-highest year for investment with over 9,000 companies backed. Among different industries, Information Communications Technology is still the largest sector by equity invested (€43 billion). It was followed by Consumer Goods & Services (16% of all companies), and Biotech & Healthcare (15% of all companies). This way innovation, job creation, stronger growth, and development are encouraged, but also the transition to a greener and more sustainable European economy.

"After reaching the high-water mark for investment in 2021, the European private equity and venture capital industry continues to reach new heights. Strong support from both inside and outside Europe demonstrates the confidence that long-term investors are placing in managers to deliver returns that can grow the pensions and savings of citizens globally."

"Rather than sitting on the sidelines, this capital - along with operational expertise - is going into European companies to transform mature businesses and get start-ups and growing SMEs off the ground." Eric de Montgolfier, CEO of Invest Europe

For more details and numbers, the full report can be downloaded here.

Would you like to write the first comment?

Login to post comments