The rapid rise of the European startup ecosystem over the last few years has made European expansion an urgent priority for top-tier founders, and an attractive growth lever in a challenging economic climate.

Frontline Growth, a VC fund for US companies looking to expand to Europe recently released a report on the experiences of US software companies that have expanded their operations to Europe.

Regarding market size, Europe represents up to 40% of global revenue for public software businesses. The authors note that "the strength of today's European tech ecosystem makes ignoring the region a costly mistake."

Let's take a look at some of the key findings:

European startups offer formidable competition

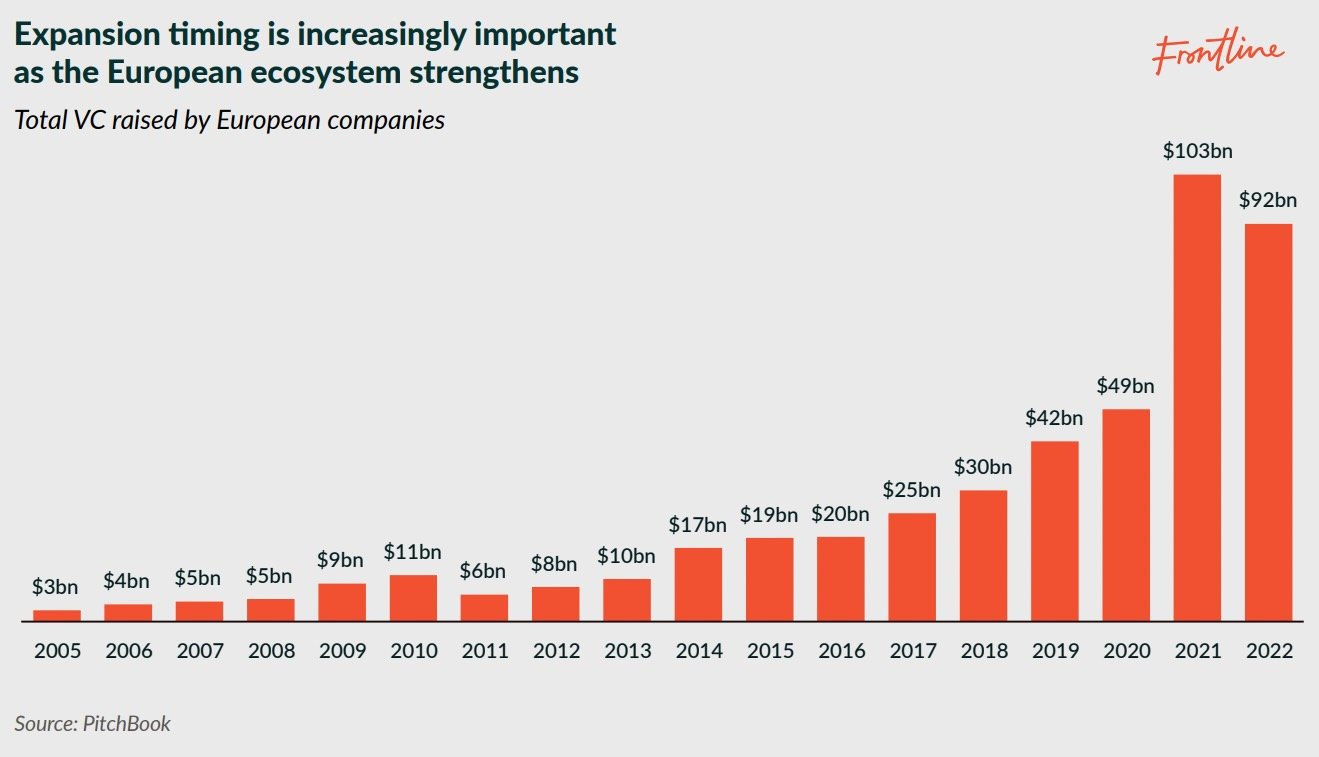

Venture capital raised by European startups has increased tenfold over the last decade, scaling to over $90 billion in 2022, despite a drop from the heights of 2021.

At the same time, the number of companies founded in Europe is now close to that of the US.

Further, European companies previously known as "copycat factories" are today" led by globally ambitious founders, bringing novel business models or technically differentiated products to market, backed by global venture funds with deep pockets.

US companies that expand too late risk leaving the door open for local competition to capture market share.

Timing matters

On average, US companies hire their first European employee two to three years after founding and typically wait even later to open their first European office — six years after founding.

After opening their first office, it's another 18 months before expanding to two additional locations across Europe.

However, few startup board members have limited experience running a truly global company, and even fewer have direct operational experience leading expansion into European markets.

Furthermore, "having a distributed engineering team is not the same as strategically expanding into new markets."

Frontline content that US companies need local go-to-market stability before attempting European expansion. They should be well-funded with inbound demand from Europe. The report notes,

In the case of freemium models, leading demand indicators are an essential starting point — where they don't exist. It may be required to "seed" the market remotely before attempting to sell there."

Also necessary is a suitably experienced team and the personal priority of the CEO to be committed to the "decades-long process of globalising the company to fulfil its true potential. Europe is just the first step."

Where are US companies basing themselves in Europe?

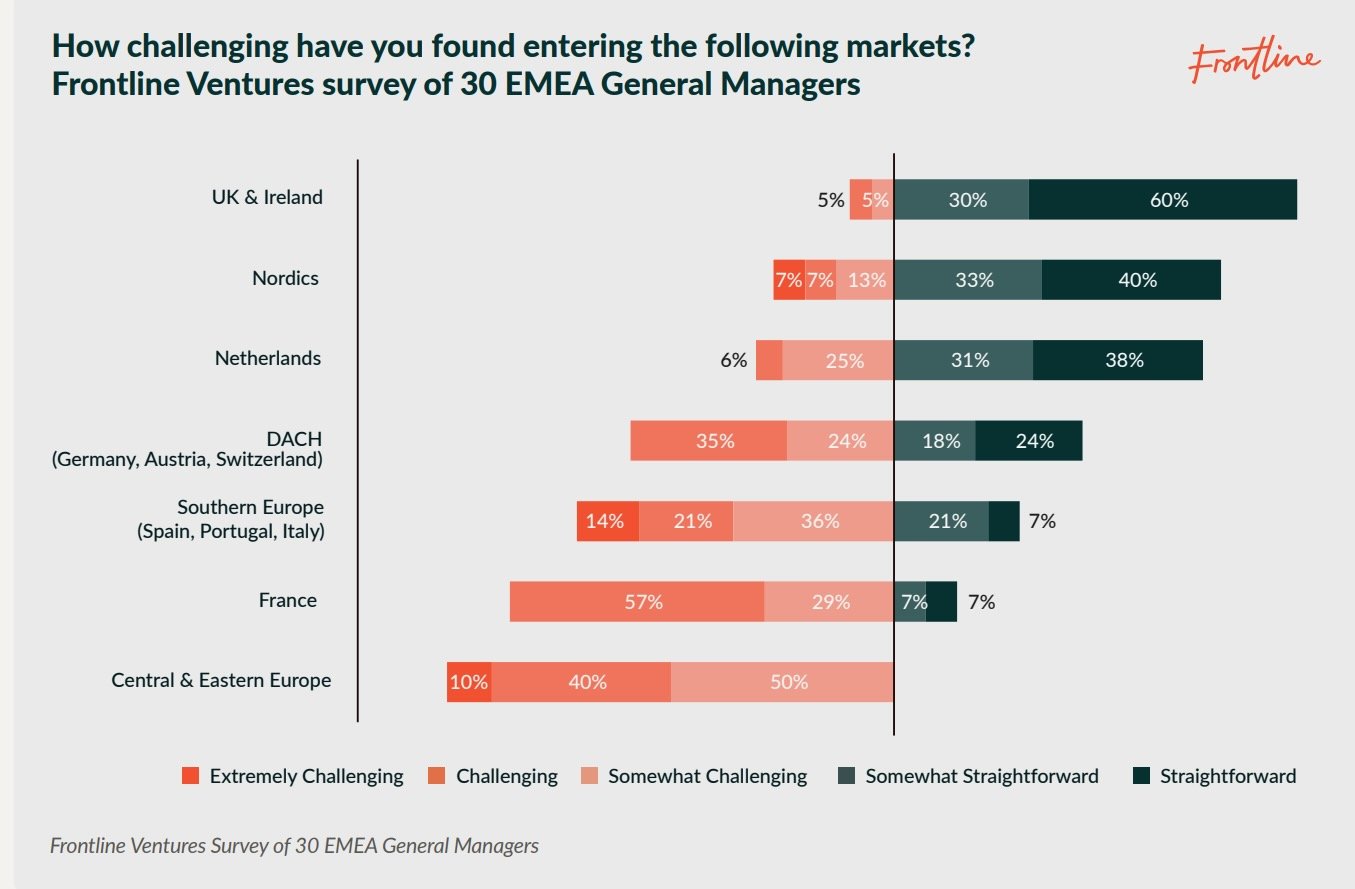

The UK and Ireland, Nordics, and the Netherlands are rated as the easiest markets to enter. The reason is cultural business norms that allow companies to sell in English and buyer behaviour comparable to that of the US.

The UK and Ireland also offer the largest addressable revenue opportunity for most companies, with the report noting, "While Germany's GDP is the largest in Europe, more stringent regulatory and business requirements make entering the market more challenging."

86% of companies choose to establish their initial presence in the UK or Ireland. However, Germany and France are the most popular choices for second-office locations, with 31% of companies opting for Germany, compared to 22% choosing France.

The kind of expansion impacts where you land

For Sales-focused expansions, the UK, Ireland and Netherlands are the most popular choices as a first base in Europe due to deep pools of junior-to-mid level sales talent, and more employer-friendly environments than France or Germany.

The UK is still the most popular location for Engineering-focused expansions, but more companies look to France, the Nordics and Central & Eastern Europe to build engineering operations.

Ukraine has been the second most popular location for US companies setting up an engineering team in Europe.

"Success amnesia" is alive and well

Frontline cites the problem of success amnesia, where companies focus on sales at the expense of local marketing, community development and brand-building efforts. Their data shows that 50% of companies don't have a single marketing resource in Europe a year after landing!

Excluding the UK, top HQ locations do not align with European startup hubs. The report cites the appeal of global minimum tax as an incentive in some countries as well as Ireland and the Netherlands' development of solid ecosystems surrounding US companies, including deep multilingual talent pools, — as a result, they remain top locations for establishing a European HQ.

No one wants to be first senior person in Europe

Surprisingly, only 24% of companies hire a generalist GM (EMEA GM or EMEA VP) as part of their landing team. And even three years after opening an office in Europe, only 41% of companies have a General Manager in place.

Of those that hire a GM, 47% of people in the role depart the company within two years of being hired – the role is at its lowest tenure in 10 years.

Frontline attributes this to "the high stakes for the first senior person hired in Europe — they're charged with building the team, driving revenue, seeding culture, and being the external face of the company across a range of topics."

Production localisation is challenging

Localisation comes with specific challenges from compliance such as GDPR and software development that can bend to search in foreign languages and multiple currencies. For example, companies should Integrate localisation into CI/CD, test translations as part of the release QA and develop a policy for incorporating customer feedback on translations in production.

Companies will also likely need engineers with localisation experience and high-quality translators, assuming AI won't cut it.

Lastly, given the size of the opportunity and the high stakes involved, FRontline asserts that CEO leadership and commitment are critical:

"European expansion can't be delegated. In times of adversity, the best CEOs surround themselves with experts and partners, embrace difficult decisions, and lead through action. In no place is this more important than globalising your company."

Lead image: Tom Podmore.

Would you like to write the first comment?

Login to post comments