In conjunction with celebrating its 20 year anniversary, VC firm Creandum, together with Dealroom has released a new report, “European tech ascendancy - Unlocking a continentʼs innovation potential”, revealing that Europe has finally moved into a position to not only challenge the tech industry dominance of the US but has the potential to overtake it within the next 20 years.

Citing that the Europe tech sector is in its best shape ever, the report points to some of the world’s leading companies including Spotify, Klarna, Revolut, Doctolib, and Personio as proof of Europe's place in the world and is poised for even bigger and better things.

Europe as a global tech challenger

According to the report, the European tech ecosystem has grown massively in the last decade to a combined value of approximately $2.5 trillion. Most of this value comes from recent cohorts, which means just one thing – a good position for future growth.

The report also revealed:

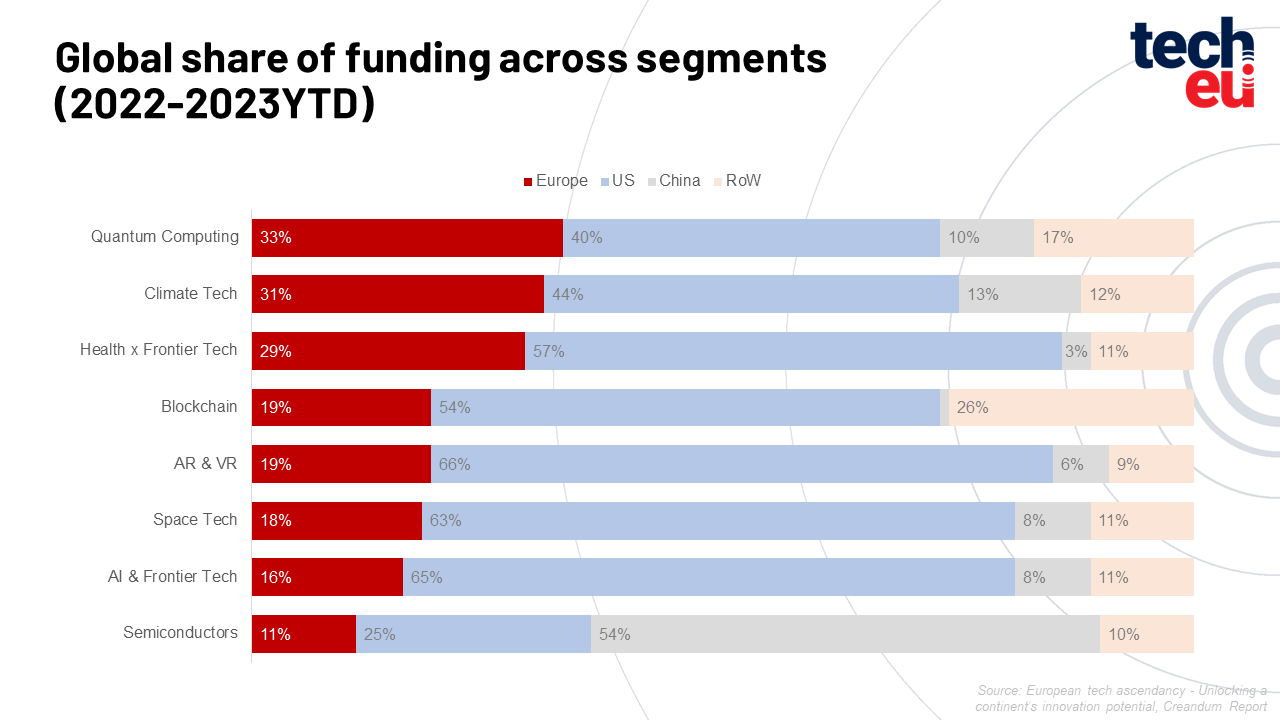

- Europe attracts 20% of global VC funding (compared to less than 5% two decades ago) with more than a third of global investments at early-stage.

- The total number of unicorns in Europe has grown 88% compared to the US’ 56% since 2014.

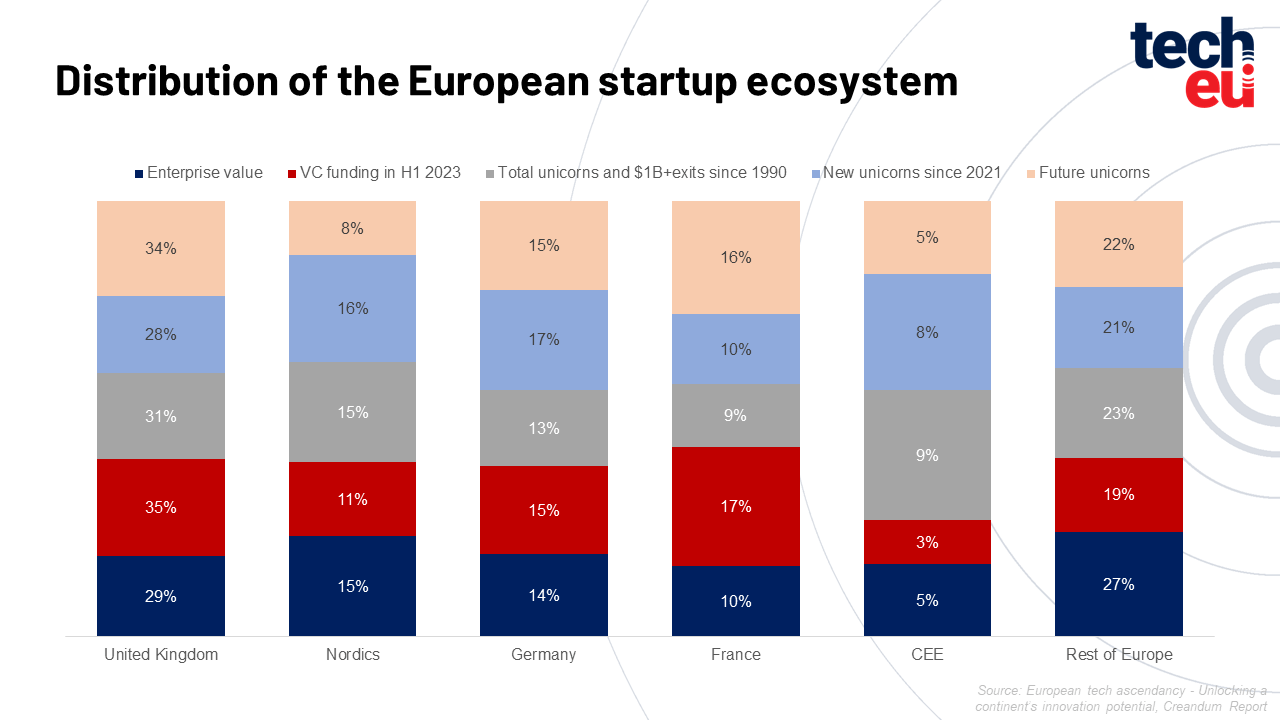

- Today Europe has 514 unicorns, spread out across 65 cities and 25 countries, which is the highest density of unicorn tech hubs of any region in the world.

- The European startup ecosystem is now increasingly distributed as the last decade has proven that great tech companies can come from anywhere.

- Across Creandum’s European portfolio, 20 companies have become unicorns including Depop, iZettle, and Pleo, and more than 60 new startups have been built by alumni from Creandum-backed unicorns Spotify (32) and Klarna (31).

Dominance and leadership across emerging sectors

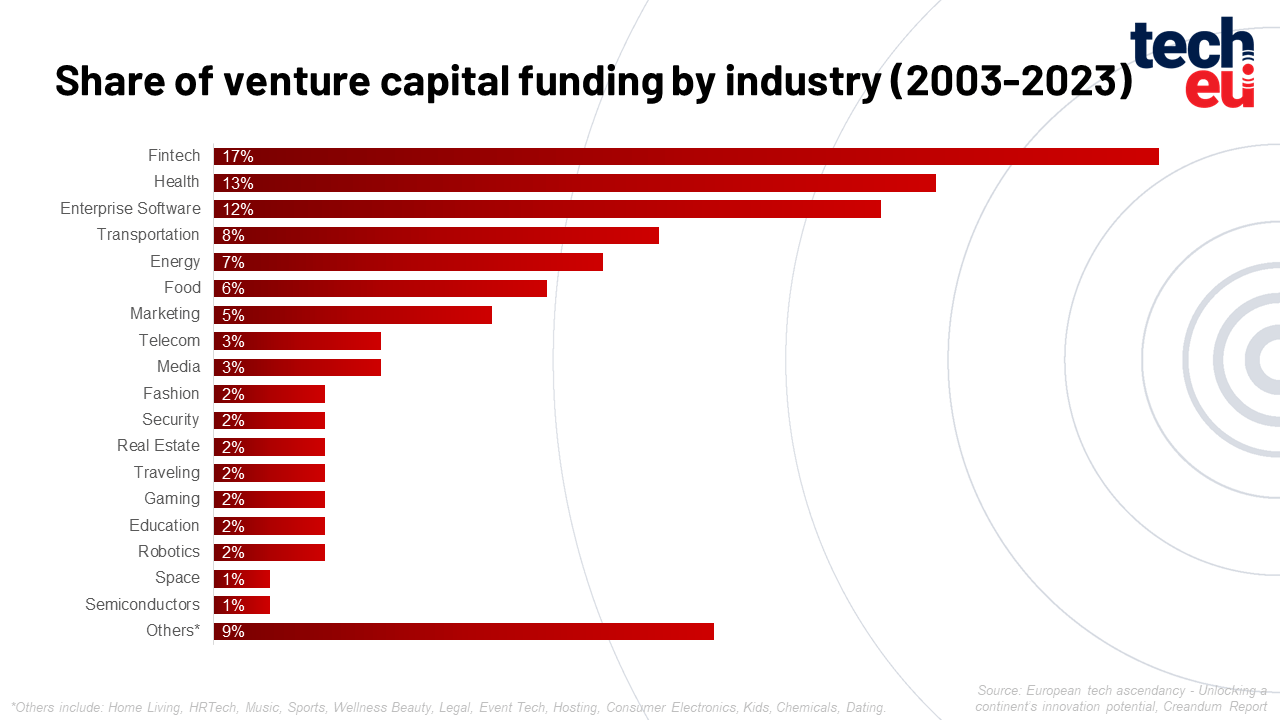

Europe has created some world-leading companies, specifically in sectors that received the most funding globally over the past 20 years, including Fintech, Digital Health, and Enterprise software.

Names worth mentioning include fintech companies Adyen, Revolut, Klarna, Pleo, and iZettle, digital health companies Kry and Doctolib, enterprise software companies like Factorial, Personio, UiPath, and many others.

The report found the fintech, digital health, and climate tech sectors, in which Europe, historically, has been strong, are set to grow even further with generative AI bringing further disruption as it is expected that mass adoption of AI will accelerate innovation and uncover more clusters.

The speed of this new technology cycle once again demonstrates that innovation is unpredictable and requires openness and rapid adoption.

- New sectors have emerged in the last year including Climate Tech, Quantum Computing, and Health, where Europe makes up to one-third of global funding.

- 22% of total European funding is going into climate tech in 2023 compared to 7% for the US (where electrification accounts for half of climate tech investment in Europe).

What to expect in the next 20 years?

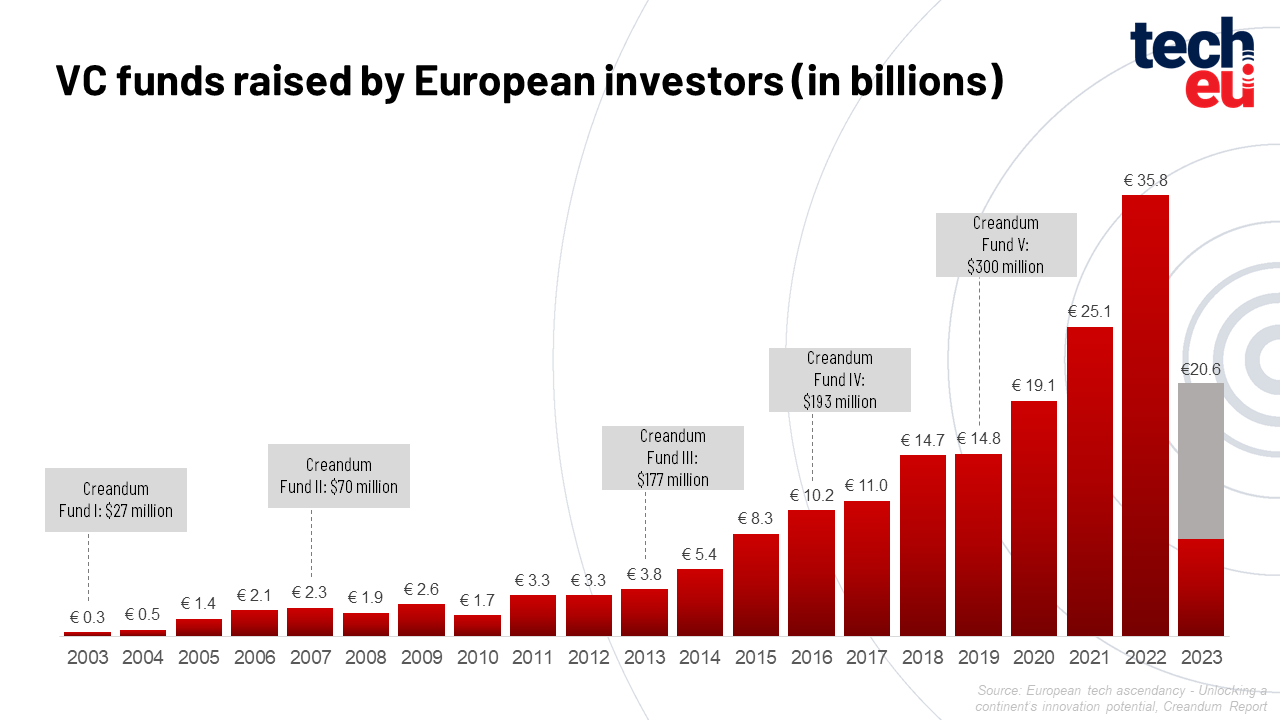

A strong and growing VC network has had a huge and significant impact on Europe’s tech sector, as it increased the amount of capital raised by 100x in the last 20 years.

Creandum alone has raised over $1.7 billion in that time, and its portfolio has gone on to raise $16.5 billion with portfolio companies employing 46,000 people in 35 HQ cities.

There are some encouraging facts that can lead us to the conclusion that in the next decade or two, Europe will show a continuous but also notable growth of the tech ecosystem.

- Science clusters are well positioned to lead in frontier tech development and more than half of the worldʼs top science clusters on emerging technologies are in Europe.

- As the climate transition is poised to transform industries that currently account for at least 25-30% of global GDP, Europe’s strength lies in this sector and presents a huge opportunity in the future.

- Huge potential remains for the transformation of many largely undisrupted, “traditional” industries, such as Real Estate, Education, and Insurance as well as consumer segments such as Food, Travel and Fashion which have seen very little VC funding compared to their large market size.

- Also, with generative AI now a focus for all companies, European companies are projected to see VC investment in this area 10x higher this year than in 2020.

"In just 20 years, Europe has gone from being an outsider to a global challenger. We’re confident that in the next 20 years, Europe can take the lead in emerging tech sectors, including digital health, climate tech, fintech and AI, that are critical to our economies and lives” commented Staffan Helgesson, General Partner at Creandum.

“For the past 20 years, our overriding ambition has been to back the best entrepreneurs and the great thing about Europe is that successful companies can come from anywhere. We have seen first-hand with companies like Spotify, which became a global category leader headquartered in Europe, how software has been a catalyst for disruption and as the ambitions of the next generation of founders get bigger, we expect to see even more great global tech companies created here.”

Would you like to write the first comment?

Login to post comments