In the midst of an ever-changing economic landscape, Europe's tech scene stands at a crucial turning point. The choices we make today, as policymakers, investors, and industry leaders, will echo into the future, moulding Europe's position in the global technology stage.

With the global economy throwing us curveballs, now is the perfect time to take stock of Europe's venture capital (VC) ecosystem and truly understand how European investors navigate the current market. It's an opportunity to see how we can adapt and thrive.

What's truly exciting is that Europe has become a captivating hub for investors from the United States and all corners of the globe. They're lured by the high quality of life and the promising investment prospects that Europe has to offer.

According to the latest data from PitchBook, the median European funding round with US participation nearly doubled in 2021, reaching €38 million. This significant increase compared to the previous year's €19.4 million demonstrates the growing interest and confidence in Europe's potential.

Pulling the Curtain Back on European VCs

For years, unravelling the mysteries of European venture capitalists (VCs) and their approach to startup investments has been a challenge. While extensive research has delved into the US venture capital market, the European VC landscape has remained largely unexplored. From deal sourcing strategies to term sheet essentials and valuation determinations, these aspects have remained elusive.

In an effort to shed light on the European VC landscape, we at Speedinvest, in collaboration with Professor Reiner Braun from the Technical University Munich, embarked on one of the most extensive surveys of European investors ever conducted. Our aim was to gain a deeper understanding of the strengths and weaknesses of the European ecosystem, identify challenges and opportunities, and leverage these insights for future advancement.

With an impressive reach and scope rarely seen before, our survey involved in-depth interviews with 437 European investors spanning the continent. Through these conversations, we sought to uncover valuable insights. What makes the European ecosystem unique? Where do we face challenges, and what opportunities lie ahead? By learning from these findings, both investors and entrepreneurs can make better-informed decisions moving forward.

Our inspiration for undertaking this survey came from a notable research project titled "How do venture capitalists make decisions?" conducted by Gompers et al. in 2020, based in the United States. This influential study served as an invaluable reference point, allowing us to draw meaningful comparisons between our findings and those from the US, enriching our understanding of the European VC landscape.

Do Unicorns Exist?

When it comes to valuations, our survey reveals a prevailing consensus among European VCs that the current market has led to the overvaluation of "unicorns" (startups with valuations exceeding $1 billion) both in Europe and beyond.

A striking 84% of investors, including those who have invested in unicorns themselves, expressed the belief that these highly valued startups are either slightly or significantly overvalued. This sentiment is in line with the recent trend where several scaleups with sky-high valuations have witnessed notable decreases in their worth.

While this viewpoint is shared by the majority of investors (84%), it is important to note that most respondents base their valuations on various factors. These factors include anticipated exit strategies, desired ownership percentages, and the valuation of comparable investments.

Diagnosing the European Landscape

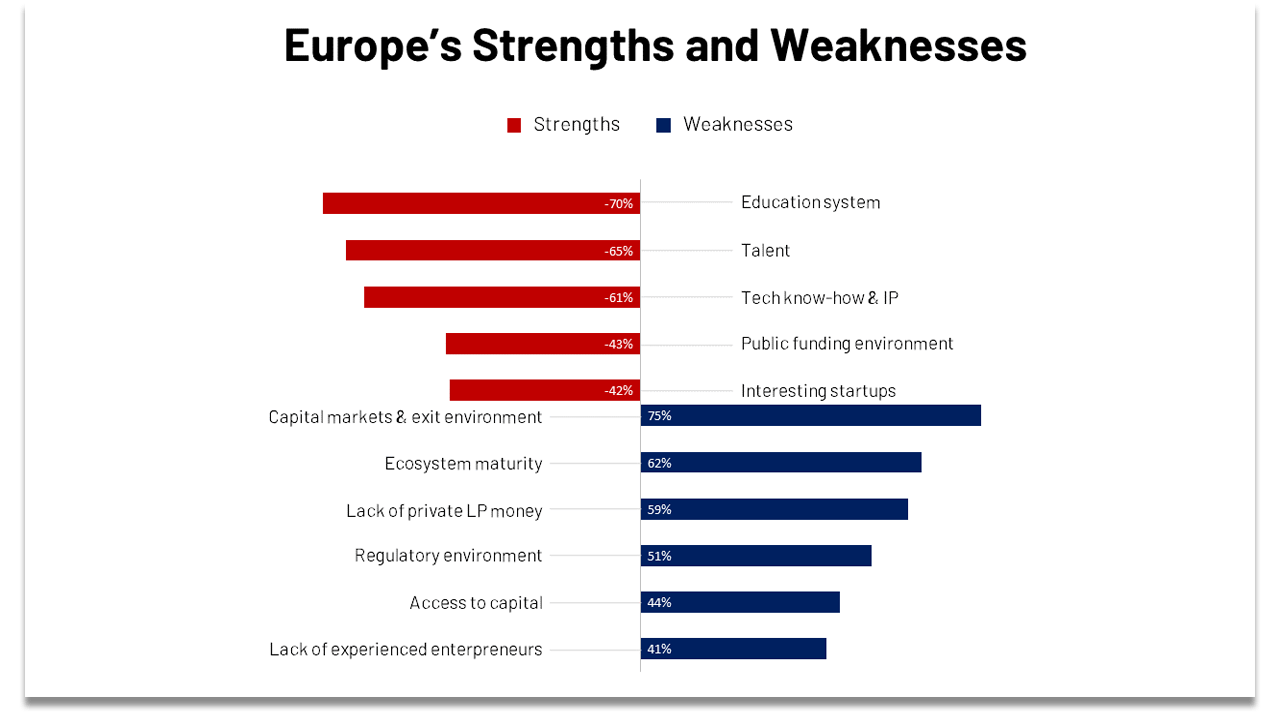

Europe’s startup ecosystem thrives on significant strengths that set it apart. According to our survey, 70% of investors recognize Europe’s educational system and universities as a major asset, while 65% highlight the abundance of talent available. Additionally, 61% acknowledge Europe’s technological know-how and intellectual property (IP) as significant advantages. The availability of public funding (43%) and the presence of interesting investment opportunities (43%) are also viewed as strengths.

However, it’s important to acknowledge that challenges persist. A staggering 75% of investors identify the capital markets and exit environment as major hurdles. The maturity of the ecosystem (62%) and the scarcity of private limited partner (LP) funding (59%) closely follow as areas of concern. The regulatory environment (51%), limited access to capital for startups (44%), and the shortage of experienced entrepreneurs (41%) round out the problematic aspects within Europe.

Europe’s fragmented nature, comprising diverse countries and regional hubs, stands in contrast to the more consolidated US market. It is unsurprising, then, that 87% of investors perceive Europe as a fragmented ecosystem. Cultural and regulatory differences, as well as the varying levels of maturity across the European ecosystem, emerge as the most commonly cited factors contributing to this fragmentation according to the survey responses. It’s for these very reasons that we at Speedinvest take pride in our pan-European presence, with 40+ investors on the ground across our five European offices, offering us a bird’s-eye view of the entire regional ecosystem with the flexibility to tap into local markets.

Looking Across the Pond

While European and US VC practices share some similarities, our survey has revealed intriguing differences between the two regions.

One notable distinction is that European investors generally seek a lower ownership stake (13%) compared to their US counterparts (23%). Additionally, they place less emphasis on stock market exposure (30%) than their peers in the US (57%).

European VC firms, in general, tend to be younger than their US counterparts, with many launching within the past decade. This youthful landscape motivates European VCs to forge strong networks and cultivate a steady flow of investment opportunities, often by accepting smaller ownership stakes or engaging in syndication.

European VC firms also primarily focus on early-stage startups, whereas the US market obtains a broader mix across both early and later-stage investments. This seemingly reflects the varying stages of the ecosystem’s maturity in both regions.

Despite the obstacles, European venture capital has captured the attention of international investors. 76% of VCs reported an influx of US investors pouring into Europe in the last 12 months.

Multiple US funds have opened European offices in the last several years and are expanding to Europe more aggressively than in the past. Over the last three years, prominent US VC firms such as Sequoia Capital, Lightspeed Venture Partners, and General Catalyst have opened new offices or embarked on notable expansions across the continent.

Philip Chopin is a Partner at one of the world's largest venture capital firms – New Enterprise Associates (NEA). He believes Europe still hasn’t tapped into its full potential.

Chopin said, “We have seen a refreshing level of enthusiasm within Europe’s startup culture. Since Europe does not have the history of large exits that are a hallmark of the U.S. ecosystem, there is capacity for European founders to possess tremendous motivation and excitement around building companies that could become the region’s foundational examples of big tech success."

Pushing Europe to new heights

By embracing the insights gleaned from this survey, Europe can take steps to establish itself as a global tech leader. While our research sheds new light on the investment decision-making process at European VCs, it also unveils a plethora of unexplored avenues for future research into the broad European ecosystem.

Despite being relatively young and smaller in scale compared to its US counterpart, the European VC ecosystem is rapidly expanding and possesses distinct strengths. By harnessing the power of Europe's education system, talented individuals, and technical expertise, while also addressing weaknesses and fragmented markets, we can foster sustainable growth and enhance our competitiveness on the global stage.

Collaborative efforts between policymakers, investors, and industry leaders are crucial to propel the European tech landscape further. Now is the time to act, seize the opportunity, and drive Europe's tech landscape to new heights.

Would you like to write the first comment?

Login to post comments