The European Investment Fund (EIF) has invested €40 million in Blume Equity, a female-founded fund climatetech growth fund. This investment marks one of the EIF’s largest into a first-time growth stage fund.

Blume invests in companies supporting the transition to a low-carbon economy and a more sustainable environment, and as to be expected, the funds will be reserved solely for European companies.

The firm’s recent investments include Internet of Things (IoT) data solutions provider Sensorfact, Normative, a carbon accounting platform focusing on emissions for large enterprise clients, Matsmart-Motatos, a company tackling food waste in the FMCG space, and robotic inspection and maintenance services to the wind turbine industry startup, Aerones.

The EIF’s €40 million investment is supported by the InvestEU programme and a regional mandate from The Netherlands (the Dutch Future Fund) as the body now joins Blume’s investor base that includes AP4 (the Swedish National Pension Plan), Visa Foundation, Impact Engine (a US impact fund-of-funds programme) and other institutional investors.

Blume Equity co-founder Clare Murray commented:

“By supporting Blume with one of the largest investments EIF has made to a first-time fund, the European Union highlights its commitment both to the environment and to supporting the growth-stage ecosystem in Europe. This partnership will help us continue our profit-with-purpose mission to support entrepreneurs tackling the climate emergency.”

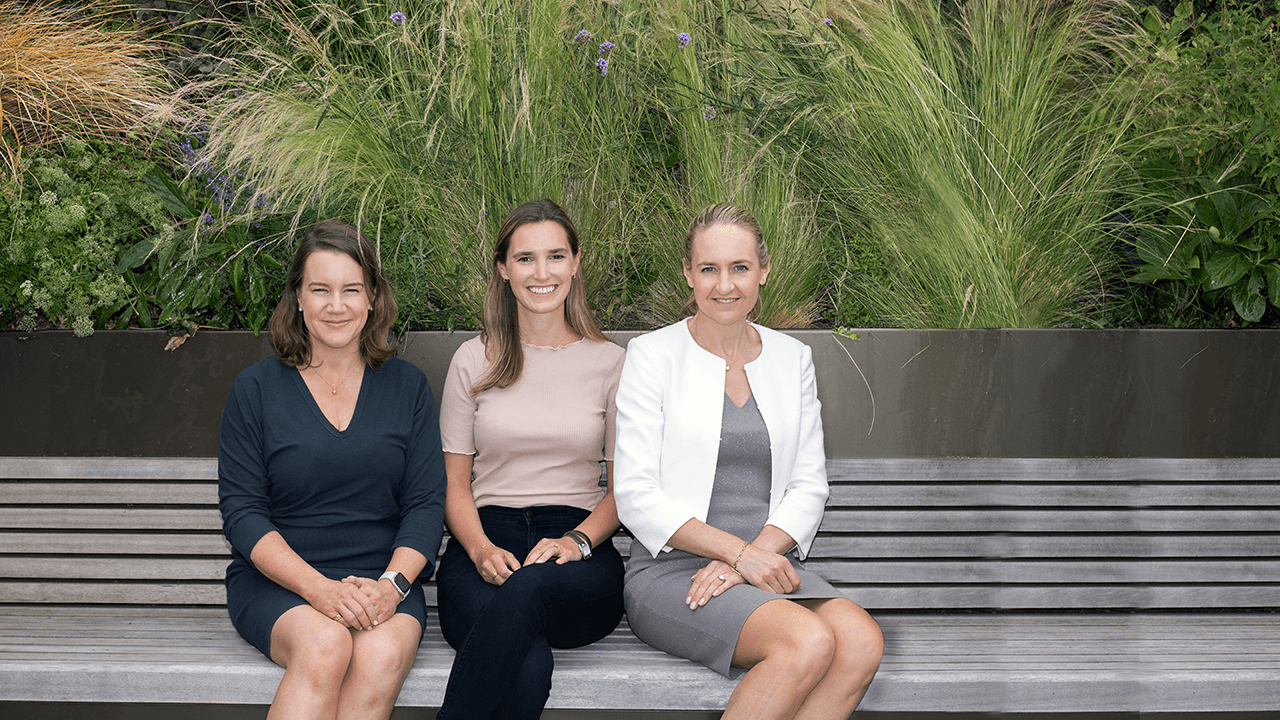

Blume Equity was founded by Eleanor Blagbrough, Clare Murray, and Michelle Capiod with previous experience at BlackRock, Goldman Sachs, McKinsey, and investment firms ECI Partners and Mid Europa Partners.

Lead image: Eleanor Blagbrough, Clare Murray, and Michelle Capiod (left to right). Photo: Uncredited.

Would you like to write the first comment?

Login to post comments