Cambridge-based semiconductor firm Pragmatic has announced the first close of its Series D funding round at £162 million. The firm says that plans for a second close are underway with £20 million already allocated to key investors.

Co-led by M&G’s Catalyst and British state-owned UK infrastructure Bank, Pragmatic’s £162 million investment round also saw participation from new investors including Northern Gritstone, Latitude, and MVolution Partners, with existing investors British Patient Capital, Cambridge Innovation Capital, and Saudi VC firm Prosperity7 Ventures renewing their commitments.

Including today’s announcement, Pragmatic has raised in excess of $400 million since 2015, and the new injection of capital is aimed at helping the company accelerate UK expansion plans, including the construction of two additional fabrication lines.

According to a statement issued earlier today, Pragmatic plans to build at least eight (the company currently has two) manufacturing lines in the UK, an initiative that intends to meet global demand for its unique technology and will create an estimated 500 highly skilled jobs in the North East of the UK and Cambridge.

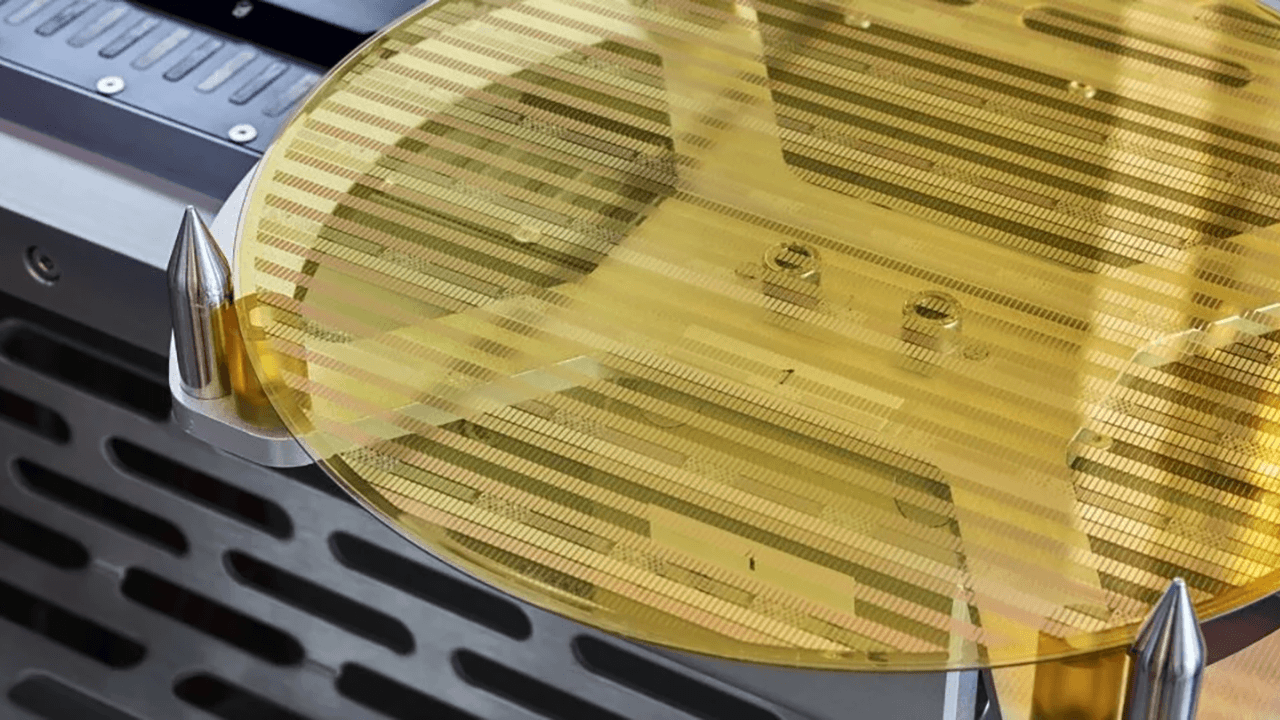

“Scaling our manufacturing capacity on the UK's first ever 300mm wafer production lines at our site in Durham will enable us to deliver hundreds of billions of chips to customers worldwide over the coming decade.” - Pragmatic CEO David Moore.

Pragmatic produces ultra-thin, flexible integrated circuits, all sans silicon. The company’s methodology uses thin-film semiconductors to create flexible integrated circuits which are significantly cheaper and faster to produce than silicon chips.

Not only does this offer an attractive alternative for many mainstream electronics applications, but also paves the way for a host of new applications not possible via traditional methods.

As an added bonus, the removal of silicon from the semiconductor manufacturing process gives Pragmatic a significantly lower carbon footprint when compared to traditional silicon chip fabrication.

On the investment, Moore shared:

“This successful Series D round is a clear testament to the massive opportunity for our innovative technology to enable item-level intelligence in virtually any object on the planet.

“Our global customers value our ultra-thin and flexible form factor, our breakthrough low cost of customisation and rapid production cycles, as well as the lower environmental footprint compared to silicon.”

Lead image via Pragmatic.

Would you like to write the first comment?

Login to post comments