Juniper, a UK-based startup offering reproductive healthcare insurance as an employee benefit, has secured £1.5 million in a pre-seed funding round. The company intends to use the investment to support a pilot programme slated for later this year.

The newly-emerged-from-stealth startup has received the backing of Insurtech Gateway alongside 2100 Ventures, Exceptional Ventures, and Heartfelt. Angel investors include Eurazeo’s Tara Reeves, Atomico angel Vera Baker, ComplyAdvantage founder Charles Delingpole, Exceptional Ventures’ co-founder Matt Cooper, and other unnamed parties.

In much the same manner as London’s Fertifa, Juniper is addressing the sensitive area often overlooked by traditional insurance packages. The startup offers coverage including contraception, STD testing, endometriosis, erectile dysfunction, and reproductive organ cancer.

Moreover, Juniper’s coverage includes egg freezing, menopause, and gender dysphoria, a USP that makes the startup the sole insurance provider to address this area.

As opposed to traditional health insurers who target low-frequency, high-value claims, i.e. those that are rarely used, Juniper is targeting employers with a staff of 250 or greater and claiming the overlooked niche of high-frequency claims with moderate costs.

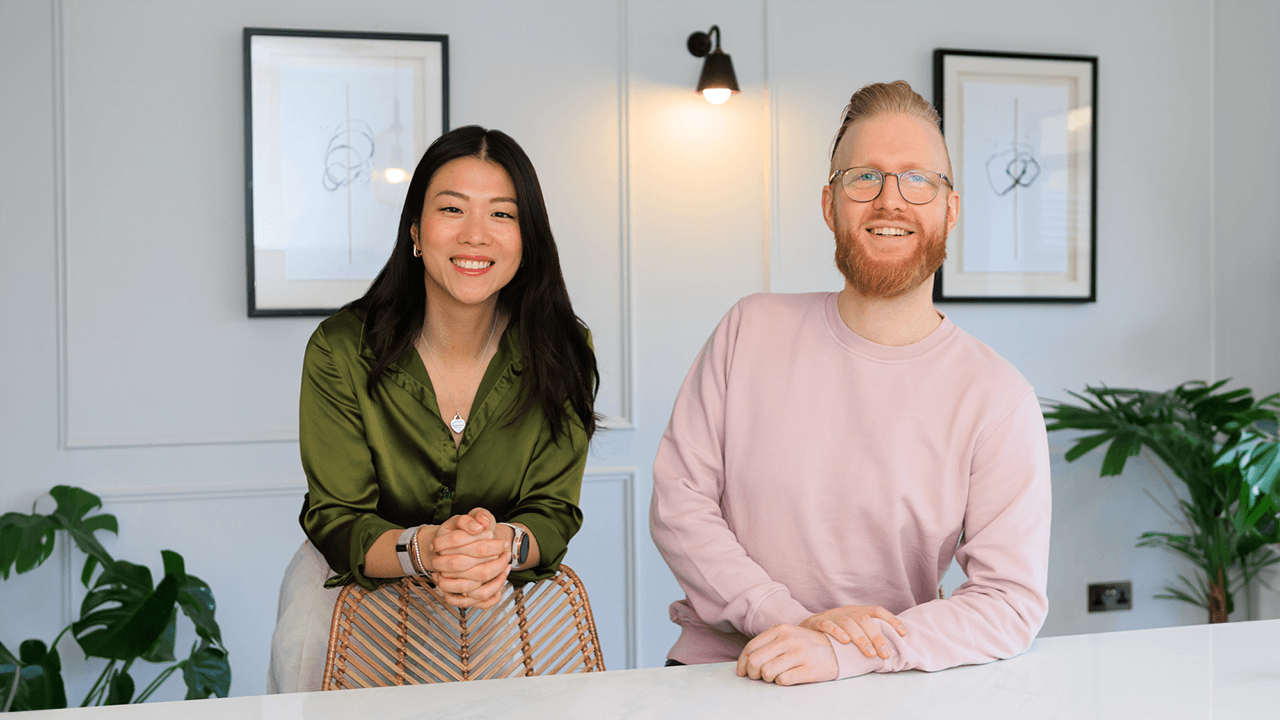

Juniper is co-founded by Ambra Zhang and Sam Pratt, and draws, in part, on Ambra’s personal experience and frustration with the limitations of corporate finance experienced at her time with Goldman Sachs. She shares:

"I was diagnosed with polycystic ovarian syndrome (PCOS) early on, and my corporate health insurance didn’t cover it, as PCOS was classified as a chronic reproductive condition.

“So, every year, I would pay £1,000 out of pocket to see my gynaecologist get my prescription. Juniper bridges this gap by providing end-to-end reproductive health support for employees and offers tailored, high-quality insurance products for employers and brokers. Our digital platform aims to revolutionise the insurance industry by meeting the unmet needs of the new generation."

Juniper CPTO Sam Pratt served as head of engineering and IVF insurance startup Gaia, and most recently held the position of senior engineering manager at Lloyd’s of London’s second largest commercial insurer, Brit Insurance.

On the investment, lead investor Insurtech Gateway’s co-founder Robert Lumley commented:

“When Juniper asked us to imagine dental insurance, but for your genitals, it opened our eyes to a substantial market largely ignored by traditional insurance.

“Juniper is removing the stigma surrounding reproductive health issues and enabling employers to offer comprehensive care for all employees. We are delighted to join them on this journey.”

Lead image: Juniper co-founders Ambra Zhang and Sam Pratt. Photo: Uncredited.

Would you like to write the first comment?

Login to post comments