According to the Tech.eu database, European tech companies raised €8.5 billion over the course of February 2024 in some 338 deals.

This figure represents a decrease of around 50 per cent compared to the previous month (January 2024 saw an investment volume of €16.7 billion) and an increase of around 95 per cent compared to the same month a year before (investment volume in February 2023 was €4.4 billion). However, it should be highlighted that one large deal, ACC’s €4.4 billion debt facility aimed at the construction of three gigafactories significantly impacts the overall view of the state of the European tech ecosystem.

This month Tech.eu has been throwing the spotlight on the fintech industry, noting that the traditional favourite has seen a decline in investment volume. Fintech companies raised €455.4 million in February 2024, and recorded a 58.6 per cent decline year-over-year (compared to €1.1 billion from February 2023).

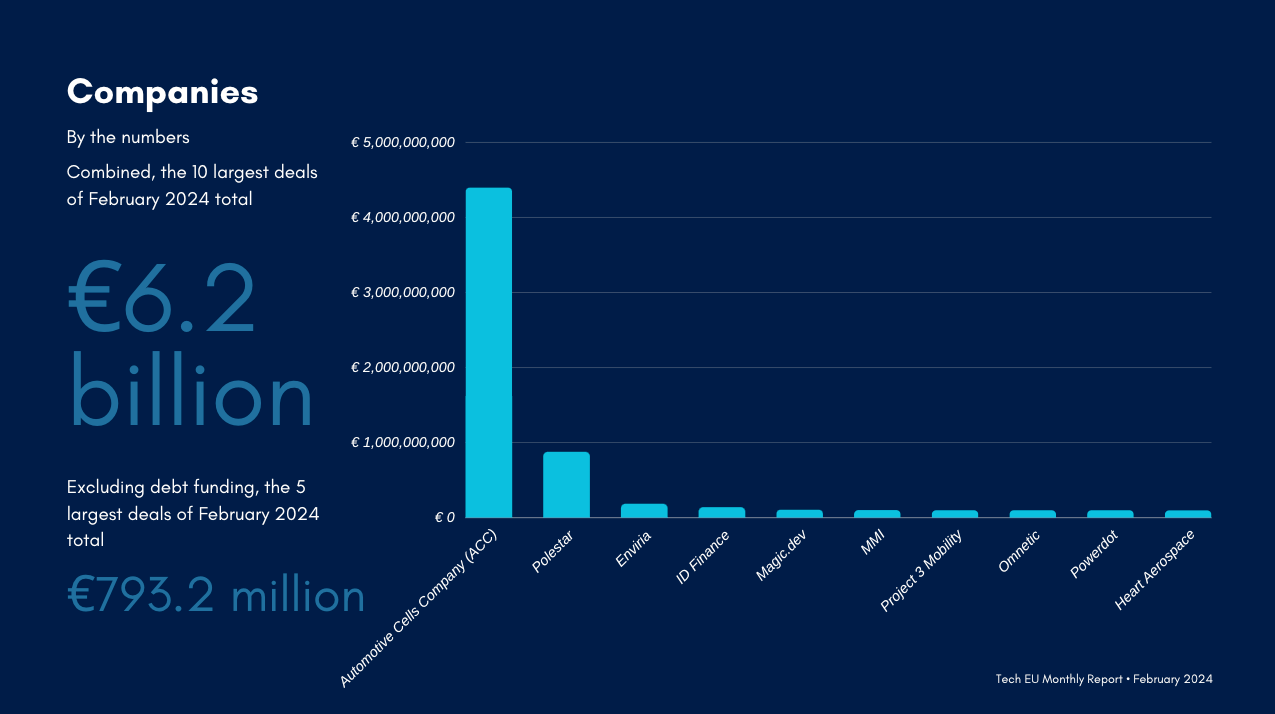

Companies

Out of 338 deals in February (a decrease of approximately 12 per cent year over year), 9 companies raised more than €100 million (each) while the value of 43 remain undisclosed.

Transportation stood out this month with two big deals:

- Automotive Cells Company (ACC), and its shareholders Stellantis, Mercedes-Benz and Saft, a subsidiary of TotalEnergies secured €4.4 billion in a debt funding facility to support the construction of three gigafactories for lithium-ion battery cell production in France, Germany, and Italy.

- Gothenburg-based Polestar, a premium electric vehicle firm has secured $950 million as a three-year loan facility with the aim to finance its next development stage.

Industries

By funding amount

February 2024 sees Transportation take the top slot by far in terms of investment volume in European tech startups, garnering 66 per cent of the monthly total at €5.6 billion.

By deal flow

In terms of deals, healthtech received the highest support with 56 deals. The software sector saw 52 deals, followed by fintech with 29 deals, cleantech 20 and artificial intelligence and energy 16 deals (each).

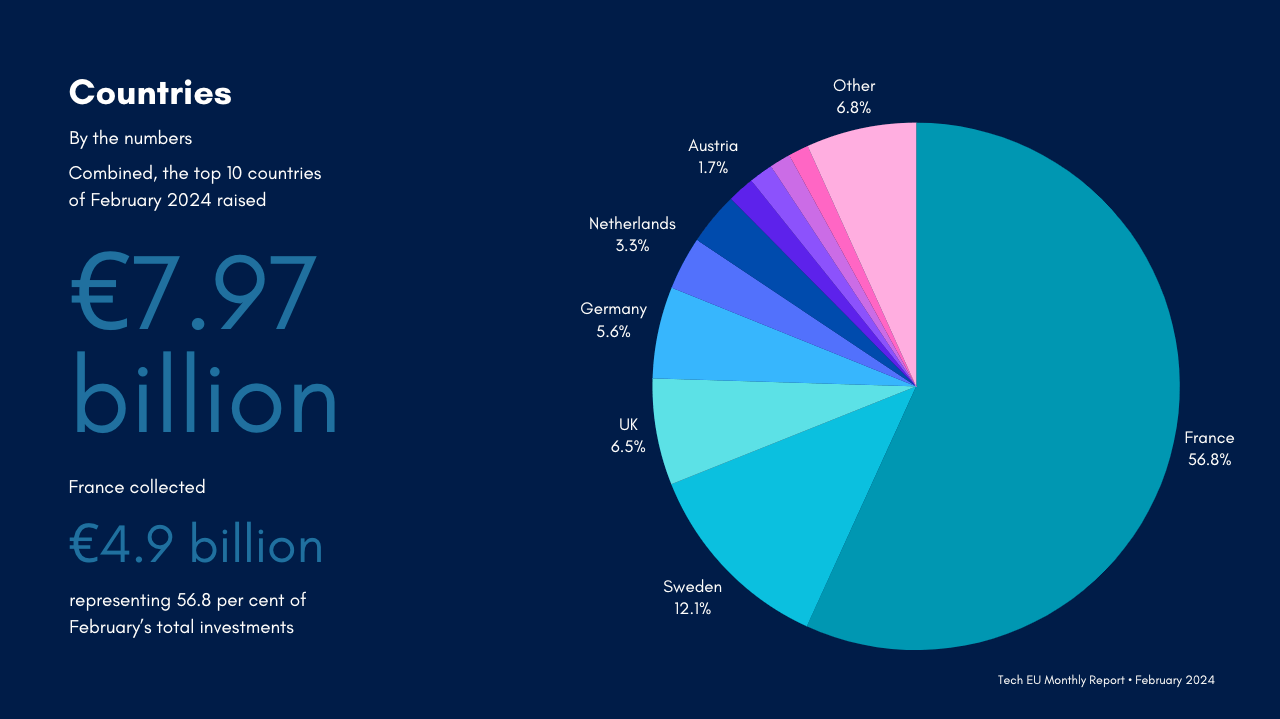

Countries

This month, pole position goes to France, with approximately €4.9 billion raised across 28 deals. In 2023, French companies raised €8.2 billion over the course of the entire year.

Rounding out the podium, Sweden took second position with €1 billion raised over 16 deals, followed by the UK with €558.5 million raised over 78 deals.

Beyond the traditionally well-funded countries, February 2024 marked the appearance of Denmark, Ireland, Portugal and Ukraine.

Exits

In February, 58 exits were recorded, out of which 44 were, as to be expected, undisclosed, and 2 were valued at €1 billion.

The biggest exit was for the UK’s Jagex which was acquired by Luxembourg's CVC Capital Partners and Haveli Investments for €1 billion.

Additional notable exits include:

- Transporttech company Zeelo acquired UK-based school transport specialist Kura.

- Conscia, a Danish provider of mission-critical IT infrastructure within networking, cybersecurity and cloud, has acquired UK digital transformation company ITGL.

- Developer team-building startup Deazy acquired Geektastic, providing customisable, peer-reviewed technical assessments that generate deep technical insight to allow enterprises to identify the best developers quickly.

Grab the PDF version of this report for even more insights, including a special foreword from Andreas Riegler, Founder & General Partner of APEX Ventures.

Would you like to write the first comment?

Login to post comments