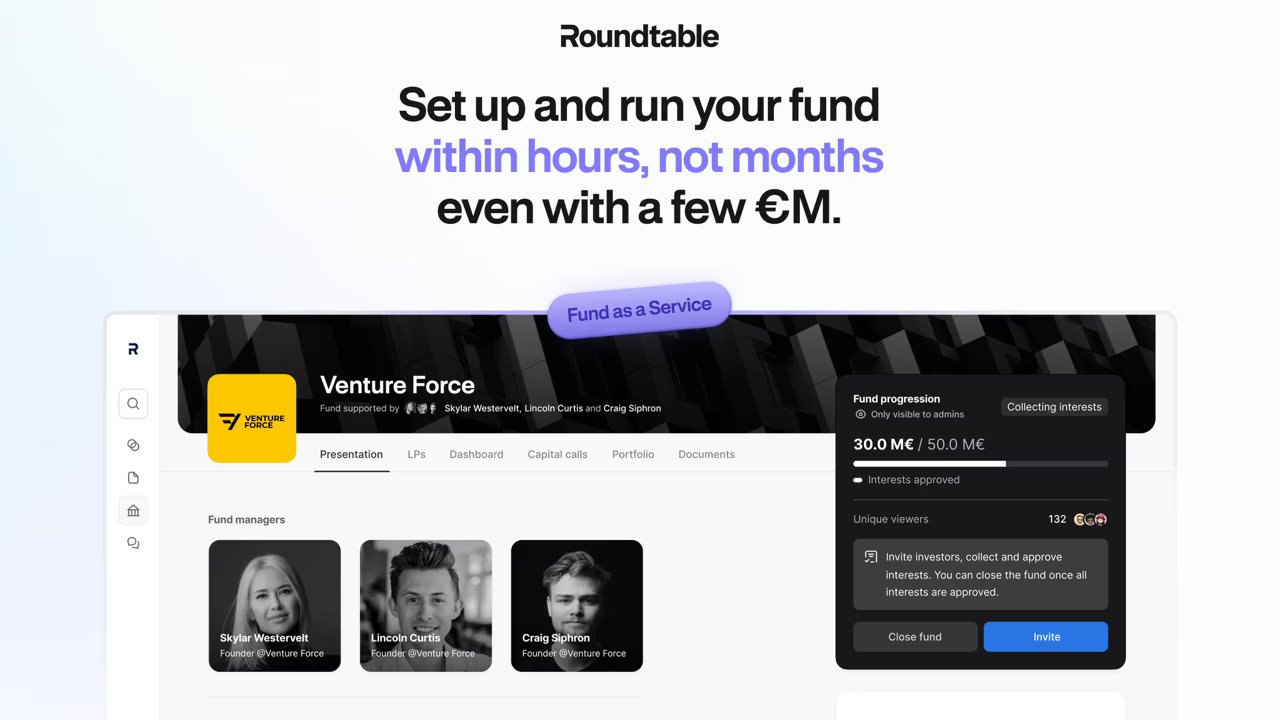

European investor Roundtable today launches its micro fund-as-a-service product, aiming to enable any investor to quickly and easily launch their own VC fund.

Roundtable is a registered EuVECA Manager in Luxembourg. It offers a platform for founders to raise capital via business angels and communities of investors. Investors can also create their own communities and invite others to join and share deals.

It previously simplified community investing in startups by facilitating over €250 million in fundraising through 450 deals in the past 12 months. Now it helps investors establish micro funds.

Launch a micro fund in hours

Roundtable's new product significantly simplifies and accelerates the process of launching a fund. It sets a much lower minimum of just a few million, as opposed to the usual €50 -100 million minimum required to launch a fund. Second, its standardised all-included fund-as-service-product eliminates the need for navigating complex legislation, dealing with lawyers, and onboarding Limited Partners (LPs).

Investors can establish a fund within a few hours instead of months. Roundtable also takes care of all required tasks, such as fund administration, audit, and reporting, enabling the reduction of yearly costs and thus the targeting of fund size.

Micro fund investment deals are on the rise

In 2021, micro funds accounted for about 20 per cent of all seed investments in the US, with the number of micro VC fund deals increasing by 219 per cent over the past decade up to 2020.

Individuals who are interested in creating a fund are usually influential business Angels, but also Partners or Principals of VC funds who want to launch their own fund, or even Alumni networks such as business schools.

Roundtable is currently supporting several micro funds targeting first closings between €10 million and €100 million. Among them is Intuition.vc, a €15 million early-stage fund led by Etienne Boutan and Hugo Amsellem, with investors including footballer Raphaël Varane. Intuition.vc focuses on investing in consumer and culture startups.

According to Evan Testa, CEO and co-founder of Roundtable:

“Micro funds, while smaller in size and capital than traditional venture capital funds, are agile, make decisions quickly, and offer hands-on support and expertise to founders, regularly providing advice and mentorship.

This approach has revolutionised the US venture capital market and is now gaining traction in Europe.

With our new product that simplifies and accelerates the creation of micro VC funds in Europe, we anticipate a similar transformation to occur in the European market.”

Roundtable’s future plans include international expansion and diversifying investment options into real estate and private equity.

Would you like to write the first comment?

Login to post comments