Today FIRSTPICK and Change Ventures teams published The Baltic Startup Funding Report, a semi-annual publication of detailed data about funding rounds for startups in the Baltics, including companies with HQs elsewhere but with a dominant base in Estonia, Latvia, or Lithuania.

The Baltic states generate funded startups per million inhabitants on par with the UK and the Nordics, with Estonia being a close second to the “startup nation” Israel and far ahead of Europe, while the Baltic states together are almost at parity with Europe's best.

Nord Security is the latest unicorn from the region, adding to the list of success the region has experienced to date, including both bootstrapped and venture-funded unicorns.

Baltic startups face global funding challenges

The Baltics are home to the general challenges in startup funding experienced elsewhere - the pullback by angels and Pre-Seed funds, the focus seed funds have on supporting their current portfolio rather than on new investments, and the Series A funding gap.

Across these three early stages, the total capital raised has stayed flat at around €115 million for this period.

Pre-Seed funding is spread thin

In the first half of 2024, the number of Pre-Seed rounds continued to decrease for the second six-month period in a row, reaching the lowest number (32) recorded in this report series.

sought-after teams,

especially startups in the AI space.

There’s a concentration of capital into fewer, larger rounds (notably many AI startup rounds) and a drying up of angel funding from the boom of 2021/2022. The authors predict that Pre-Seed venture funds will have scarce resources, given the challenges of raising funds.

The Seed stage pain points

Seed rounds haven’t increased, and some startups are turning to venture debt instead of equity/convertible note investments.

The authors assert that it is becoming increasingly difficult to negotiate higher valuations at the Seed stage as many investors have been burned by having to support their portfolio startups as they struggle to reach the results necessary for raising Series A.

Many of today's Seed stage rounds are bridge and extension rounds as teams focus on surviving until they can raise their Series A, leading to a decrease in the median round size from about €2 million to €1.5 million in H1 2024.

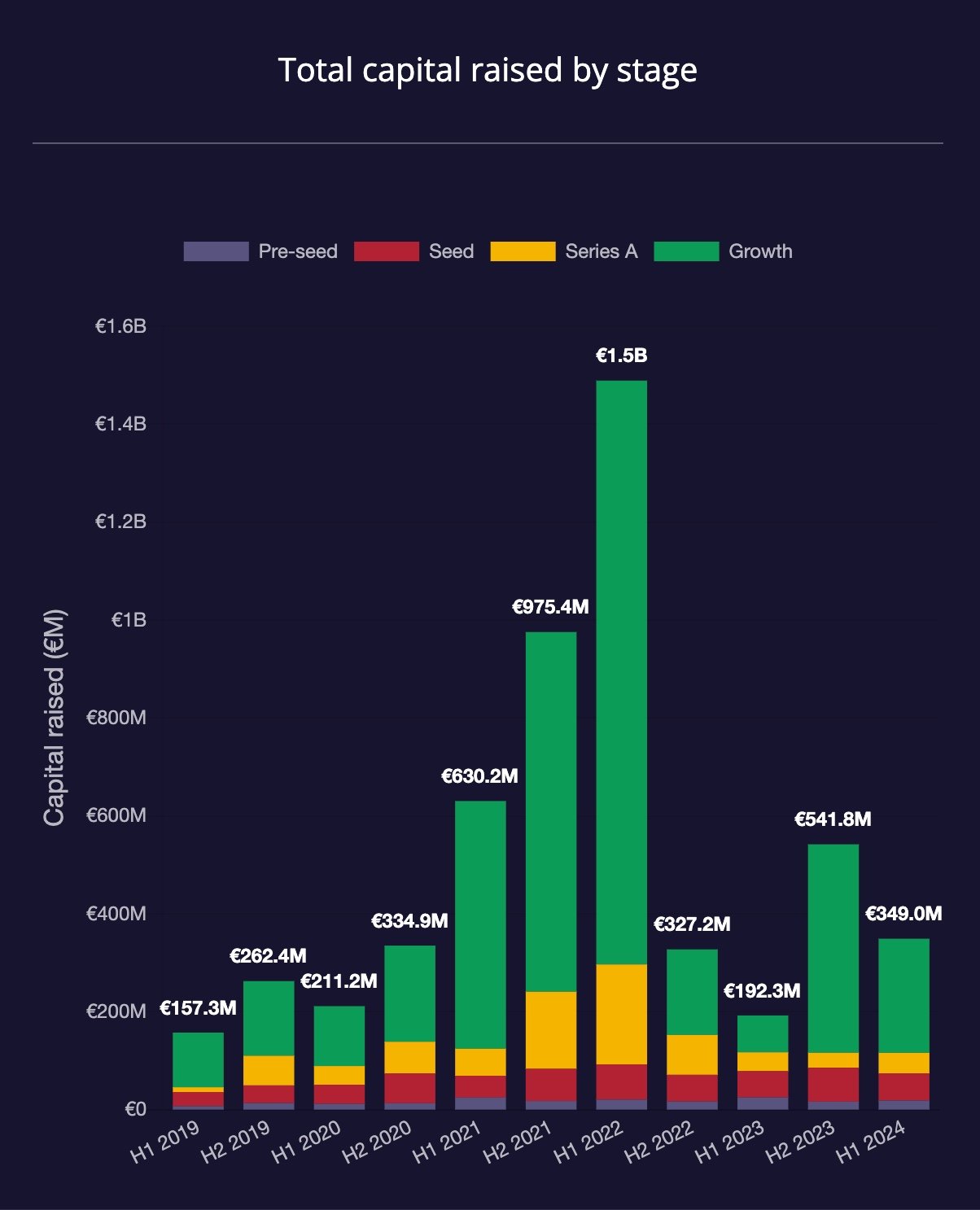

Baltic startup growth capital shows signs of recovery

However, while growth capital deployed during the first half of 2024 was less than in the prior six months, it was still more than the 12 months of H2 2022 and H1 2023, showing that growth capital is returning, albeit nowhere near the €1B+ levels of H1 2022.

The collected data suggests that Estonia is still a market leader in the number of total rounds closed. In fact, for Series A and growth rounds in H1 2024 it has already reached more than half (9) of the number of rounds (13) it closed in 2023.

However data from the first half of this year suggests that there is a shift in Pre-Seed startup valuations with the median startup in Latvia and Lithuania now able to attract Pre-Seed funding at ~30 per cent higher valuations than startups in Estonia. This could be explained by the high number of AI startups, especially in Lithuania, with serial founders behind them raising rounds at particularly high valuations.

However, when it comes to Seed rounds — Estonian startups can still attract funding at higher valuations than Latvia and Lithuania.

Lead image: Freepik.

Would you like to write the first comment?

Login to post comments