According to the Tech.eu database, European tech companies raised €5.2 billion over the course of November 2024. This figure is 30 per cent higher than the previous month when European tech companies raised €4 billion. Compared to November 2023, however, the amount has decreased by around 8 per cent, as European tech companies raised €5.6 billion that month.

RJ Schuurs, Partner at Antler, commented on the November numbers within the European tech investment landscape in our November Tech.eu Pulse, a compact version of the monthly report:

We have seen countless examples of startups that focus on capital efficiency and start with relatively small Pre-Seed and Seed rounds go on to raise significant amounts of funding further down the line.

This long tail of early-stage startups may not attract the same kind of headlines, but they are the engine room of the European tech ecosystem and represent a critical mass of venture-backed, fast-growth startups whose success will define the next ten years.

Capital is available for great founders building great companies in a wide range of sectors and a wide range of countries. As we approach the end of the year, this is a strong platform to build on in the year ahead.

For his more detailed review as well as more in-depth analyses of the European tech ecosystem, including industry and country performance, exit activities and more, check out our November report.

And here is the list of 10 biggest European tech deals in November which collected together around 50 per cent of the total amount collected this month.

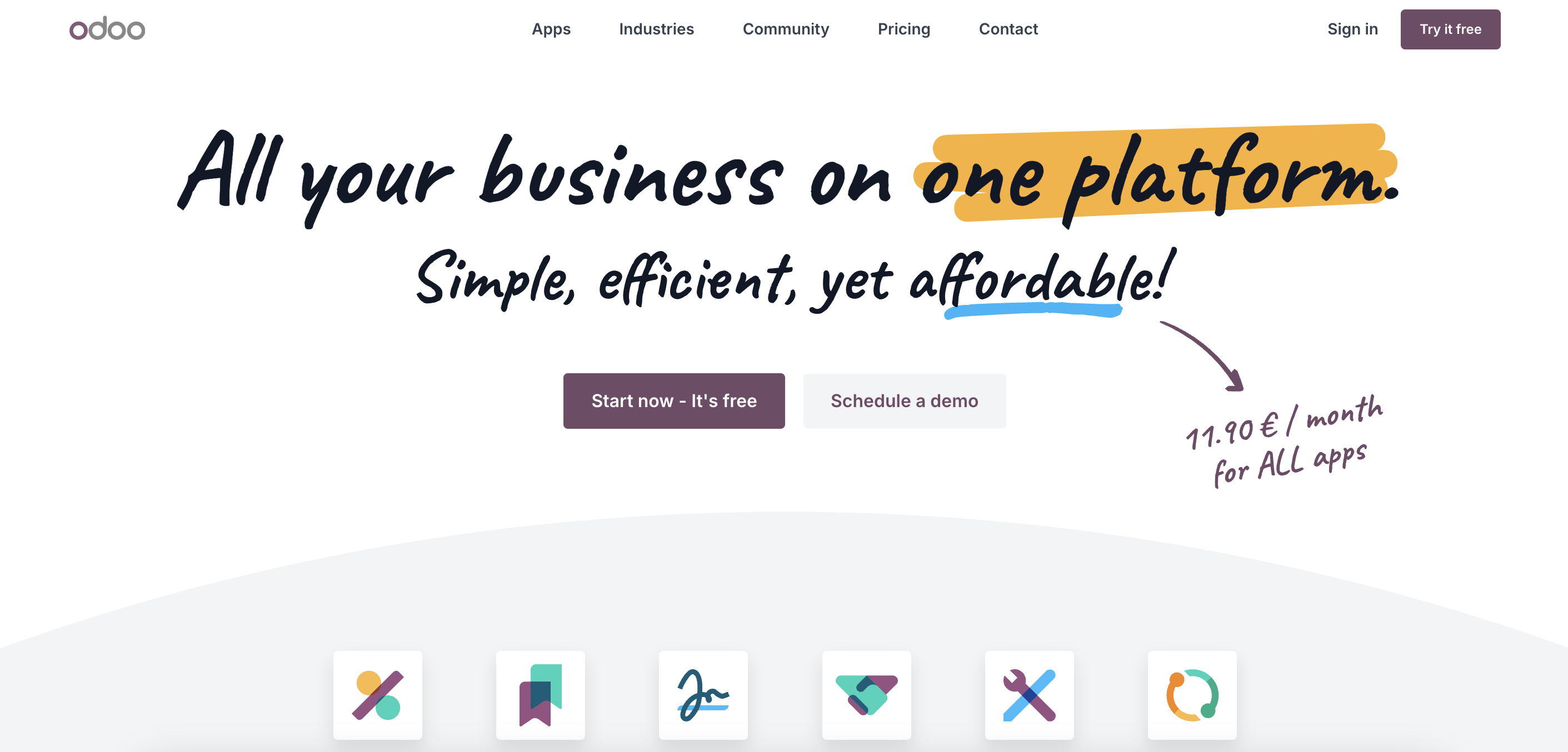

Odoo (Belgium)

Odoo is an open-source suite of integrated business applications developed and maintained by Odoo SA.

The platform enables seamless management of diverse business operations through its comprehensive suite of apps, including Odoo CRM, Sales, Accounting, Warehouse Management (WMS), HR, Projects, Marketing, and more.

Odoo's modular design ensures full integration across functionalities, making it a robust alternative to traditional enterprise solutions like SAP ERP, Oracle E-Business Suite, Microsoft Dynamics, and Netsuite.

This month, Odoo raised €500 million in secondary capital, reaching €5 billion valuation.

Insider (Türkiye)

Insider is a B2B SaaS platform that empowers enterprise marketers to craft individualized, cross-channel customer experiences.

By unifying customer data across multiple channels and systems, Insider leverages its AI-powered intent engine to predict customer behavior and deliver personalized experiences through Web, App, Web Push, Email, SMS, and popular messaging apps like WhatsApp and Facebook Messenger.

Recognized globally for its innovation and leadership, Insider recently achieved unicorn status, earning acclaim as one of the few woman-founded, women-led unicorns.

The company raised $500 million Series E funding, bringing its funding to over $772 million.

SeQura (Spain)

SeQura is a company that deliver cutting-edge, flexible, and user-friendly payment technologies designed to help merchants attract, convert, and retain more customers.

Leveraging advanced risk-scoring capabilities, the company provides access to credit for shoppers who might otherwise be excluded, achieving the highest acceptance rates for flexible payment solutions in the market.

SeQura has raised over €410 million, enabling the company to expand into three new international markets: the United States, the United Kingdom, and Germany.

Lighthouse (UK)

Lighthouse is a commercial platform for the travel and hospitality industry.

Lighthouse's platform provides tools to boost bookings and optimize operations, powered by proprietary technology that processes over 400 terabytes of travel and market data daily. By leveraging AI, it delivers actionable insights that help customers make smarter, more efficient operational decisions.

Trusted by over 70,000 hotels across 185 countries, Lighthouse is the only platform that combines real-time hotel and short-term rental data.

The company raised $370 million in Series C funding, which will be utilized to enhance its platform, pursue strategic acquisitions, and support global expansion efforts.

Iwoca (UK)

Iwoca is a provider of finance solutions to SMEs.

The company is designed to eliminate the hassle of traditional lending by offering tailored, fast, and flexible funding solutions that focus on opportunities rather than obstacles.

Through innovative partner integrations and a robust Lending API, Iwoca ensures businesses can access finance when and where they need it. Its award-winning credit risk engine delivers quick, precise funding decisions based on real business performance.

This month, the company raised $200 million which will use to expand its business reach.

The Exploration Company (Germany)

The Exploration Company (TEC) designs, manufactures, and operates spacecraft for space station logistics and exploration.

Focused on reusable and refillable spacecraft, TEC aims to make space exploration more affordable, modular, and sustainable.

The company is developing Nyx, a reusable, in-orbit refuelable spacecraft capable of flying to any space station and returning to Earth with up to 3,000 kg of cargo—the largest down-mass available worldwide. Nyx will offer services at 25-50% lower costs than other vehicles and be refurbished for subsequent missions.

TEC plans to launch its mid-size capsule, Mission Possible, in 2025, carrying 300 kg of payload, with Nyx set for its maiden flight in 2028, delivering cargo to the International Space Station for ESA.

The company secured $160 million in Series B funding, increasing its total funding to nearly $230 million.

Tokamak Energy (UK)

Tokamak Energy is a company focused on delivering fusion energy in the 2030s—providing a clean, secure, affordable, and sustainable energy source for the world.

With over a decade of experience, Tokamak Energy is the only private fusion company developing two critical technologies for efficient and commercially viable fusion energy: the compact spherical tokamak and high-temperature superconducting (HTS) magnets.

Through its dedicated division, TE Magnetics, Tokamak Energy collaborates with key manufacturing partners to become a leading supplier of HTS technology, not only for fusion energy but also for innovative applications in science, renewable energy, and propulsion across water, air, and space.

The company raised nearly £100 million to fast-track its ambitious plans to commercialize fusion energy and expand its high-temperature superconducting technology division, TE Magnetics.

Tessl (UK)

Tessl is revolutionizing software development for the AI era.

Unlike traditional development, which ties software to code and limits flexibility, Tessl enables AI Native Development, allowing developers to define functionality in natural language while AI handles implementation and maintenance. This innovative approach accelerates development, simplifies maintenance, and makes software creation more accessible to a wider range of creators.

Beyond development, Tessl’s AI Native platform can autonomously maintain software, managing updates, security patches, and optimizations with minimal human intervention. Tessl is also building an open ecosystem, inviting developers, teams, and tool creators to join in reshaping the future of software development.

The company raised $125 million for AI native software development.

Impress (Spain)

Impress is a leading provider of orthodontic technology specializing in invisible aligners.

With operations across Spain, Italy, Portugal, France, the UK, Germany, Sweden, the Netherlands, Ukraine, and the U.S., the company focuses on patient-centered care, leveraging advanced technologies like AI-driven treatment planning and remote monitoring, all backed by strong clinical oversight.

Serving over 250,000 patients annually, Impress is Europe's largest chain of invisible aligners, revolutionizing orthodontic care with its innovative, accessible solutions.

Impress secured $117 million, which will be used to expand access to high-quality, medically-driven orthodontic care across Europe.

Northvolt (Sweden)

Northvolt is a company focused on producing sustainable lithium-ion batteries for electric vehicles and energy storage systems.

With a mission to accelerate the transition to renewable energy, Northvolt delivers high-quality, eco-friendly battery solutions. The company places a strong emphasis on innovation and sustainability in its manufacturing processes to address the increasing demand for clean energy technologies.

The company has recently filed for Chapter 11 bankruptcy protection in the US, marking a setback for Europe’s efforts to reduce its dependence on Chinese battery manufacturing. It has secured $100 million in new financing to support the bankruptcy process, with operations continuing as usual. The company anticipates completing its restructuring by the first quarter of 2025.

Would you like to write the first comment?

Login to post comments