In 2024, Spain's tech ecosystem attracted over €3.3 billion in investment, marking a 37.5 per cent increase from the previous year (€2.4 billion raised in 2023). Fintech emerged as a dominant sector, accounting for nearly one-third of the total investment.

Spain's ecosystem is defined by its diversity and specialisation. Besides fintech, the country boasts 1,210 deep tech spin-offs generating €2 billion in revenue and employing over 12,000 people, according to a report by Mobile World Capital Barcelona. Additionally, Spain's adoption of AI solutions by enterprises has surpassed the EU average, with a 9.2 per cent adoption rate in 2023.

While Barcelona and Madrid remain central hubs, cities like Valencia, Málaga, and San Sebastián are emerging as significant players. Valencia, for instance, ranks among the top 10 EU startup hubs, driven by initiatives like the Lanzadera accelerator.

Spain's digital infrastructure is among the most advanced in Europe. The government's España Digital 2026 strategy allocates over €4.3 billion to enhance 5G and AI capabilities, aiming to strengthen the country's leadership in advanced technologies.

Despite these advancements, Spain faces challenges in attracting late-stage capital, essential for scaling startups. Additionally, regional disparities in investment and resources persist, with northern regions like Catalonia and Madrid receiving a disproportionate share. Addressing these imbalances is key to fostering a more inclusive and competitive ecosystem.

Here are 10 companies to watch in 2025.

Sequra

Amount raised in 2024: €410M

SeQura is a company specialising in flexible payment solutions for the e-commerce and retail sectors.

SeQura offers services such as "buy now, pay later" and instalment plans to enhance customer acquisition, retention, and conversion for merchants. Its tailored solutions address the specific needs of various sectors, enhancing sales performance while empowering consumers with interest-free credit, savings options, and instalment plans of up to 24 months.

The company has experienced significant growth, expanding its presence in Southern Europe and Latin America, and continues to innovate in the digital payment space.

In 2024, the company closed a financing round of more than €410 million in debt and equity, underscoring the confidence of some of Europe's largest investors in seQura's business model and vision.

Job&Talent

Amount raised in 2024: €268M

Job&Talent is a leading global HR platform.

The company connects workers with employers through its mobile app, offering a seamless process from job search to payroll. Utilising advanced algorithms and data analytics, Job&Talent matches candidates with suitable job opportunities, aiming to simplify the hiring process for both job seekers and companies.

With a presence in multiple countries, including the UK, Germany, France, and the US, Job&Talent serves a diverse range of industries, providing flexible workforce solutions to meet the evolving demands of the labour market.

Job&Talent secured a €268 million working capital facility in 2024, consolidating its existing credit lines into a single, efficient financing solution to fuel its long-term growth.

Nebeus

Amount raised in 2024: €250M

Nebeus is a fintech company offering a comprehensive financial platform that bridges traditional banking and cryptocurrency services.

The company provides multi-currency accounts, crypto-friendly IBANs, and a suite of tools including crypto-backed loans, insured cold storage, and globally issued payment cards. Regulated by the Bank of Spain, Nebeus empowers digital nomads and marketplaces with payment, crypto, and card solutions, facilitating seamless management of both fiat and digital assets.

The company secured €250 million in institutional funding in 2024 for its crypto-backed loan programme.

Zunder

Amount raised in 2024: €225M

Zunder is a company specialising in ultra-fast electric vehicle (EV) charging infrastructure.

Founded in 2017, Zunder aims to provide seamless, high-speed charging solutions powered entirely by renewable energy. With over 170 stations and more than 950 charging points operational in Spain, France, and Portugal, the company is rapidly expanding its network to meet the growing demand for sustainable mobility.

Zunder's commitment to innovation is evident through its user-friendly technology, including Plug&Charge functionality and mobile app integration.

The company has secured a €225 million loan in 2024 to accelerate the deployment of its charging infrastructure.

TravelPerk

Amount raised in 2024: €220M

TravelPerk is a SaaS company that offers an all-in-one corporate travel and expense management platform, enabling businesses to book, manage, and report on travel activities seamlessly.

The platform provides access to a wide range of travel options, including flights, accommodations, and transportation, while integrating expense tracking and policy compliance tools. With over 2,000 employees and a global presence, TravelPerk serves companies of all sizes, aiming to simplify business travel and enhance efficiency.

In 2024, the company raised €220 million across two rounds to boost platform investment, enhance customer experience with new inventory features, introduce business travel services, and expand AI-driven product automation.

PLD Space

Amount raised in 2024: €132M

PLD Space is an aerospace company founded in 2011. It is a pioneer in Europe in the development of reusable launchers, with its Miura rocket family and the LINCE crewed capsule.

The company achieved the first successful launch of a European private suborbital rocket with Miura 1 in October 2023 and is preparing for the orbital launch of Miura 5 in late 2025 or early 2026. The company is also developing the LINCE capsule, intended for crewed missions, with test flights scheduled for 2028 and the first crewed flight in 2030.

In 2024, the company raised €132 million across three rounds to support its goal of launching the MIURA 5 mission by the end of 2025.

ID Finance

Amount raised in 2024: $150M

ID Finance is a fintech company that specialises in providing digital financial services, including credit scoring, lending, and banking solutions, primarily targeting emerging markets.

ID Finance leverages data science and machine learning to assess creditworthiness and deliver financial products to underserved populations. The company aims to enhance financial inclusion and empower individuals with accessible financial tools.

In 2024, the company secured $150 million in debt funding, which will fuel the expansion of Plazo, ID Finance’s key financial wellness app.

Capchase

Amount raised in 2024: €105M

Capchase is a fintech company, specialising in providing non-dilutive financing solutions to high-growth companies, particularly those with recurring revenue models.

The company offers a platform that enables businesses to access upfront capital by leveraging their future recurring revenues, allowing them to fund operations and growth initiatives without giving up equity. Capchase's services include revenue-based financing, automated invoice collection, and lending infrastructure tailored for SaaS and other subscription-based businesses.

In 2024, the company raised €105 million to expand Capchase Grow, supporting UK and European SaaS businesses with non-dilutive financing to fuel growth without giving up equity.

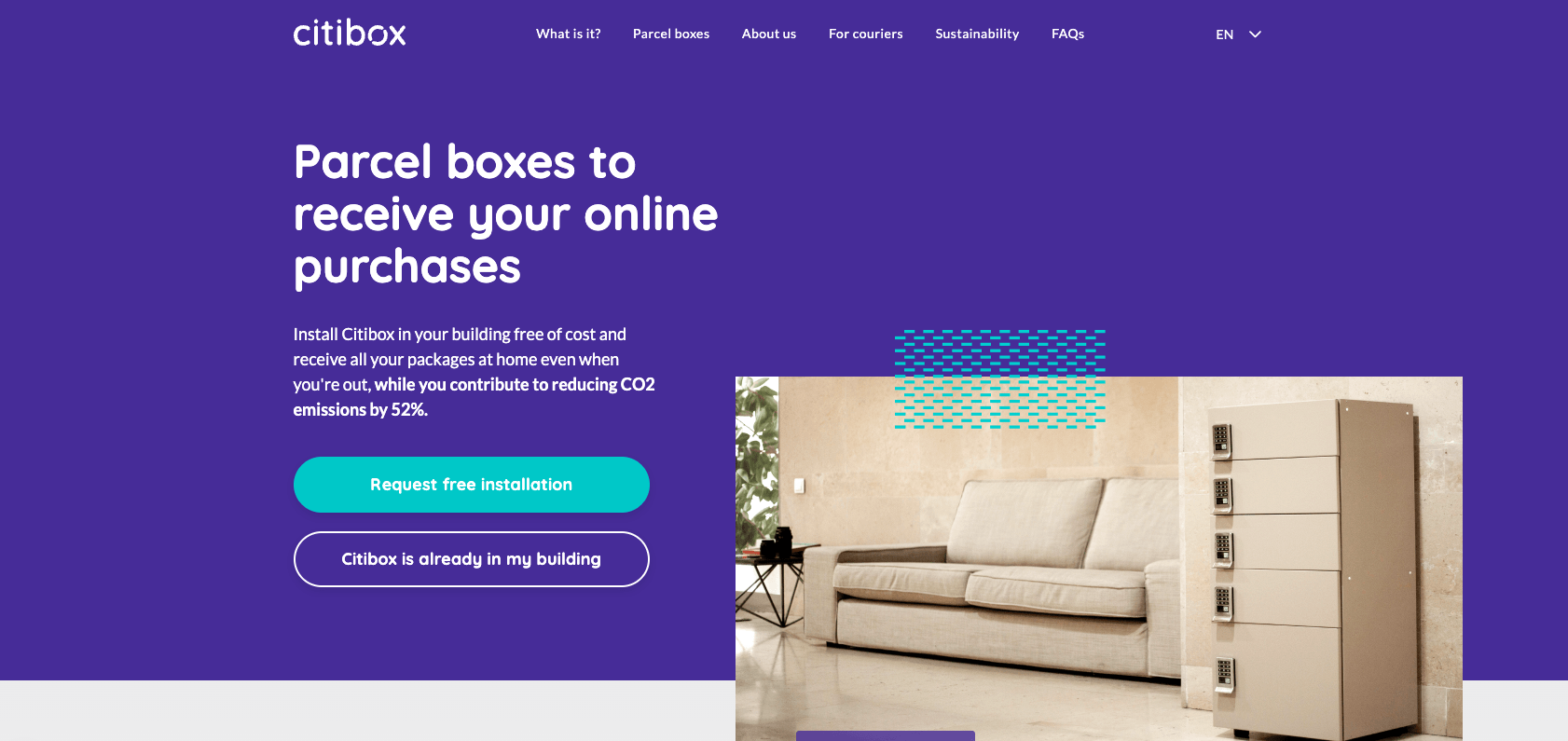

CitiBox

Amount raised in 2024: €80M

Citibox is a company that addresses the challenges of last-mile delivery by installing smart parcel lockers in residential building lobbies. These lockers enable couriers to deliver packages securely and efficiently, even when recipients are absent.

Users receive real-time notifications via the Citibox app and can access their parcels 24/7. The service is free for residents and aims to reduce delivery failures, CO₂ emissions, and urban congestion.

The company raised €80 million in 2024 to expand its network of smart mailboxes throughout Spain.

Factorial

Amount raised in 2024: €74.5M

Factorial is an HR software company that offers an all-in-one platform designed to streamline human resources processes for small and medium-sized businesses.

Factorial's features include time tracking, employee self-service portals, payroll automation, performance reviews, and expense management. With over 12,000 clients in more than 95 countries, Factorial has become a leading HR solution for SMEs. In 2022, the company achieved unicorn status with a $1 billion valuation following a $120 million Series C funding round.

In 2024, Factorial secured €74.5 million to further expand its presence in Europe and North America.

Would you like to write the first comment?

Login to post comments