Europe’s fintech market attracted strong capital inflows in H1 2025, reaching €5.2 billion. The UK stood out as the clear magnet for investors, securing €2.5 billion (48 per cent of the total) and leading both in deal count (74 deals, 34 per cent of the market) and in scale, with six of the ten largest transactions.

A notable aspect is the role of debt financing, accounting for 4 of the 10 largest fintech deals, indicating a growing appetite for structured, asset-backed capital, particularly in lending, payroll, and consumer finance.

Beyond the UK’s dominance, Germany and Sweden also played pivotal roles, contributing major rounds in areas such as climate-fintech, SME lending, and banking infrastructure. This broader continental strength underscores Europe’s resilience and adaptability as fintech continues to expand its footprint.

The sector’s diversity is equally notable: from climate-fintech and embedded finance to wealth management, payments, and consumer lending. Together, these deals demonstrate how fintech innovation is permeating every corner of financial services.

Here are the 10 biggest fintech deals in H1 2025.

Bees & Bears (Germany)

Amount raised in H1 2025: €500M

Bees & Bears is a Berlin-based climate fintech company dedicated to accelerating the adoption of renewable energy solutions.

Bees & Bears offers a digital platform that integrates directly into producers’ sales processes, managing workflows and data while bundling assets. Instead of paying high upfront costs, end clients can access solutions through affordable monthly leasing or contracting rates.

By combining fintech innovation with climate impact, Bees & Bears helps drive the transition to a cleaner, more resilient energy future.

In January 2025, Bees & Bears secured €500 million in funding from an undisclosed bank in the DACH region.

Carmoola (UK)

Amount raised in H1 2025: £300M

Carmoola is a London-based fintech transforming car finance with a fast, transparent, and digital-first approach.

Founded in 2021, it lets drivers check borrowing power in 60 seconds, use a virtual card to pay instantly, and choose flexible finance options like HP or PCP.

With no hidden fees, smart budgeting tools, and green incentives for EVs, Carmoola puts customers in control of their car-buying journey.

In June, Carmoola secured a £300 million ABS facility with NatWest and Chenavari, bringing total funding to over £540 million.

Wagestream (UK)

Amount raised in H1 2025: £300M

Wagestream is a B‑Corp fintech on a mission to improve everyday workers’ financial wellbeing.

Through employer partnerships, its app provides a research-backed toolkit (early access to pay, budgeting, saving, loans, coaching, and pension tools) designed to boost resilience and long-term security. Guided by a social charter and an Impact Advisory Board, Wagestream delivers fair, measurable financial benefits.

In May, Wagestream secured a £300 million debt financing facility provided by Citi.

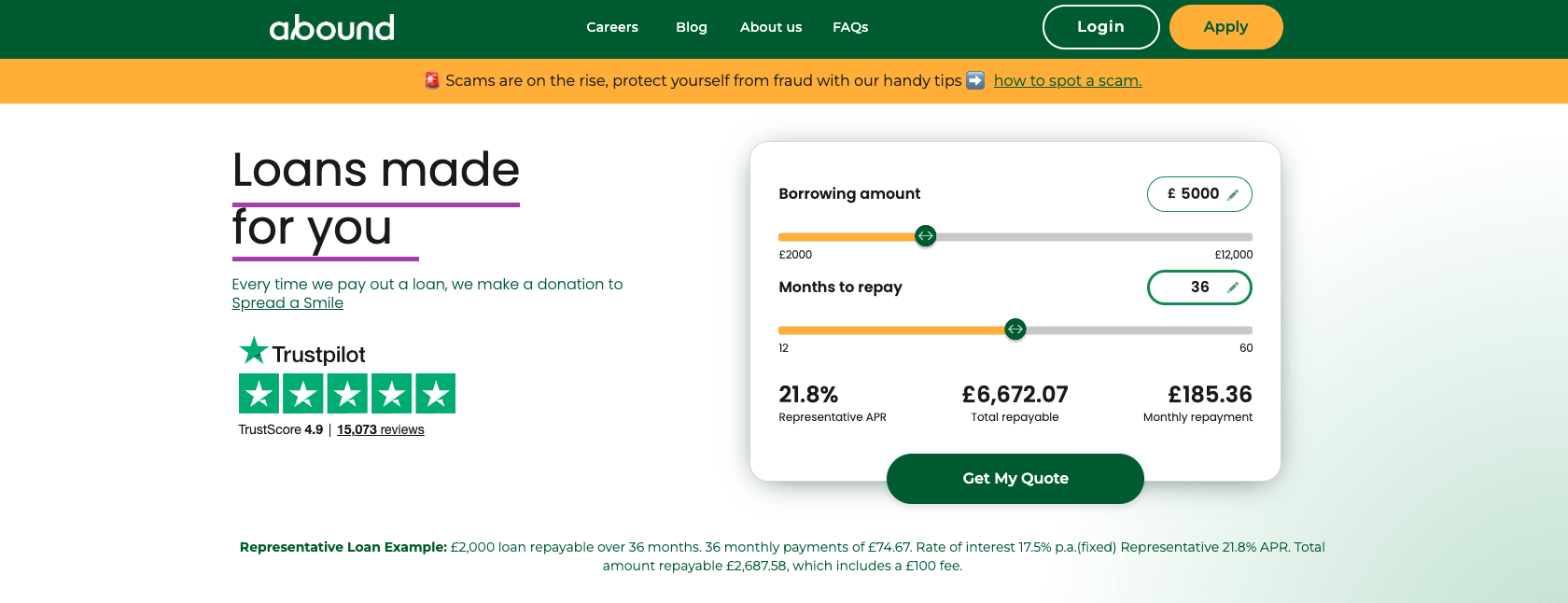

Abound (UK)

Amount raised in H1 2025: £250M

Abound is a London-based fintech redefining consumer lending by looking beyond traditional credit scores.

Powered by AI and Open Banking, its platform reviews real income and spending data to assess affordability more accurately. This approach enables Abound to offer fairer, more flexible, and accessible loans, helping customers borrow responsibly while avoiding the pitfalls of high-cost credit.

In March, Abound secured £250 million in financing from Deutsche Bank.

365 Finance (UK)

Amount raised in H1 2025: £150M

365 Finance is a London‑based alternative finance provider offering flexible, revenue‑based funding to UK SMEs.

Its flagship “Rev&U™” merchant cash advance allows quick access to finance, often within 24 hours, repaying via a small share of daily card sales. With no hidden fees, no fixed terms, and high approval rates, 365 Finance supports growing businesses across various sectors.

In February, 365 Finance secured a £150 million debt facility with Pollen Street Capital.

Dojo (UK)

Amount raised in H1 2025: $190M

Dojo, built on the Paymentsense platform, is a UK-founded payments fintech launched in 2009.

With over 1,200 team members, it supports 126,000+ businesses through tech that transforms transactions into meaningful relationships within the experience economy. Dojo prides itself on simplifying payments and enriching customer interactions.

In May, Dojo secured its first equity raise of $190 million from Vitruvian Partners.

Scalable Capital (Germany)

Amount raised in H1 2025: €155M

Scalable Capital is a Munich-based digital investment platform founded in 2014.

It offers scalable tools for investing and trading: Scalable Wealth, a low-cost, automated digital asset management service, and Scalable Broker, enabling independent trading in stocks, ETFs, funds, crypto, and derivatives.

With smart tech, intuitive design, and minimal fees, it empowers people across Europe to build their financial future.

Scalable Capital closed a financing round in June, raising €155 million.

Froda (Sweden)

Amount raised in H1 2025: €150M

Froda is a Stockholm‑based fintech, founded in 2015, that delivers fast, transparent business loans for SMEs across Europe.

Offering tailored financing, up to 5 million SEK, with no hidden fees, instant decisions, and BankID access, Froda also provides savings accounts and embedded lending solutions, empowering small businesses with accessible, fair financial support.

In February, Froda received €150 million (SEK 1.7 billion), aimed at expanding lending capabilities for small and micro-enterprises with improved terms and broader reach.

Zepz (UK)

Amount raised in H1 2025: $165

Zepz is a leading digital payments platform enabling fast, secure, and affordable money transfers across 130+ countries.

Operating in 50+ markets and supporting over 5,000 corridors, Zepz helps millions of customers send $10B+ annually, empowering global communities with greater choice and financial freedom.

In April, the company secured a $165 million debt finance package.

SolarisBank (Germany)

Amount raised in H1 2025: €140M

Solaris is a Berlin-based, fully licensed Banking-as-a-Service platform founded in 2016.

It enables businesses across Europe to effortlessly embed digital banking, such as accounts, cards, payments, lending, and KYC, into their offerings via APIs while handling all regulatory and infrastructure complexities.

Solaris secured a €140 million Series G funding round in February.

Would you like to write the first comment?

Login to post comments