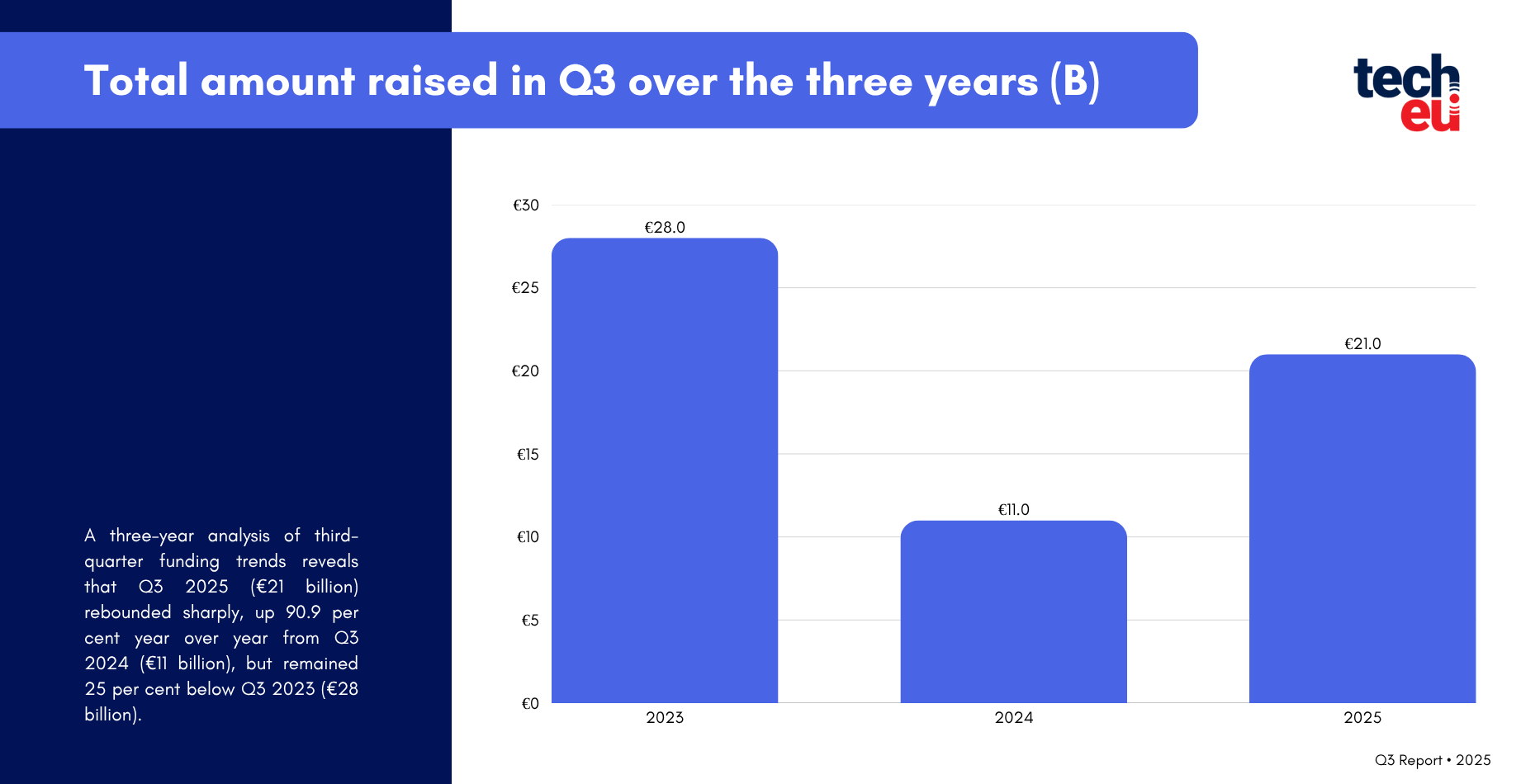

Three-year analysis of third-quarter funding trends reveals that Q3 2025 (€21 billion) rebounded sharply, up 90.9 per cent year over year from Q3 2024 (€11 billion), but remained 25 per cent below Q3 2023 (€28 billion).

Fundraising in Q3 2025

Beyond total capital raised, the number of deals continues to decline year over year: European tech startups closed 1,067 deals in Q3 2023, 981 in Q3 2024 (−8.1 per cent), and 912 in Q3 2025 (−7.0 per cent vs 2024; −14.5 per cent vs 2023), marking a steady contraction in deal activity over the past three years.

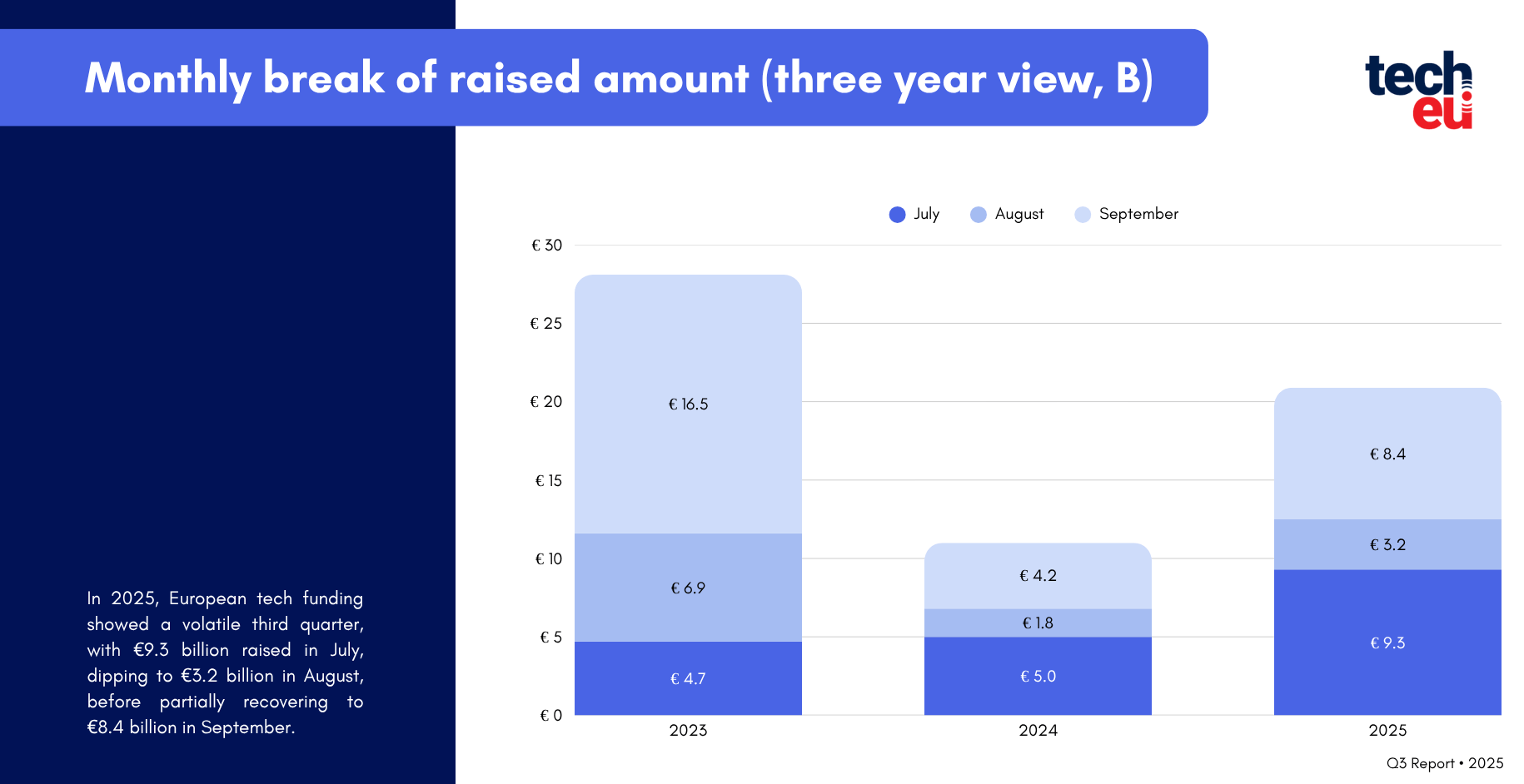

Monthly break down

Would you like to write the first comment?

Login to post comments