Europe’s new wave of spacetech companies is building a full-stack ecosystem in orbit and on the ground. Young ventures across Germany, France, the UK, Spain, Switzerland, the Baltics and beyond are developing everything from small and microlauncher rockets, reusable spaceplanes and re-entry capsules to satellite buses, thermal Earth-observation constellations and high-thrust electric propulsion systems.

Around them, specialised players are tackling ground infrastructure, space situational awareness, optical communications and “space-as-a-service” models that let customers share satellites and hosted payloads rather than build their own.

Alongside these core space firms, dual-use and space-heritage technologies, such as laser systems and CO₂ capture originally developed for space missions, are finding applications in defence, climate and critical infrastructure, underlining how Europe’s space innovation is spilling over into wider industry.

The following are the ten largest funding rounds in the European spacetech industry during the first half of 2025.

Isar Aerospace (Germany)

Amount raised in H1 2025: €150M

Isar Aerospace is a Munich-based aerospace company (founded in 2018) dedicated to providing cost-efficient, flexible launch services for small and medium satellites and constellations.

With a strongly vertically integrated approach, from design and manufacturing to launch operations, they built their two-stage liquid-fuelled rocket Spectrum almost entirely in-house.

Isar Aerospace aims to democratize access to space by offering launch services that combine flexibility, cost-effectiveness and sustainability.

In June, Isar Aerospace signed €150 million convertible bond deal to bolster sovereign European access to space.

EnduroSat (Bulgaria)

Amount raised in H1 2025: €63M

EnduroSat is a Bulgarian aerospace company founded in 2015 (headquartered in Sofia) that engineers, builds, and operates CubeSats, nanosatellites, and larger satellite platforms.

EnduroSat combines hardware development with a “Space-as-a-Service” model, providing turnkey satellite solutions, from mission design and payload integration to launch and in-orbit operations.

Leveraging a modular, software-defined satellite architecture, the company enables flexible, multi-mission satellites that drastically reduce cost, complexity and time-to-orbit.

EnduroSat raised €63 million over two rounds in the first half of the year. Later, in October, the company closed an additional round ($104 million) to expand production of advanced small satellites.

Look Up (France)

Amount raised in H1 2025: €50M

Look Up is a French space deep-tech company dedicated to space safety, security and sustainability.

Combining a global network of new-generation SORASYS ground-based radars with its SYNAPSE digital platform, Look Up delivers high-precision Space Situational Awareness and Space Domain Awareness services.

Its solutions help governments, institutions and commercial operators detect, track and protect orbital assets, ensuring safer, more sustainable space operations for future generations.

In June, Look Up raised €50 million to accelerate the deployment of its global network of space surveillance radars.

Space Forge (UK)

Amount raised in H1 2025: £22.6M

Space Forge is a space-tech company pioneering in-space manufacturing by developing reusable satellites that serve as orbital factories.

Their flagship platform, ForgeStar, leverages microgravity and the unique conditions of space to produce advanced materials, such as next-generation semiconductors and novel alloys, that are difficult or impossible to manufacture on Earth.

By combining orbital production with a return-capable, reusable satellite design, Space Forge aims to reshape industries from quantum computing to clean energy, while reducing carbon footprint and enabling a new era of sustainable, space-based manufacturing.

Space Forge raised £22.6 million in May to advance in-space manufacturing.

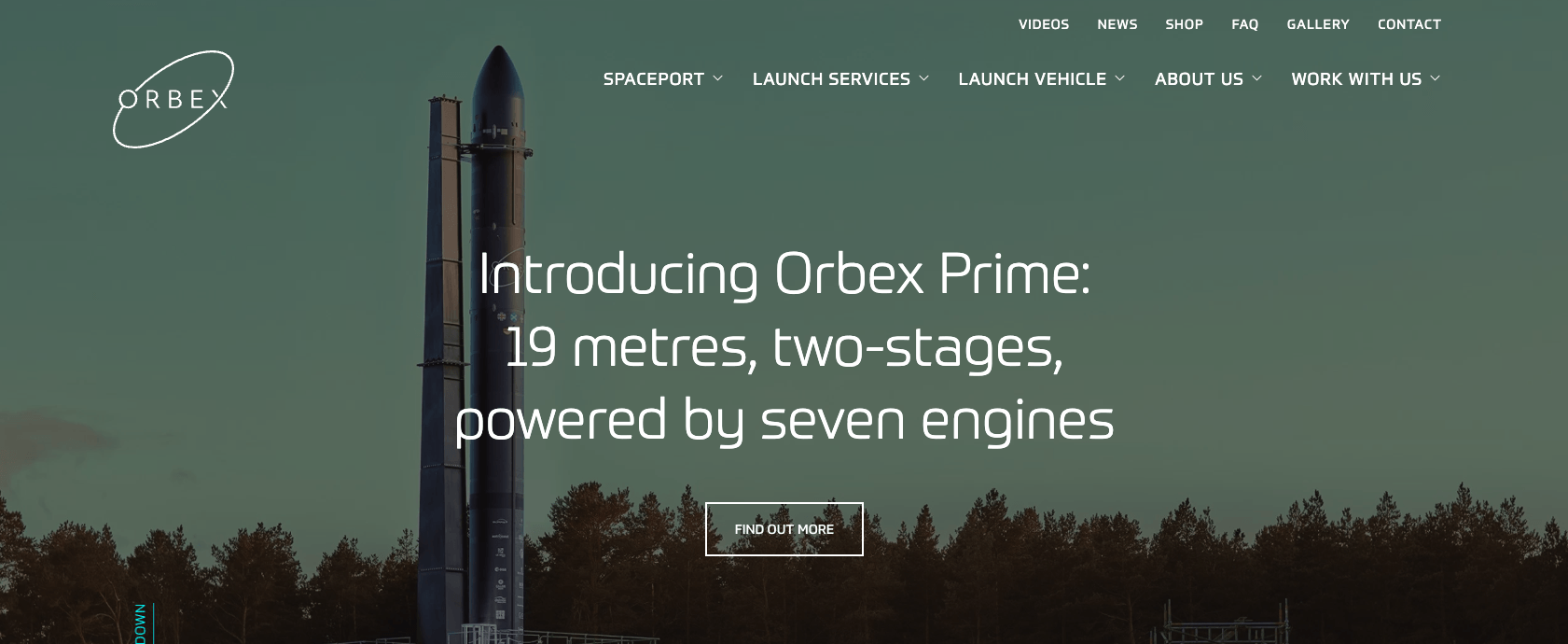

Orbex (UK)

Amount raised in H1 2025: £20M

Orbex is a UK-based aerospace company, developing low-cost, environmentally friendly orbital launch services for the small satellite market.

Its primary vehicle, Orbex Prime, is a 19-meter, two-stage microlauncher using renewable bio-fuel, and built with advanced materials like carbon-fibre and 3D-printed engines for high efficiency and lower environmental impact.

Orbex aims to help small-satellite operators access orbit affordably and sustainably, offering dedicated launch services, flexibility, and a reduced carbon footprint compared to conventional rockets.

In January, Orbex secured a £20 million direct investment from the UK government as part of a Series D fundraising round.

Skynopy (France)

Amount raised in H1 2025: €15M

Skynopy is a company that offers “Ground-Station-as-a-Service” for Low Earth Orbit satellites.

Through a hybrid global network of ground stations, combining third-party infrastructure and its own antennas, plus a cloud-native virtualised modem platform, Skynopy enables satellite operators to send commands and download mission data with high throughput, low latency, and simplified integration.

In June, Skynopy secured €15 million to build out a global network of high-throughput ground stations, enabling real-time satellite data downlink services tailored especially for Earth-observation constellations.

ATMOS (Germany)

Amount raised in H1 2025: €13.1M

ATMOS Space Cargo is a company pioneering sustainable return logistics from orbit.

Using its novel PHOENIX re-entry capsule (with an inflatable heat shield) the firm enables cost-effective, reliable Earth–Space–Earth transport of scientific payloads, experiments and in-orbit manufactured goods.

By designing lightweight, reusable capsules capable of returning cargo from microgravity, ATMOS aims to enable regular life sciences research, material science, in-orbit manufacturing and even rocket-stage return, making space more accessible and practical.

ATMOS Space Cargo received €13.1 million in funding in February, enabling the company to strengthen its engineering and testing capabilities and accelerate development of its PHOENIX 2 capsule.

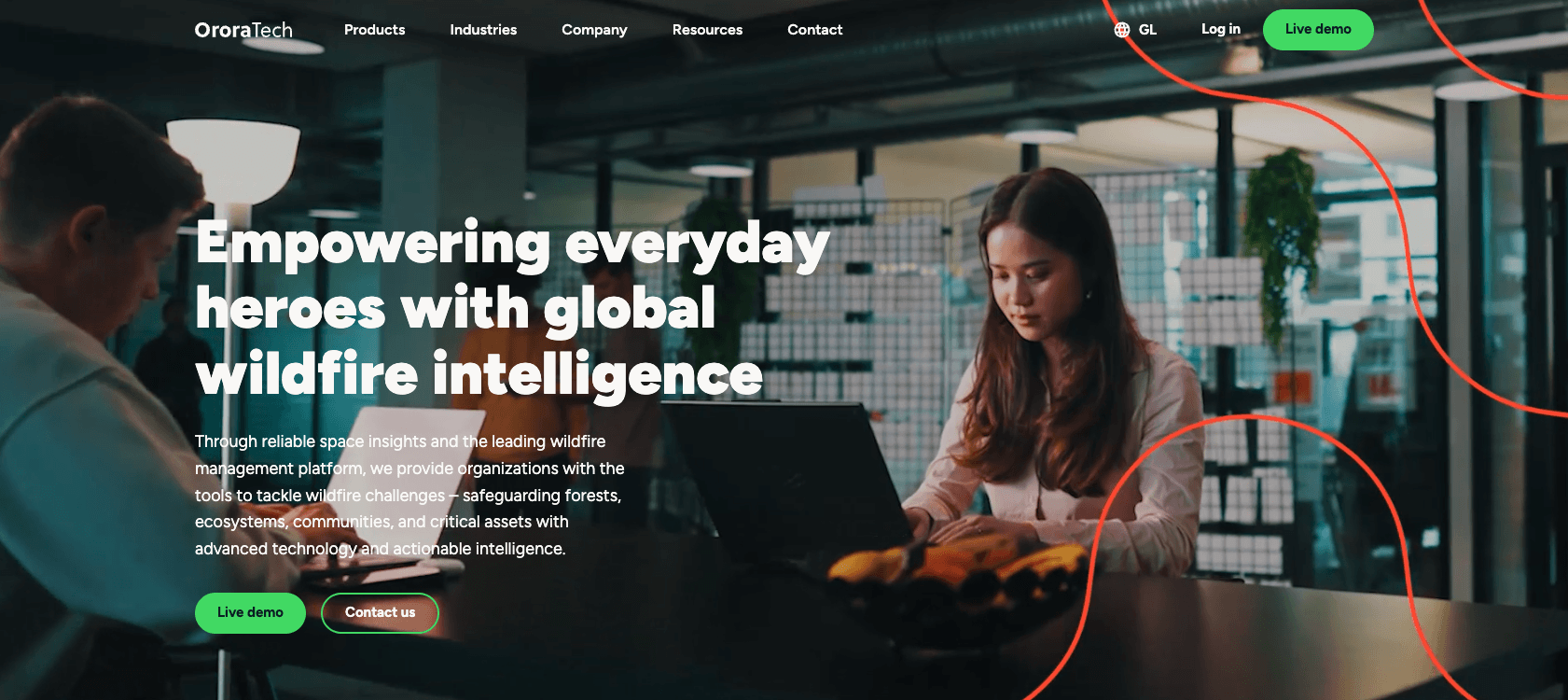

OroraTech (Germany)

Amount raised in H1 2025: €12M

OroraTech is an aerospace start-up, founded in 2018, that leverages space-based thermal sensing and AI to detect, monitor, and predict wildfires worldwide.

Through its Wildfire Solution platform, powered by data from both public satellites and OroraTech’s own infrared-equipped nanosatellite constellation, it delivers near-real-time hotspot alerts, fire-spread predictions, and post-fire burn-area analysis.

OroraTech aims to support first responders, governments, forest managers and infrastructure operators in safeguarding communities, ecosystems and assets from wildfire threats, day or night, anywhere on Earth.

In May, OroraTech raised €12 million to scale satellite-powered wildfire forecasting tech.

Magdrive (UK)

Amount raised in H1 2025: $10.5M

Magdrive is a space-tech company developing next-generation electric propulsion systems, to enable more manoeuvrable, efficient and versatile spacecraft.

Their flagship thrusters are designed for applications ranging from satellite servicing and constellation management to in-space logistics, offering compact, high-impulse propulsion without heavy fuel tanks or cryogenics.

By pushing electric propulsion toward performance levels approaching chemical rockets, with the flexibility and efficiency of electric systems, Magdrive aims to accelerate the adoption of advanced, sustainable propulsion across the satellite and space services industry.

In February, Magdrive raised $10.5 million to advance R&D on its high-thrust electric propulsion systems for satellites of all sizes, build a UK manufacturing facility, and establish a US office.

Aistech Space (Spain)

Amount raised in H1 2025: €8.5M

Aistech Space is a space tech company that builds and operates a constellation of small satellites to deliver high-resolution, high-frequency thermal and multispectral Earth-observation imagery, along with satellite-based communications, AIS/ADS-B asset tracking and remote sensing.

Using its own instruments (including a proprietary thermal-infrared telescope), Aistech Space provides geospatial intelligence for applications such as deforestation and fire-hazard monitoring, agriculture, environmental and infrastructure surveillance, and maritime/air-traffic monitoring.

In June, Aistech Space raised €8.5 million to advance its 2025–2028 strategic plan, including the deployment of the Hydra satellite constellation.

Would you like to write the first comment?

Login to post comments