European tech companies experienced a cooler investment climate in November 2025, as total funding dropped to €4.6 billion across 271 deals, down sharply from October’s €8.3 billion and also November 2024’s €5.2 billion.

Despite the slowdown, several key markets maintained strong momentum. The UK led all countries with €1.25 billion in investments, followed by Germany (€673.5 million), the Netherlands (€620.5 million), France (€553.2 million) and Switzerland (€425.8 million), underscoring a continued concentration of capital in Europe’s largest tech ecosystems.

From an industry perspective, fintech remained the most heavily funded sector with €1.2 billion, reaffirming its position as a cornerstone of European tech. Transportation (€452 million) and software (€448.2 million) also attracted substantial investor interest, reflecting ongoing demand for mobility innovation and digital transformation solutions.

Sebastian Peck, Founding Partner at KOMPAS VC, commented on the November numbers within the European tech investment landscape in our November Tech.eu Pulse, a compact version of the monthly report:

November saw massive commitment from major VCs, including Aspirity Partners closing an €875M debut fund for B2B tech champions, Sofinnova Partners securing €650M for biopharma and medtech breakthroughs, and Future Energy Ventures raising €205M for the next wave of energy innovation.

At KOMPAS VC, we see this shift reflected across the regions we invest in. Europe’s competitive edge will increasingly come from companies addressing core industrial challenges, improving productivity, driving decarbonisation, and building resilience across supply chains and critical infrastructure.

These are the technologies that will define a competitive and sustainable economy over the next decade.

For his more detailed review and more in-depth analyses of the European tech ecosystem, including industry and country performance, exit activities, and more, check out our November report.

Here are the 10 largest tech deals in Europe from November, accounting for 50 per cent of the month’s total funding.

Capital on Tap (UK)

Amount raised: £500M

Capital on Tap is a UK-based fintech company that provides small and medium-sized businesses with fast, flexible access to credit.

Through its business credit card and integrated spend-management platform, the company offers credit limits of up to £250,000, unlimited 1% cashback, no annual or foreign exchange fees, and tools for issuing virtual or employee cards.

Capital on Tap enables businesses to track expenses in real time, integrate with accounting software, and manage cash flow more efficiently. Since its launch, the company has helped over 200,000 businesses streamline their finances and access the funding needed to grow.

Capital on Tap closed “London Cards 3,” its third asset-backed securitisation (ABS), a £500 million funding facility backed by its business credit card receivables.

Picnic (Netherlands)

Amount raised: €430M

Picnic is a Dutch online supermarket that operates entirely through its mobile app, offering a full range of groceries delivered directly to customers’ homes.

Using electric delivery vehicles and data-driven route planning, the company provides efficient, low-cost, and environmentally friendly deliveries. Picnic focuses on affordability by keeping prices low, eliminating unnecessary overhead, and offering free delivery with scheduled time slots.

Picnic has secured €430 million from existing investors and is directing a significant portion of the funding toward expanding its operations in Germany.

Spotawheel (Greece)

Amount raised: €300M

Spotawheel is a digital platform for buying and leasing high-quality used cars, designed to make the process transparent, reliable, and accessible.

The company sources vehicles through a data-driven selection process and conducts comprehensive technical inspections, providing customers with detailed reports and a clear history for each car. Through its online marketplace, users can browse certified, accident-free vehicles, arrange test drives, and complete purchases or subscriptions entirely online.

Operating across several European markets, the company aims to simplify the used-car experience while ensuring trust and value for customers.

Spotawheel raised €300 million in combined debt and equity financingwhich will to expand its presence across Europe and grow its subscription fleet.

HoloSolis (France)

Amount raised: €220M

HoloSolis is a solar energy company focused on rebuilding large-scale solar PV manufacturing in Europe by producing low-carbon, high-efficiency PV cells and modules domestically.

The company is developing one of Europe’s largest solar gigafactories in Sarreguemines-Hambach, France, designed to reach an annual capacity of 5 GW, enough to supply around one million homes. Using advanced n-type TOPCon technology that avoids rare critical metals, HoloSolis aims to deliver high performance with a lower environmental footprint.

HoloSolis secured €220 million in public and private financing, with the aim of strengthening EU energy sovereignty, cutting carbon emissions, and supporting the clean energy transition.

Quantum Systems (Germany)

Amount raised: €180M

Quantum Systems is an aerospace and aerial-data intelligence company that specialises in the development, design, and production of advanced electric vertical take-off and landing (eVTOL) small unmanned aerial systems (sUAS) that combine multi-sensor data collection with AI-backed real-time processing.

Serving both commercial and defence clients, Quantum Systems delivers drone platforms used for geospatial mapping, security, public safety, humanitarian, industrial, and defence operations.

With global operations and a dual-use mandate, Quantum Systems has positioned itself as a leading provider of unmanned aerial intelligence platforms for both civilian and defence-oriented markets worldwide.

Quantum Systems raised €180 million in a Series C Extension to accelerate its AI, software, and hardware development across all domains, connected by the multi-domain mission software MOSAIC UXS.

Zilch (UK)

Amount raised: $175M

PayZilch (often known simply as “Zilch”) is a UK-based fintech company offering a flexible “buy now, pay later” payment platform that lets consumers split purchases into interest-free instalments or pay in full to earn rewards.

Through its app, users receive a virtual payment card that works globally where Visa is accepted; they can choose to pay upfront and receive up to 5 per cent cashback, or spread payments over six weeks or three months.

PayZilch is designed to offer an alternative to traditional credit cards, with no annual fees and a simpler, transparent payment model, making shopping more flexible and manageable while helping users build credit over time.

Zilch raised over $175 million in an equity and debt funding round as it eyes acquisition targets.

Flatpay (Denmark)

Amount raised: $170M

Flatpay is a fintech company that provides straightforward, flat-rate payment solutions for small and medium-sized businesses.

Its offering includes in-store card terminals, point-of-sale systems, and online payment tools, all designed to eliminate hidden fees and complex pricing structures.

By combining simple hardware, intuitive software, and reliable service, Flatpay aims to help businesses streamline transactions, reduce administrative burdens, and manage their finances more efficiently across the Nordics and beyond.

After securing $170 million in funding, Flatpay has become the country’s latest unicorn.

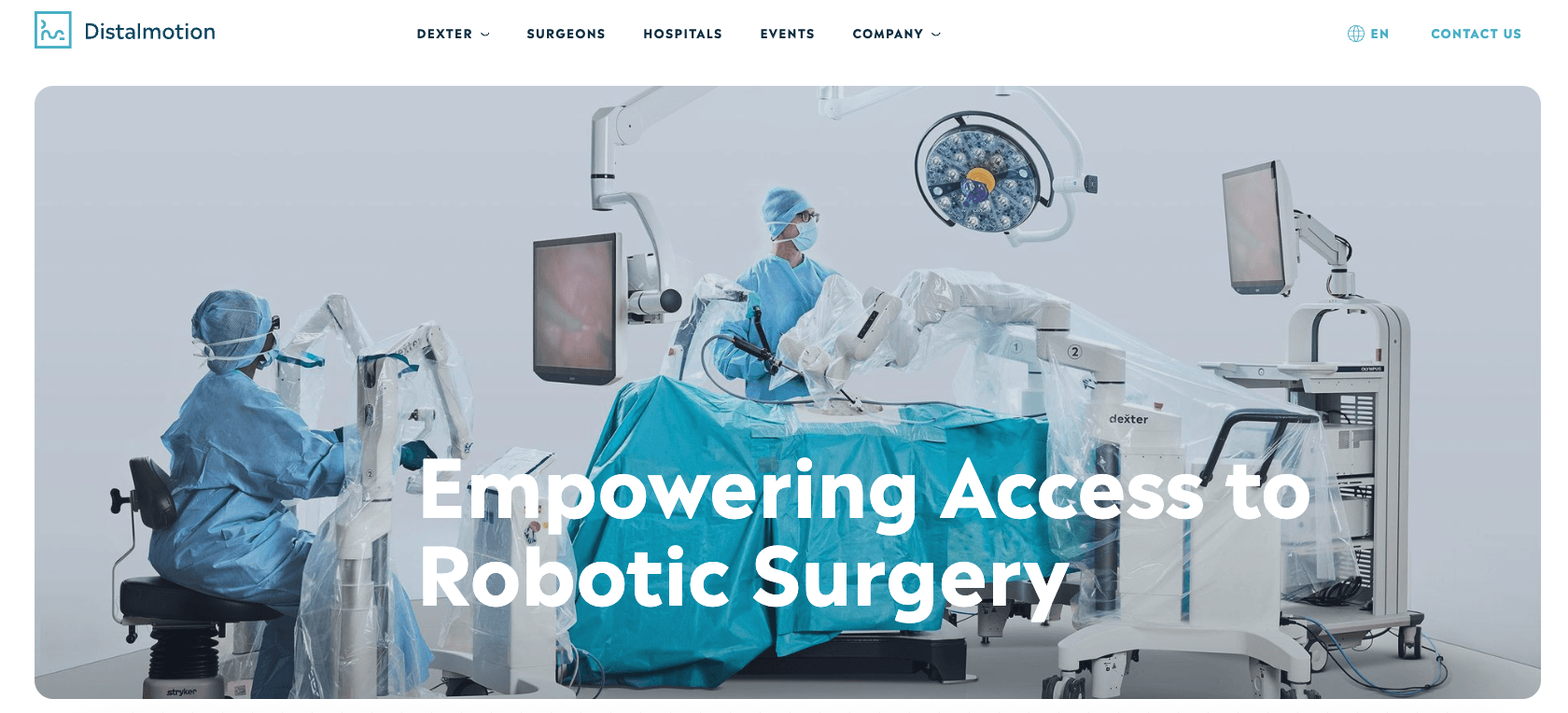

Distalmotion (Switzerland)

Amount raised: $150M

Distalmotion is a medical-technology company dedicated to expanding access to robotic-assisted surgery by simplifying its adoption for hospitals and outpatient centres worldwide.

Its flagship product, the DEXTER® Robotic Surgery System, is a compact, mobile surgical robot designed for soft-tissue procedures that integrates seamlessly into existing operating rooms without requiring structural changes.

DEXTER combines the precision and dexterity of robotic surgery with the flexibility of laparoscopic techniques, offering surgeons ergonomic, wristed instruments, a sterile console for bedside access, and an open architecture compatible with existing visualisation and laparoscopic devices.

With regulatory approvals in Europe and the United States, and a growing number of installations at hospitals and ambulatory surgery centres, Distalmotion aims to make minimally invasive, robot-assisted care more widely and affordably available.

Distalmotion closed a $150 million Series G funding round, which will be used primarily to accelerate US commercial adoption of DEXTER as well as to support ongoing clinical and product development initiatives.

Ferroelectric Memory Company (Germany)

Amount raised: €100M

Ferroelectric Memory Company (FMC) is a semiconductor firm that develops next-generation memory technologies, notably its proprietary hafnium-oxide-based solutions.

FMC’s product lineup includes DRAM+ and CACHE+ memory chips, which combine the speed of DRAM with the persistence of non-volatile storage.

Through its innovations, FMC positions itself as a European memory-tech pioneer, aiming to enable scalable, energy-efficient memory infrastructures for the next generation of AI, cloud, industrial and edge computing environments.

FMC raised €100 million to set new standards in memory chips with its highly innovative technology.

NestAI (Finland)

Amount raised: €100M

NestAI is a Finnish “physical AI” lab that builds next-generation technology for real-world, mission-critical applications.

Positioned as “a lab for the brilliant and the bold,” it focuses on solving significant human and societal problems, emphasising curiosity, boundary-pushing innovation, and a culture of humility, accountability, and creativity.

The company develops advanced AI systems for unmanned vehicles, autonomous operations, and data-centric command-and-control platforms used in areas such as logistics, inspection, security, and defence, to strengthen Europe’s technological sovereignty in critical infrastructure and defence.

NestAI has raised €100 million in new funding, which it will use to establish a physical artificial intelligence laboratory and to develop autonomous vehicles and command-and-control systems for defence applications.

Would you like to write the first comment?

Login to post comments