Zug-based Klarpay has obtained its banking license from the Swiss Financial Market Supervisory Authority (FINMA) thereby making them the first licensed fintech in Switzerland that’s focused on delivering all the banking privacy and stability that the alpine country is known for.

The company’s founders Martynas Bieliauskas and Mihkel Vitsur have contributed their own capital of $6.5 million, with Klarpay committed to working solely with e-commerce, digital entrepreneurs, and social media influencers.

Regulators are catching up to the game, and naturally, regulating. What this translates into for traditional financial institutions is that they’re often confused as quite how to classify the risks associated with online-only businesses.

"From our experience as internet entrepreneurs, established financial institutions always had a hard time understanding and evaluating our business cases," says Klarpay CEO Martynas Bieliauskas.

And even if an online company can establish a Swiss bank account, the bank that they’ve chosen to go with often simply doesn’t offer the products or services that they require.

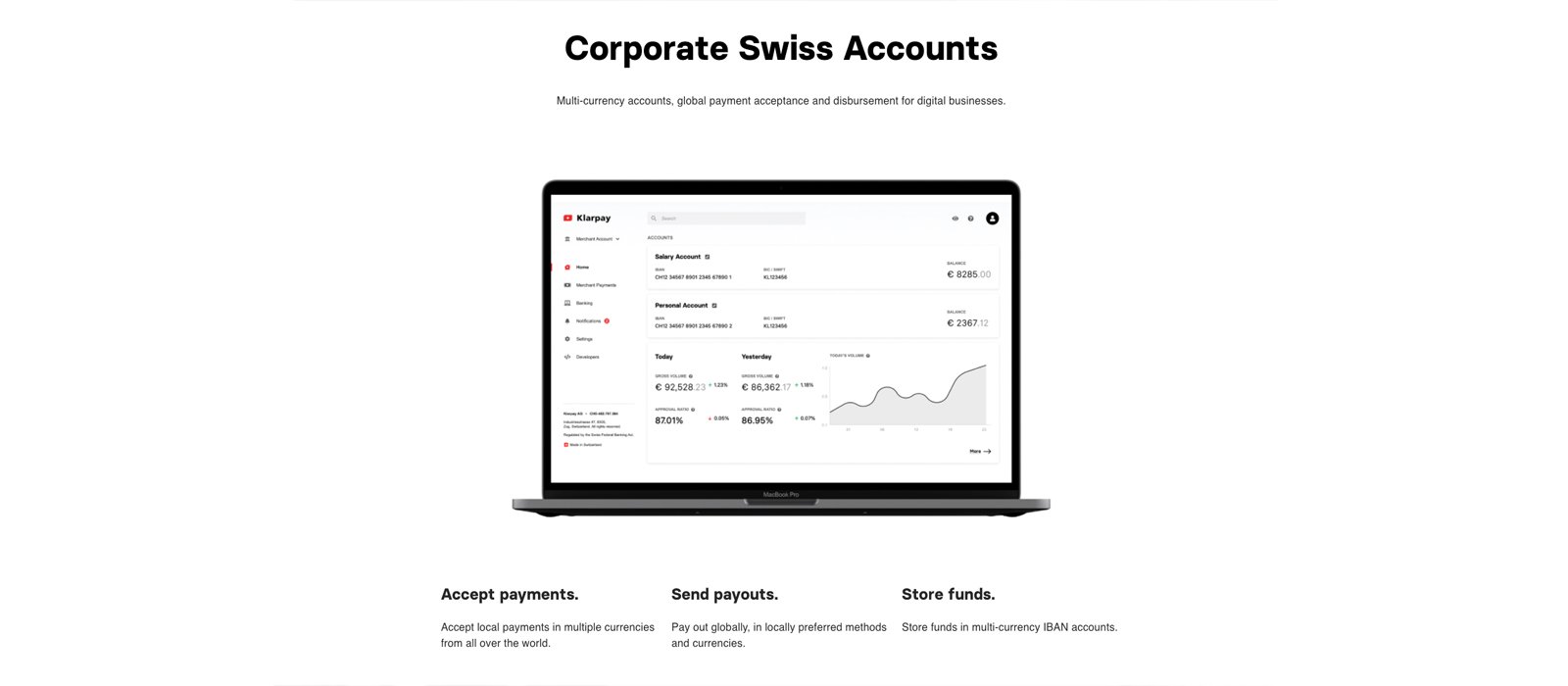

Klarpay’s raison d'être is to fill this void. They offer 436 payment acceptance methods in over 96 regions. Likewise, the firm can release funds to 169 countries in 65 local methods.

"We don't want to invent anything new. Reliable solutions are out there. By bundling the best of breed payment products, we can offer these as an all-in-one package to online businesses," adds Bieliauskas.

Klarpay is now licensed and will open the shop doors in the second half of this year.

Would you like to write the first comment?

Login to post comments