Editor’s note: This is a sponsored article, which means it is independently written by our editorial team but financially supported by another organisation, in this case, Infoshare. If you would like to learn more about sponsored posts on tech.eu, read this and contact us if you are interested in partnering with us.

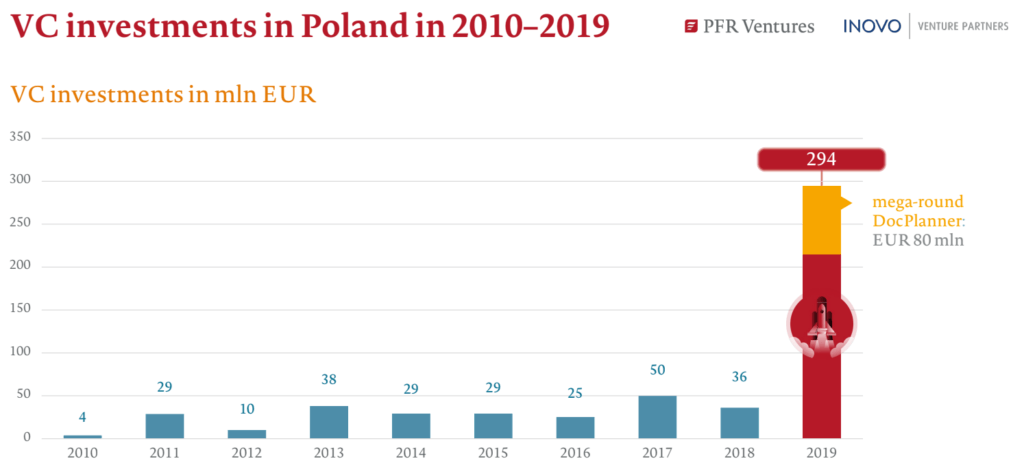

The region of Central and Eastern Europe (CEE) has long been mostly overlooked by well-established European and US-based VCs — but it isn't anymore, it seems. If we had to pick up one example market to look at, we'd make it Poland: in 2019, the investment in the country's startups had grown eight times (!) year-on-year to reach some €294 million — more than in the nine years before that, combined.

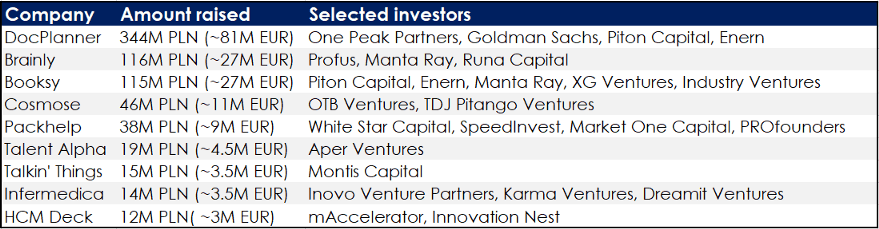

Even without the €80 million mega-round that Poland's DocPlanner raised last year, the numbers suggest that the Polish startup ecosystem could be entering an explosive growth phase.

The funding data, collected and presented by PFR Ventures and INOVO Venture Partners, shows a total of 269 transactions executed last year. The money had come from 85 different VC funds, both Polish and international.

It's not very surprising that the local funds were responsible for a vast majority of deals — 254 out of 269, — which, however, accounted only for 37 percent of the transaction value. Simply speaking, international funds had invested much larger sums in much fewer later-stage startups.

“Poland is one of the fastest-growing countries in Europe and coupled with fantastic AI/ML talent to build disruptive enterprises, the local consumer market has sufficient scale to build large businesses across CEE and Western Europe,” said Aman Ghei, principal at Finch Capital. “We believe in investing in founders and teams.

“Over the last couple of years, we have seen a generational shift in the types of entrepreneurs coming from Poland with more emphasis on creating disruptive companies vs lifestyle companies. This is one of the main reasons we have backed Symmetrical and PerfOps. In terms of FinTech, Poland has one of the most sophisticated banking infrastructures in Europe, with 20+ banks having large portfolios and market values of $1b+. This means a mature ecosystem exist when disruptive financial services need to be built on top of existing infrastructure.”

What gives an even deeper insight into what's happening in Poland is that as many as 225 funding deals came from public-private funds. One of the long-time criticisms of the Polish startup ecosystem has been that the amount of public money available has all but killed the motivation in entrepreneurs.

With the new numbers in, it could be that the strategy to nurture and support as many founders and companies as possible has somewhat worked.

“The positive impact of public funds on market development has already been noted in previous years, especially in 2017, when BRIdge program started to invest, but it is first time that we can also see more transactions for more than PLN 1 million,” said Przemysław Kurczewski, Deputy Director of the National Centre for Research and Development.

Growing attention

The growing numbers of well-funded successful startups have already started turning heads across Europe and globally.

“Startup chapter at Infoshare, the biggest startup and tech event in the CEE region, started in 2014, and for the first few years almost all Startup Contest applications came from Polish projects,” said Greg Borowski, Infoshare CEO. “It was understandable when you consider the sources of cash available for startups on our domestic market and the origin of active investors.

“Something changed in 2018, when only 22 percent out of almost 500 Startup Contest applications were Polish. The rest came from the whole Europe and beyond, which might be perceived as the first signal of change. The trend was maintained in 2019, we got 601 forms with less than one-fourth coming from startups incorporated in Poland. What is more, the number of non-Polish investors attending Infoshare since 2018 has also skyrocketed, which can be connected with their increased interest in the region.

“For the 2020 edition, most of the already confirmed funds are those interested in the CEE, including Poland, but not necessarily located here with their daily activities. It is also worth to add that year by year Infoshare hosts more mature projects (early and growth stage). This opens doors for different stage investors to optimise their deal flow schedule and by coming to Gdansk get in one place for two days a large number of potential investments to check.”

Local VC also expect to see more deals in the following years.

“round 25 percent of Seed stage companies manage to raise their Series A rounds, and 12% continue to raise Series B,” Tomasz Swieboda, managing partner at Inovo wrote in a Medium post. “Using the above numbers, this should translate into around 61 Series A rounds and roughly 3–4 Series B rounds in 2020/21. Such a situation is not only beneficial for us, as we invest primarily in the Series A stage, but also to the entire ecosystem, as the average Series A round is at 10–12M PLN, meaning up to 732M PLN of market value from this segment alone!”

…Four years ago, I wrote an overview of the Polish startup ecosystem based on a series of interviews recorded in Warsaw. One of the issues voiced by entrepreneurs was that there were “not many big funds that could lead a Series A or Series B round.” It seems like the effort of all parts of the ecosystem to solve this has paid off — and the startups and VCs in Poland have now exciting future lying ahead of them, with more and more interested parties coming from across the continent.

To see the change with your own eyes, join the Infoshare conference, held on September 23—24 in Gdansk, Poland. The event gathers more than 6,000 people — entrepreneurs, investors, media, and ecosystem players, — and everyone can find something for themselves.

Would you like to write the first comment?

Login to post comments