Can you hear that sound? It’s the European and Israeli tech ecosystems accelerating. Yes, that's right, accelerating.

While conversations over the past few months, especially in the US, have focused on a slowdown in the investment market, data compiled by tech.eu for the first two months of 2016 shows that the European tech scene is, for now, in very good shape.

In January and February of this year, European and Israeli technology companies raised a combined €2.6 billion across 527 deals, which represents a year-on-year increase of 34% and 158%, respectively.

98 of the 527 deals did not disclose the amount of funding being raised, meaning that the total amount that has been deployed in Europe to date is actually larger than €2.6 billion.

To put these figures in context, in 2015 there were 1,517 investments in Europe, which means that in just two months fundraising activity in the old continent has reached one third of last year’s total. The €2.6 billion raised by startups in the first two months of 2016 (at least, see above) is similar to the total amount for Q1 2015 (€2.8 billion).

According to Mattermark’s Danielle Morrill, the same is happening overseas, as deal volume and capital deployment in the US in early 2016 are up 4% and 7%, respectively.

As we noted in January, Europe continued to see a significant uplift at the early stage. In January and February 2016, there were 316 investments of up to €5 million, almost three times as many as in the same period last year. The biggest increase, as visible in the graph above, took place at the pre-seed stage (rounds smaller than €500,000) and in funding rounds of between €1 million to €5 million.

It’s also worth noting that, so far this year, we’ve seen six times as many rounds in the €5 million to €10 million bracket (56 vs. 9) and 11 more deals greater than €20 million (34 vs. 23), demonstrating that significant growth is happening across all stages.

Location-wise, France continues to lead the continent in terms of investments, with 97 deals in just two months and a +593% increase compared to the same period a year ago. The UK (86), Germany (69), Sweden (60) and Israel (46) rounded the top 5.

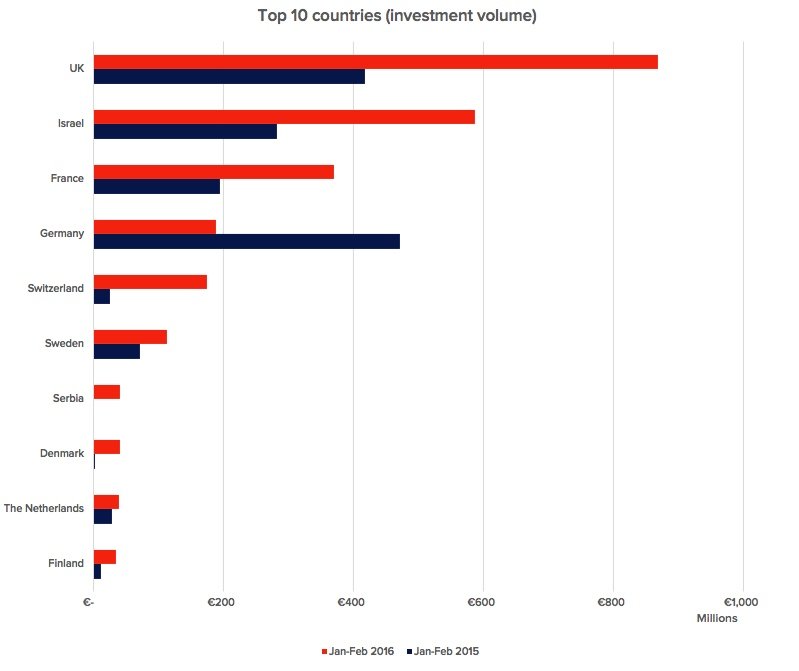

Things change quite a bit when the focus is on the total amount raised in each of the markets, as the UK was once again number one with €869 million raised so far in 2016 (+108% YoY), followed by Israel (€587 million), France (€370 million) and Germany (€189 million).

It’s also worth highlighting that Germany’s €189 million represents a YoY decrease of 75%, mostly caused by large rounds from Kreditech, HelloFresh and Delivery Hero in early 2015.

Other notable appearances in the top 10 countries are Switzerland (€175 million, +587% YoY) and Denmark (€40 million, +1,436% YoY), thanks to MindMaze’s €91 million round and Vivino’s €22.8 million, respectively.

These were the top 20 funding rounds in Europe and Israel in January and February:

FinTech continues to be the favourite vertical for investors, as financial technology companies were responsible for 66 funding deals in January and February, almost 50% of the total amount of FinTech deals in 2015 (142).

Hardware, marketplace, enterprise SaaS and e-commerce were the four other verticals in Europe’s top 5.

Volume-wise, security technology companies have raised the most funding in 2016, with €314 million. As many as 8 different security companies closed deals greater than €10 million in the first two months of the year; unsurprisingly, 6 were based in Israel.

FinTech, health and travel companies also saw investment volumes greater than €200 million in January and February.

Next month we'll publish two new reports analysing European funding and M&A activity in Q1 2016.

Also read:

European Tech Funding Report 2015

European Tech Exits Report 2015

Photo courtesy of Pixabay / WikiImages

Would you like to write the first comment?

Login to post comments