Huddle is a cloud-based, enterprise-grade project management and content collaboration software maker with offices in the UK - where it as founded in 2006 - and the United States.

According to its website, Huddle is used by more than 100,000 organizations worldwide, including mammoth companies like SEGA, AKQA, Unilever, P&G and KIA Motors, to "securely manage projects, share files and collaborate with people inside and outside of their business".

tech.eu had a chat with co-founder Andy McLoughlin (pictured above) and asked: how far can he and its soon 200+ employees take Huddle?

Ivo Spigel: Hi Andy, let's jump right into it. As far as we can gather, Huddle seems to be on a stable growth trajectory. We saw you mentioning elsewhere that the company might hit 200 employees this year. Are you going to make that?

Andy McLoughlin: No, not yet. The plan is to be at about that number in the next quarter, and we're currently about 175 people. We are hiring and have a load of open positions though!

Besides London and Silicon Valley, you also have staff in New York and Washington, correct?

Yes. Right now we have a presence in Washington, as well as three key offices in London, San Francisco and New York.

You're working with both the UK and US governments, so I'm guessing that the Washington presence is related to your relationships with the US government?

That's right, yes! Where we stand with the US government is that we officially launched our service for the US government in May of this year.

Back in September last year, we signed a strategic investment and technology development agreement with In-Q-Tel (IQT), which is commonly known as the venture arm of the CIA.

As a result, Huddle is being used by IQT customer agencies, the Department of Homeland Security Science and Technology Directorate (DHS S&T) and National Geospatial-Intelligence Agency (NGA).

Huddle's US government users also include the likes of NASA and the Office of the Secretary of Defense.

So, in other words, everybody using Huddle should be really, really worried by now?

Well ...

Just kidding! But still ...

Yeah... The instance we have for those guys is a completely separate instance. In the UK, we also have a private instance of Huddle – Huddle IL3 – which is hosted on FCO Services’ Government Secure Application Environment cloud infrastructure.

This enables teams across the government to access and distribute content up to IL3 – restricted- with the appropriate security measures in place. The public instance of Huddle is used by governments to share and access content up to and including IL2 – protected level - as well as our other users across the world.

Ok, but I'm sure there are still plenty of conspiracy theories floating around.

Umm, yeah! I think somebody made that exact joke a while ago!

What are some of the other key metrics that you consider as being central to your business and would be willing to share?

The other main metric we talk about is just the number of businesses on the platform. Right now, Huddle has more than 100,000 organizations using the Huddle platform to share and collaborate.

Anything else? Is the number of the companies your main metric? Or can you share some usage stats with us?

It is. The number of companies is a fairly good proxy for the number of users and then for the amount of usage. The last time I looked at these metrics in great detail was probably some time ago, when we were raising the last round.

There is huge acceleration in both the revenue that the company is making, as well as the amount of content and activity going on on the platform.

In the interest of quantifying that growth, what does this mean in month-over-month or quarter-over-quarter revenue increase? What is the main timeframe that you measure your growth by? Are you doubling, tripling ...?

Huddle is targeting revenue growth of more than 100 percent year-on-year. We are putting a lot of our focus on mid-market and enterprise customers, and those sectors are going to grow by a factor of four or five this year.

Growth is really good, really steady. I think it's great for a company of our age to see growth in triple digits.

How does that reflect on your profitability in the short term? Taking into account the investment you've received and the runway you have left, are you profitable and if not, how close are you to break-even?

We don't discuss financials I'm afraid ...

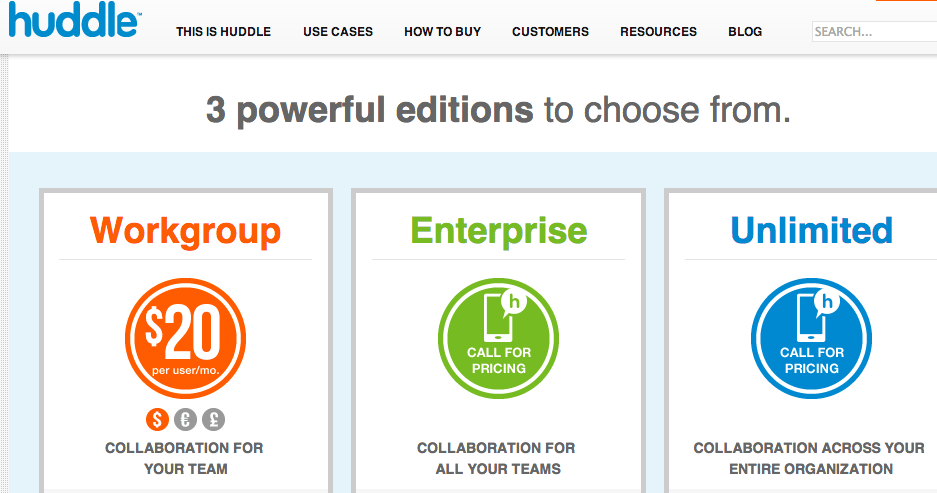

One can try. This is a pretty basic question, but I need to ask it anyway, what is your basic revenue structure? Is it per seat, per company?

It's per seat. Like a lot of SaaS businesses, we started off with a freemium, per-company model where you bought it and it was a flat cost to your company. It was really all about making sure you have your product-market-pricing fit correct.

We found that businesses that were best suited to Huddle were bigger companies. You know, because of the support we provided and because of the complexity of the content management and the workflow. Small companies can get by with tools that were cheaper, and what we found was that it was the bigger companies who really connected with Huddle, and bigger companies expect to buy software in a different way than small companies.

So what we did was move away from the freemium „bronze to gold“ model to a per-user / per-month pricing model. Which meant that it's still very scalable: a small company can buy Huddle and not pay too much, but then it allows us to scale out when we are selling thousands and thousands of seats.

I assume you have different price ranges for clients of various sizes?

We are actually going to be announcing a new pricing structure in the next month or so. Currently, it's pretty simple, it's $20 per user, per month, and we can provide discounts at scale.

So, aside from the discounts and the volume, it's essentially a fairly straightforward single price per user, per month model?

Correct.

Is the plan to make it more complicated?

No, no, no. It's going to stay as simple as possible!

When you talk about seeing that the bigger, more complex enterprise are a more natural fit, I'm guessing that this isn't something that you started out with, by design? I'm assuming it's something that evolved over time?

It is.

When you were starting out back in 2006, did you think you were making software that would be used by Fortune 500 companies?

I think we always knew that it's going to be a tool which would be attractive to larger businesses, we just didn't know how much larger. The very small end of SMEs has traditionally been pretty well-served by Web / SaaS companies while there haven't been great services in the mid-market and upwards.

What we found was that it's pretty hard to sell into the enterprise from day one. You need to have relevant customers, you need to have good case studies.

Frankly, having small businesses on the platform is a great way to validate what you're building. We saw it as part of the journey. What happened was that we got dragged up into the bigger businesses pretty quickly - within a few months of going live we had some huge organizations using Huddle, all of whom wanted slightly more flexible means to pay than just a credit card, or were looking for a licensing model that was going to fit better with their business.

Neither Alastair (Mitchell, Huddle co-founder and CEO) or myself or anyone else had any real experience selling into government, but what we found very quickly was that the tool that we built solved many of the issues faced by government organizations – supporting an increasily mobile workforce and working with consultants and other partners across the firewall.

Each government department is almost like their own mini company, they have their own IT, they have their own firewall, they probbably have their own SharePoint instance.

A mini fiefdom.

Exactly. That's right! What we found was that as soon as they needed to collaborate with another government department, they couldn't use their SharePoint because it doesn't work outside the firewall, they couldn't use e-mail because email is just, you know, a great communication tool but a terrible collaboration tool.

We've all been in that position where you need to share a document with ten people, you send it by email, you get ten versions back and you spend the next three days trying to get the damn thing together.

I recognize the pain.

So, for them, a tool that had all of the version control and auditing of something like SharePoint but which was available in the cloud and could be spun up in seconds rather than days was actually really attractive.

It happened really quickly - we got this great base of usage inside government which has just grown and grown and grown! The government is now probably the second or third largest vertical we're selling into.

What are the first two?

I'd say that marketing / brands and professional services are probably still the largest. The activities they are doing there are generally very similar.

If you're an agency, you're using it to collaborate with different customers and if you're a brand, you're using it to collaborate with your different agencies. What's really nice is we see this kind of network effect where an agency will be using it with a bunch of their clients, they invite one of their clients into it and the client says "Hey, this is kinda cool! We should be using this to work with our PR agency in a different country or with an agency that produces video content!“

Then the company becomes a client and they spin out their work with other agencies and they don't need to worry about different user names and passwords and different URLs because it's a kind of multi-tenant, SaaS solution - they see everything in one place.

Quite often in enterprise scenarios in large companies and governments, there is a technology provider such as Microsoft or SAP or Salesforce, and then often there are partners, companies that are specialists in doing the implementation on the ground. That collides slightly with the cloud model, so how do you work that out?

I mean, do you have a consulting practice or do you have partners that do that, or do you rely on the end users having their own teams implementing Huddle?

You know, it really depends on the customer. Some customers, especially the very small guys, they just want to pick it up and get going with it.

We've built Huddle to be pretty simple - any user can get up and run with it pretty quickly. Larger companies, when they are looking for best practices, when they want to get a large number of people up and running, they engage our Customer Success team.

This is very similar to Salesforce's "customer for life“ team. The CS guys, their entire role is to get the customer up and running. They understand best practices, they can help users get up and running, they can help users with any questions they have, they can really promote usage within the business. Frankly, for us, the more usage we see in a business, the more successful the company would be, the better the lifetime value of that customer for us.

So, you are primarily creating the consulting or services capacity within the company itself. You aren't creating an ecosystem of resellers and implementation partners – that doesn't seem to be your primary focus?

We do have a partner ecosystem. These partners could be anything from strategic partners like TIBCO, they could be partners who are integrating Huddle into their platform – an example there would be RightSignature, Fileboard, Otixo, SkySync - where guys who have great apps hook them into other storage ecosystems.

Then we have partners who are providing consultancy, who are providing new business referrals - those are our commercial partners. So, we do have partners who do that, and they get involved with the customers they bring to us.

In government especially, we actually have a partner in the UK who can help and assist with rollouts as well. We really just want to help the customers to be successful so if they want to use the partners to help them with the rollout, that’s fine. If they want us to do it, that’s fine as well. If they want to do it themselves, that’s great too.

Quick question about the physical deployment. I would guess you have multiple data centers - are there customers who want to have Huddle on premise?

We get asked about this reasonably often, as you'd expect. We feel that in 99,9% of cases, the Huddle's secure public cloud is more than adequate for the majority customer usage. We have great security. We've invested huge amounts of money and time in stuff like ISO 27001 compliance, encryption, a strong SSL between the client and server, various other bits and pieces.

Where we will consider on-prem deployments is where there are enough users to really warrant that. Government is a great example of that, where you can see a path to tens or hundreds of thousands of users from one single service.

The large banks might be another case where they simply can’t deploy stuff on the public cloud because of regulation issues.

I’d like to keep as many of our customers on the public cloud as possible, but I think you have to be realistic and know that there are going to be times – due to specific industry regulations, for example - when you can’t do that.

We’re open to having these kinds of conversations, but the public cloud for us is where we really want to try and drive most of our customers.

Tell me a little bit about how you and Alastair work together. With most of the companies that I’ve talked to, there is usually a founder, one person that is driving the company.

You guys started together from the beginning, you decided early on that you would both invest personally in the early stages of the company, in equal amounts. How does that work today? Are you based in the same place? How do you collaborate efficiently?

Sure. In the very early days, the responsibility split out quite easily, Alastair was the commercial and operations guy, responsible for driving sales, customer service and marketing, and I looked after product and technology, everything on that side of the house.

Now, as we've grown the team around us we've been able to become a bit more specialised.

We hired a CTO in 2008, who looks after technology, and our first product director in 2009. In 2010., I moved out to the US to begin to grow our US presence, getting Huddle known, and to build a team out here as well.

Alastair stayed in the UK managing the operations there and I came out to the new frontier to get set up here. I was still overseeing the product strategy, partners and alliances because most of them were based here on the West Coast, and Alastair was running the shop in the UK.

Our VCs have always said that they wanted both founders on the ground, on the West Coast, simply because, if we eventually sell it's probably going to be here, if we eventually float, it's probably going to be in the US market – but this obviously depends on what is best for us at the time.

Frankly, if you're building a big global business, this is really the center of the Earth for the type of thing that we are doing. Alastair made the move out here at the end of last December. So now both founders are here, we have our CMO out here.

Our VP of Sales, our VP of Human Resources and our VP of Product and Technology are still based in London. Really, the UK remains the engine room and hub for the technical side of the business. With Alastair now in San Francisco too, I no longer have to be the "senior man in the office“ in San Francisco - he can do a lot of that stuff as well.

We're kind of feeling our way a little bit now, given he's only been out here for about three months, how the roles work. I still have a huge focus on product and technology. I need to bridge the gap between the commercial team here in San Francisco and product guys, the technology guys in London. I still own all of our alliances and partnerships.

Alastair and I work very closely together on building out the profile, meeting investors should we wish to raise another round, meeting with the banks if at some point we should decide to go public... in general just trying to become as well-known in the US as we are in the UK.

How far do you feel that you've come along in that sense? Huddle and both of you are something of a shining example for many in the European tech scene. Do you feel that Huddle as a brand is as established in the US as you'd like it to be? How far along are you on that path?

There's still a way to go. Huddle in the US today is probably a lot like Huddle was in the UK several years ago. People in our industry know us pretty well, we're pretty well known by VCs but if you stopped the man in the street, even in the general startup industry, and mentioned "Huddle“ – he might know the name, but he probably wouldn't know exactly what we do.

Our aim is that we are as well-known out here as we are in the UK and Europe so that when people say "Huddle“ out here they'd say exactly the same thing: that we're a shining example of how startups can really perform well.

We've still got some way until we get to that but we're certainly on the right track. We've been making terrific hires in the last few months. We hired a head of marketing, Chris Boorman; he was the CMO of Informatica which is a big, publicly-traded software company. Our VP sales Simon ran the UK and Ireland operation for Salesforce up until recently. I think that we have now the team to really achieve those goals.

And I’m sure you were able to help Alastair pick an apartment and a neighbourhood in San Francisco?

This is another point where we’re a little bit different. My girlfriend and I, we’re both city people, we like doing all the stuff that being in the city affords. You know - going to great bars and restaurants, seeing our friends.

Alastair has a young family with two kids. He always wanted to live by the water, so he has ended up living in the North Bay in a place called Tiburon which is absolutely beautiful. It’s gorgeous, he has this amazing view from his garden which is straight on the water, you can hear seals barking in the morning, but it’s a bit of a trek to get back to San Francisco and if he misses a ferry at 8pm then he has to get a very expensive cab ride home while I can stay up until all hours at the weekend and be home in ten minutes from almost anywhere in the city.

But neither of you are in Silicon Valley in the strict sense?

No, neither of us are in the Valley. Although Alastair is geographically further away, his existence is more similar to living in the Valley. Our office is in the middle of San Francisco. Most of our staff live in San Francisco. There has been a big change in the last three years where most of the hot startups on the West Coast are based in San Francisco rather in Silicon Valley.

Assume you are talking to a hot startup that's really found a fantastic niche, built disruptive technology, and they're based either out of London, or maybe Berlin, or maybe even Tallinn, and these guys are doing really, really well and find themselves in a dilemma ... do they need to move to the States, do they need to immediately go the Valley and should they even target the US as their primary market.

Maybe they're thinking about Asia or other markets. The question for startups that I keep encountering over and over again is, is it almost a necessity to go to the States?

I get to speak to a lot of different startups on exactly this topic. I've invested in a lot of European companies, I think I've made some 20+ angel investments now, and I think about fourteen of them are European companies. This is something that I talk about a lot with them, do they need to be here, and if they do, where in the US they should come to?

I think for a lot of companies being in the US is a bit like a badge of honour. You know, they don’t really know why they need it, but they think they do.

Everybody says they do!

My advice to them is, just be very, very frank with yourself. Do you actually need to be out here? Because not every company does. If you’re building a broad consumer technology or a broad enterprise technology then this is the best place in the world to be because this is where the great companies are.

I think, though, if you’re building a technology for specific markets, the music industry, or the fashion industry, or the finance industry, then San Francisco certainly isn’t the best place because those industries don’t really exist here right now.

If you’re focused on the Asian market, then no, you absolutely don't need to be here. And more people do seem to realize that adding an extra office doesn’t make things twice as hard, it makes things ten times as hard. Because of all the communication which seems to happen so easily when you’re all in one space, you really have to work at it.

And so, you have to have a damn good reason for even considering opening a second space. And if you do have a good reason to do it, then make sure that you’re doing it in the right place.

Back to your team. In terms of the percentage of people, are you half-and-half US/UK or are most of the people still in the UK?

We have about two thirds of our people based in London. All of our operations, finance and HR is based there. Our engineering and product is based there, our European sales and account management is based there.

In the US, we simply split it down by geography. So East Coast sales are based in New York and West Coast and Central sales, business development, strategy and US account management and the founding team is based in San Francisco.

So like I described it before, San Francisco is a kind of outward-facing face of the company because this is where the founders are, while the engine room of the business is in London.

Tell us about your investors, in terms of how they came together?

For each round you've raised, you had the previous investors participate. Eden Ventures took part in all three rounds, Matrix Partners came in at the B and also the C round ... Can you comment at least briefly on the various funds that are your partners, what was the relationship, and what was the process – particularly for the last, bigger round?

The very first round we raised, we met with a lot of London VCs. Eden was a reasonably young firm with a big vision. We fit well in their portfolio. They didn’t really have a huge portfolio at that time, so there was no worry about competition. They have been great supporters all the way trough.

When we were raising the B round they made a lot of introductions to a lot of different VCs in the US and Europe. And what we’ve seen is, over the last two years and as this market has become super hot, there has been a lot of investment in a lot of companies who are directly competitive with Huddle.

Matrix Partners was one of probably four or five US VCs that we received a term sheet from, and I think they were probably the last company we met but the first to give us a term sheet. We were really impressed by how quickly they moved and how honest they were. Josh Hannah, who is the partner from Matrix, is just an absolute legend - really smart, really gets our business, really supportive.

Our C round was primarily driven by the US contacts that Josh provided. Companies that he enjoys working with, companies that he sits on the board of other businesses with ... He has a hit list of probably ten VCs that we think are fantastic that aren't invested significantly in competitive businesses.

He told us "You guys meet them, go and see what you think and let us know“. So we met them, some we liked, some we didn’t like. We felt the same way about Jafco Ventures - who led the C round - as we did about Matrix and Eden. They were a really solid firm with a great portfolio, and really, really just got what we were trying to build.

We also took money from DAG Ventures, which is a really interesting fund. They have a follow model. They have seven or eight VCs that they will follow - they see them as being seven or eight best VCs in the world. Matrix is one of those firms, and if Matrix has invested then DAG will generally take a very strong look at investing in the follow-on round.

We took money from In-Q-Tel as well, because of the government connection. And finally, we took money from a couple of prominent angels – Herb Madan and Subrah Iyar.

Subrah is the founder and CEO of WebEx, which went public and was eventually acquired by Cisco. He likes our business; he sees a lot of similarities between Huddle and where he wants to take WebEx and so it’s been great having him on board as well. A super nice guy, really well connected, he’s on the phone whenever we want him.

There’s one or two more points I want to address, particularly about your personal angel investment work. You mentioned quite a number of different projects. How do you select them, or do they approach you? If somebody wants to pitch Andy McLoughlin ,who has so much on his plate every day... How do you go about looking at potential angel investments?

What we don’t see enough of are European entrepreneurs putting money back into the ecosystem the same way you see it out here on the West Coast. In the UK, it’s reasonably rare for an entrepreneur who’s had a great exit or made money along the way, to really support other businesses. They make their money, they buy a big house and then you never see them again. What I’ve been trying to do really foster that virtuous circle which just doesn’t generally exist right now. I love looking at European businesses because there is so much potential. They can run really lean, they can get a lot done on not as much cash compared to the US. I'd say it costs twice as much, if not more, to operate here in San Francisco than it does in most of Europe. I like startups who have a sound operation somewhere in Europe but want to expand over here, and they have a good reason to expand over here as well. Pipedrive is a great example. A terrific business, a great product. They started in Tallinn, but quickly realized that their biggest market would be the US. Now they have several people on the ground in Silicon Valley and are aggressively building their operations over here. They're hugely impressive and growing at a crazy rate! Well, the Estonians are a pretty incredible bunch - there are many hot companies coming out of there. Yeah, absolutely. What I look for is a completely fresh approach. Investing isn't a purely altruistic process. I've got to see some gain in it for me, so that means a valuation which is reasonable. One of the things about Silicon Valley is that the valuations are just ridiculous. European companies that can come out with a valuation which more accurately reflects the stage that the business is in, is always very appealing. A great product, something which really excites me, something which I can see myself using, or Huddle using is really good because I can road test it, or get the guys to road test it. I like to look at projects which either have the potential to go all the way - could this be a business which is worth a billion dollars? Or a business in a space which is hot enough, where there's potential for it to be acquired for a significant amount in the not-too-distant future. In one interview with Alastair, he mentioned Huddle becoming a $500 million-dollar business, which to me is an interesting number because usually people talk either about a $100 million-dollar businesses or a billion-dollar business. What are the next steps for Huddle a few years down the road? What are your key initiatives? Do you see Huddle really becoming a billion dollar business or taking its stock public? That interview was probably given a couple of years ago... What we've seen is our business accelerating at a pace that's becoming incredibly hot. We absolutely now see that this is a business that will be worth a billion dollars or more. The challenge for us is, how quickly can we get there? Over the next year or two or three, our challenge is to continue to grow in a scaleable way. Building a business to be bought is a very risky game. Building a sustainable business with long-term value for the investors and the customers is really the best way to go and we'll continue to try and execute on that. When you look at the growth rate that we're on right now, an IPO doesn't really seem like such a long way away because we don't have to grow that many years in order to get to that point. Ok, so how long, how far away? Oh God ... I don't know that I'd even like to say it! Two years, maybe three. Lots still to do! Andy, thanks a lot for your time. Featured image credit: Heisenberg Media