The Spanish government may not be a big fan of local startup entrepreneurs building businesses and act like they should be punished for it, but at least the money hasn't - yet - stopped flowing.

Spain just got a new 194 million euros injection into its venture capital industry through FOND-ICO, the national 'fund of funds'.

Axis, the management company behind it, announced the investment of those 194 million euros into nine private VC funds, out of 23 candidates spread across four categories:

- Venture Capital funds (Seed stage)

- Cabiedes & Partners (Cabiedes & Partners IV SCR SA)

- Inveready (Inveready Asset Management SGECR SA)

- Venture Capital funds (Growth stage)

- Bridgepoint Advisers

- MCH Private Equity (MCH Private Equity Investments SGECR SAU)

- Talde Gestión (Talde Gestión SGECR SA)

- Incubation funds

- Clave Mayor (Clave Mayor SGECR SA)

- Suanfarma Biotech (Suanfarma Biotech SGECR SA)

- Debt funds

- N+1 (Alteralia Management S.à.r.l)

- Trea Capital (BTC Investments 2012 S.à.r.l)

The total committed investment for this round is 669 million euros, which brings the total committed investment since late 2013, up to 1.9 billion euros in less than a year.

The previous investment came only seven months ago, and hasn't been deployed yet. We reached out to several of the funds and they confirmed us that the new funds will start operating in 2015.

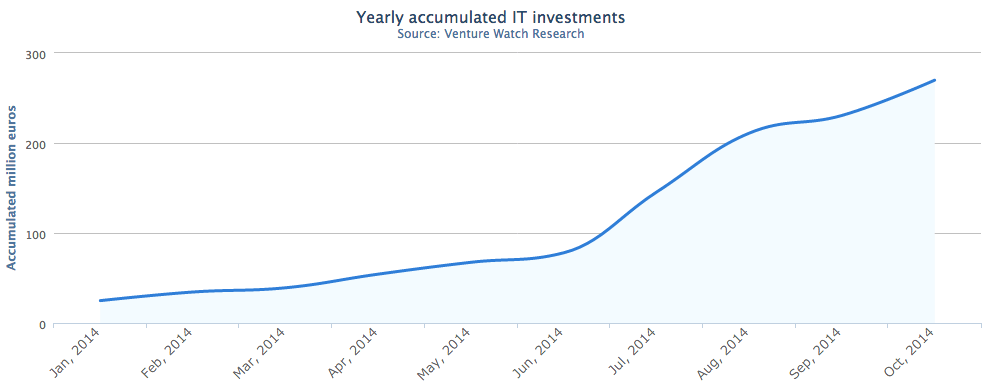

According to Venture Watch Research (see disclosure below), there's been an increase of 16% in VC investment since 2013, and a whopping 75% since 2012. If we count the most recent deals by Wallapop (5 million euros) and RedBooth (8.8 million euros) this month, the difference rises to 17% since 2013, and this is without counting the FOND-ICO investments.

Disclosure: Venture.Watch Research is a brand from Press42, a company owned by tech.eu co-founder Alex Barrera.

This recent investments is great news for the Spanish venture capital ecosystem as nearly all the renowned funds in the country have got a piece of the FOND-ICO pie: Adara Ventures (Dec. 2013), Axon Capital (May 2014), Caixa Capital Risc (May 2014), Seaya Ventures (May 2014) and now Inveready (Nov. 2014) and Cabiedes & Partners (Nov. 2014).

As most of the funds haven't been deployed yet, we expect to see a major uptake in deals and total investment during the next few years, starting in early 2015.

Also interesting to note that investments from international VCs in Spanish startups have just reached its highest level ever.

All this is great news for Spain, despite the continuous undermining of the startup ecosystem by the Spanish government in recent times.

Featured image credit: bf.photo / Shutterstock

Would you like to write the first comment?

Login to post comments